This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Curve Bear Flattens on Powell Remarks

October 1, 2024

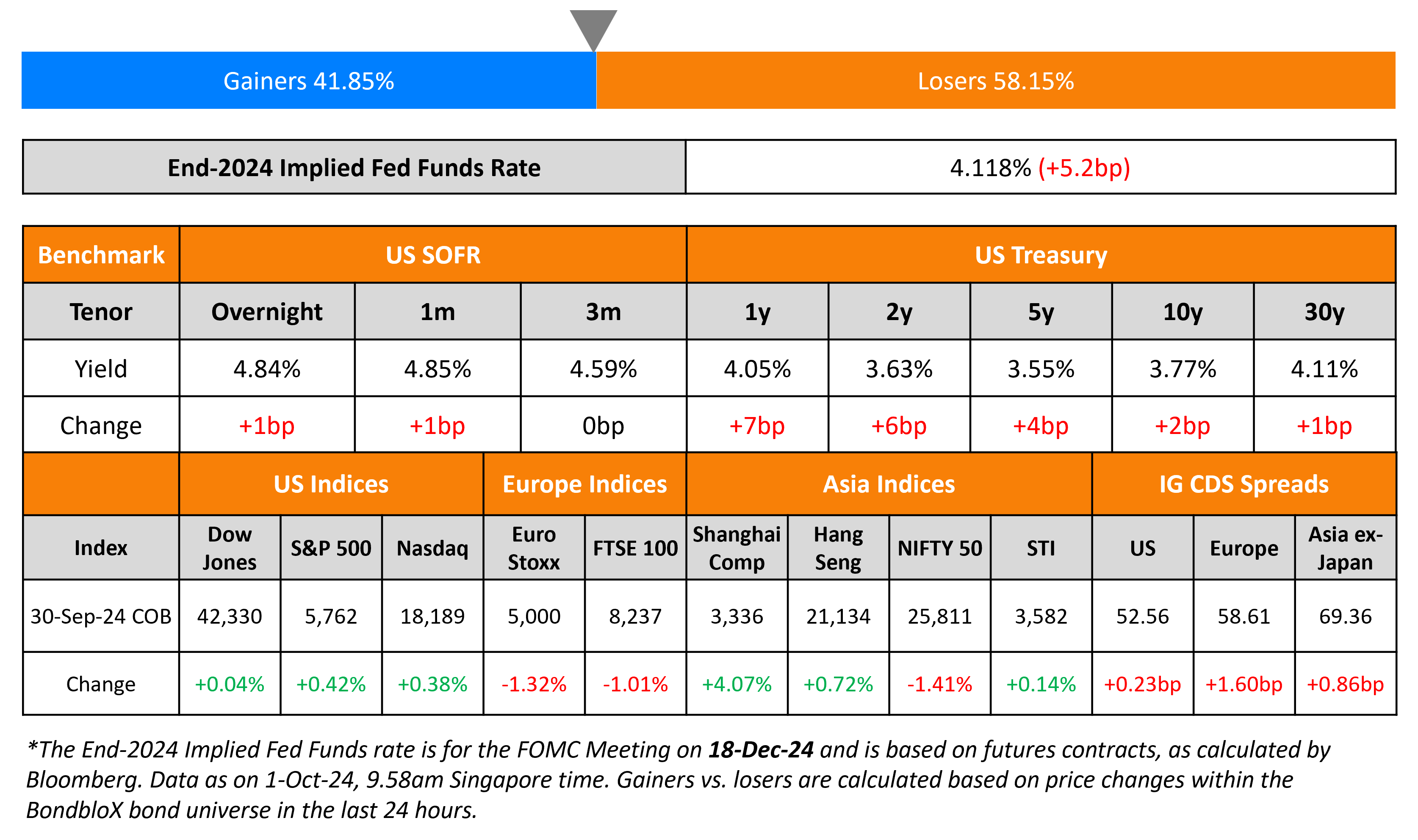

The US Treasury curve bear-flattened yesterday, with short-term yields up by about 5bp while long-term yields rising by about 1-2bp. The move comes following Powell’s remarks during a Q&A held yesterday, where he suggested that the Fed will base its future interest rate decisions on the incoming economic data and not on any “preset course”. He also commented that the FOMC “is not a committee that feels like it’s in a hurry to cut rates quickly”. He reiterated that inflation is on a deflationary course as of now, and that the labour market remains strong. On the backdrop of these comments, traders have begun pricing in less than three rate cuts by the end-2024 as per Fed Funds Futures data. US IG CDS widened by 0.2bp, while HY CDS held largely steady. US equity markets ended broadly higher, with both S&P and Nasdaq up by 0.4%.

European equities, on the other hand, ended lower. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.6bp and 3.6bp, respectively. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads widened by 0.9bp.

New Bond Issues

- OUE S$ 5Y Green @ 4.2% area

Turkiye Vakiflar Bankasi (Vakifbank) raised $500mn via a 5.25Y Sustainable bond at a yield of 6.95%, 30bp inside initial guidance of 7.25% area. The senior unsecured notes are expected to be rated B+ (Fitch). Proceeds will be used to finance and/or refinance eligible businesses and projects in accordance with the Issuer’s Sustainability Bond Framework dated August 2023.

Rating Changes

- Newcastle Coal Infra Junior Debt Upgraded To ‘BB+’; Outlook Positive; Senior Debt ‘BBB+’ Rating Affirmed; Outlook Stable

- Energy Development Oman SAOC Upgraded To ‘BBB-‘ From ‘BB+’ Following Similar Action On Sovereign; Outlook Stable

- Fitch Downgrades DIRECTV’s Long-Term IDR to ‘BB’; Places Ratings on Negative Watch

- Fitch Downgrades Petkim to ‘CCC+’

- Moody’s Ratings Downgrades Estee Lauder to A2; Outlook is Stable

Term of the Day

Diaspora Bond

Diaspora bonds are sovereign bonds that target investors that have immigrated to other countries. The reasons for emigration range from political unrest to better opportunities. For issuing countries, it is considered to be a possible stable source of finance, particularly in bad times, and can support the sovereign’s credit rating. For investors, it is believed to be a semblance of patriotism for the country of origin whilst also serving to manage risk since debt is serviced in local currency. Israel and India are two prominent nations that use this form of financing, having collectively raised $35-$40bn via diaspora bonds. Some bonds even carry a “patriotic discount” that reduces the borrowing cost for the issuing sovereign.

Talking Heads

On Yield of South Africa Bonds Dropping Below 10%

Kevin Daly, strategist at Goldman Sachs

“This leaves us bullish on SAGBs, where we think yields can gradually grind lower over time as South Africa’s authorities restore fiscal credibility. The coalition government, which now includes the Democratic Alliance, known for its commitment to fiscal discipline, reduces the risk of fiscal underperformance”. Recommended a shift into the longer end of the yield curve, saying that recent fiscal outperformance “has not been incorporated into market pricing.”

On Powell Suggesting 50bp More Rate Cuts in 2024

Wasif Latif, President, and CIO at Sarmaya Partners

“It looks like Powell’s “over time” comments put a wet blanket on the market’s enthusiasm for the expected rapid fire rate cuts. There’s a bit of repricing going on based on those comments. There’s that usual disconnect between the bond markets and the equity market, where you see an initial move and then a bounce back.”

On Investors Pouncing on European property bonds

Hugo Squire, HY portfolio manager at Schroders

“I like to think of it as a reverse ‘Minsky moment’, you either owned enough of these real estate names, or you fell behind your peers. Real estate hybrids are a big factor in the wide distribution of returns among European high-yield funds.”

Top Gainers & Losers 1-October-24*

Go back to Latest bond Market News

Related Posts:

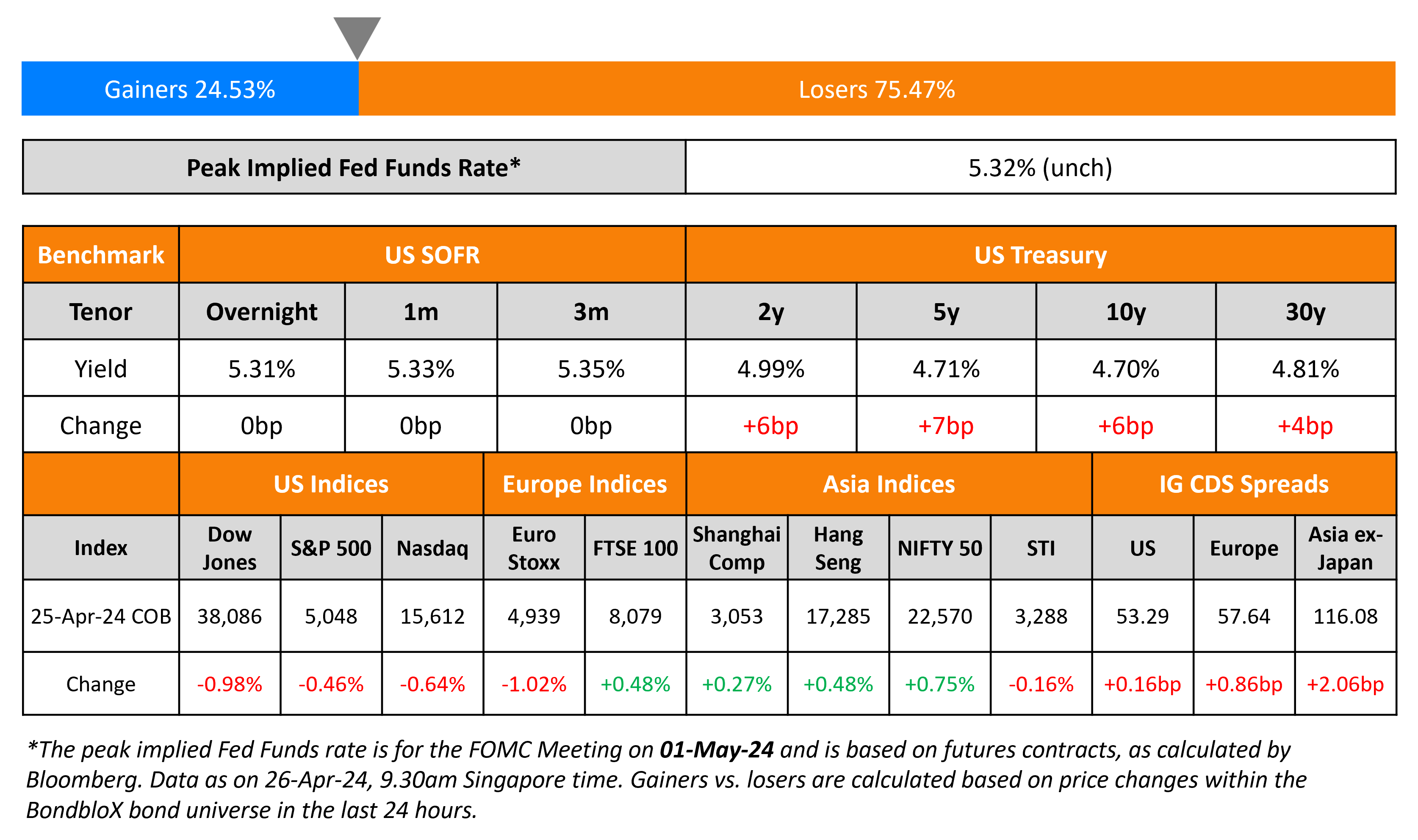

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024