This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasuries Recover by 4-5bp; GFH Financial Prices $ Sukuk

October 25, 2024

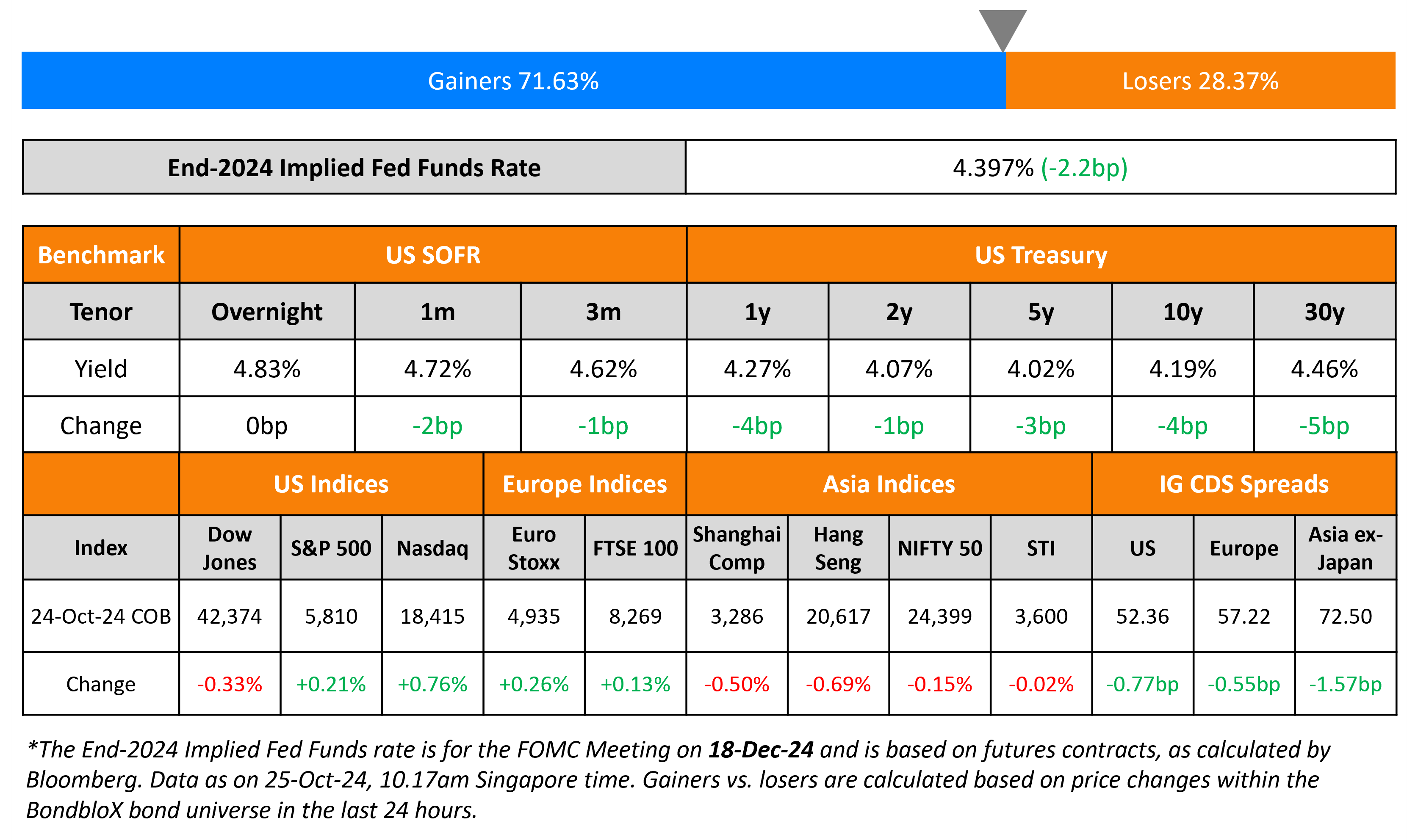

US Treasuries recovered by 4-5bp across the curve yesterday, after witnessing three consecutive days of declines. This recovery counteracted the release of lower than anticipated initial jobless claims for the week, as well as stronger than expected preliminary figures for the Manufacturing and Services PMI for the month of October. The initial jobless claims for the week came in at 227k, vs. estimates of 247k. The Manufacturing PMI was reported at 47.8 (up from 47.3 last month), and the Services PMI was at 55.3 (up from 55.2 last month). Aside from this, Cleveland Fed President Beth Hammack remarked that the Fed’s fight against inflation is not over yet. She cited geopolitical tensions in the Middle East and housing services inflation as key drivers that are hindering the Fed’s progress toward its 2% inflation target. US IG and HY CDS saw a tightening of 0.8bp and 2.7bp respectively. Looking at US equity markets, the S&P and Nasdaq closed higher by 0.2% and 0.8% respectively.

European equities closed broadly higher as well. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.6bp and 1.1bp respectively. Asian equities have opened with mixed moves this morning. Asia ex-Japan IG CDS spreads were 1.6bp tighter.

New Bond Issues

GFH Senior Sukuk Limited raised $500mn via a 5Y Sukuk bond at a yield of 7.5%, 50bp inside initial guidance of 8% area. The senior unsecured notes are rated B-/B. Proceeds will be used to settle existing financing, including the concurrent tender offer, and for its general corporate purposes.

Rating Changes

- Italy-Based Banco BPM Upgraded To ‘BBB/A-2’ On Substantial Additional Loss-Absorbing Capacity Buffers; Outlook Stable

- Moody’s Ratings upgrades EFG Bank’s long-term deposit and senior unsecured debt ratings; outlook changed to stable from positive

- PPF Telecom Group B.V. Upgraded To ‘BBB-‘ On Majority Stake Acquisition By e&; Outlook Stable

- Moody’s Ratings changes NOVA’s outlook to stable from negative; ratings affirmed

Term of the Day

TLAC

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Credit’s Blanket Rally Turning to Cherry Picking

Dillon Lancaster, a portfolio manager at TwentyFour Asset Management

“With spreads at the tighter end and growth looking below trend with certain elements of uncertainty, it is prudent to remain at the higher end of the credit spectrum. In corporates, spreads don’t make a bunch of sense to be reaching down.”

Viktor Hjort, global head of credit strategy and desk analysts at BNP Paribas

“The catalyst is flows. During rate-cut periods, funds flow from the short end, such as money markets, into high-quality fixed income. Hence flows favor high-quality outperformance.”

“This seems more like a technical relief rally following the recent strong selloff. The fundamental backdrop, reflected by solid US economic activity, continues to favor higher Treasury yields.”

On Rate Cuts Accelerating US Banks’ Move to HY Investments – Wes West, Nomis Solutions

“Banks have decided that the short-term hit from selling lost-value securities is worth the tradeoff for long-term gain of purchasing new higher-yielding securities.”

Top Gainers & Losers 25-October-24*

Go back to Latest bond Market News

Related Posts: