This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasuries Rally Driven by Weak PCE Data

September 30, 2024

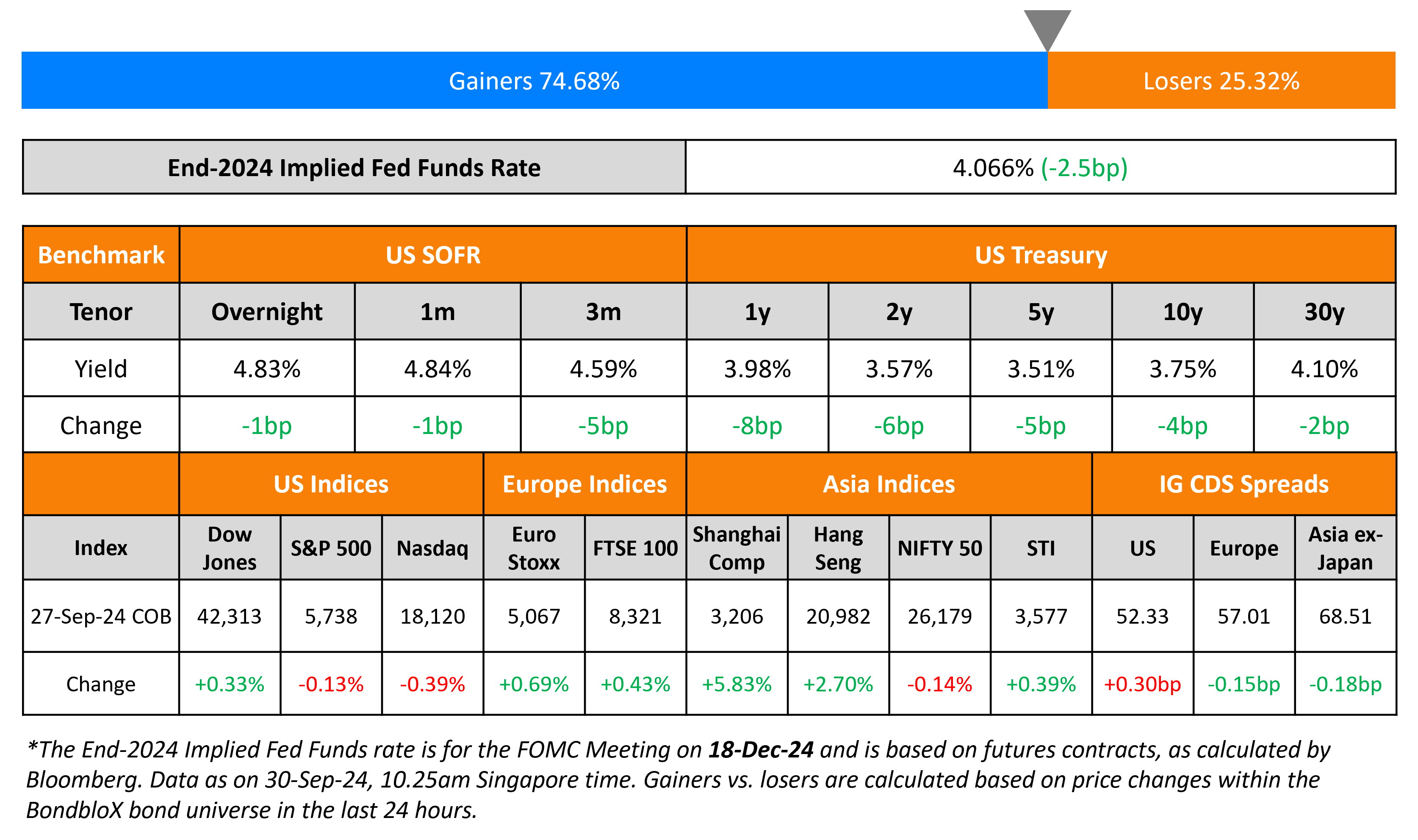

US Treasuries rallied by about 4-6bp across the curve on Friday driven by weak PCE figures for August. The annualized PCE Price Index came in at 2.2%, lower than the expected 2.3% and the previous month’s figure of 2.5%. The annualized Core PCE Price Index came in-line with estimates of 2.7%, vs. 2.6% in the previous month. US IG and HY CDS widened by 0.3bp and 23.4bp, respectively. US equity markets ended lower with S&P and Nasdaq down by 0.1% and 0.4%, respectively.

European equities, on the other hand, ended higher. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 0.8bp, respectively. In Japan, former Defence Minister Shigeru Ishiba was elected as the nation’s next Prime Minister and will step into his new role tomorrow. Ishiba is generally known for holding a rather hawkish stance on the BoJ’s interest rate decisions. Although he has not explicitly expressed this stance since his victory, there was a notable selloff in the NIKKEI index, which opened more than 4% lower earlier this morning. Meanwhile, the Hang Seng and CSI indices have continued to rally. Asia ex-Japan CDS spreads also tightened by 0.2bp.

New Bond Issues

Rating Changes

- Oman Upgraded To ‘BBB-‘ From ‘BB+’ On Continued Public Sector Deleveraging; Outlook Stable

- Moody’s Ratings upgrades Montenegro’s ratings to Ba3, outlook remains stable

- OQ Chemicals Rating Raised To ‘CCC-‘ On Amend-And-Extend Completion; Outlook Developing

- Moody’s Ratings downgrades Israel’s ratings to Baa1, maintains negative outlook

- Fitch Places PERU LNG on Rating Watch Negative

- Moody’s Ratings revises Air Canada’s outlook to positive; affirms Ba2 CFR

Term of the Day

Convertible Bonds

As the name suggests, convertible bonds are debt instruments issued by a company where the bonds can be converted into equity shares of the company by the bondholders at a particular ratio and at particular points in time. Thus, it is a hybrid security as it has characteristics of both debt and equity. Convertibles generally carry a lower coupons and sometimes tax advantages for the issuer.

Talking Heads

On Being Bullish on PEMEX’s Bonds

Alejandra Andrade, analyst at JPMorgan

“Although negative from a governance perspective, the possibility of the oil driller being reclassified as a “public company” from its current label as a “state productive company could have positive rating implications at Fitch. A classification alone does not dictate where Pemex will go and how it will behave. But rather the government will continue to shape Pemex’s future regardless of the classification.” She recommends clients buy bonds due in 2035 and 2048, specifically, which trade below par and offer 10% yields.

On Risky Chinese Real Estate Bonds Beating Nvidia’s Returns

Andrea Seminara, chief executive officer at London-based Redhedge Asset Management

“I cannot recall something similar in my career. The magnitude of the gains is unprecedented, unless we look at pure distressed situations.”

On Warning Against Big Increase in Capital Requirements

Colm Kelleher, UBS’s Chairman

“What I really have a big problem with is the increase in capital requirements. It just doesn’t make sense. We should focus on more important issues such as liquidity management and, above all, the full resolvability of a bank. If politics forces us to massively increase our capital, then Switzerland has decided that it no longer wants to be a relevant international financial center.”

Top Gainers & Losers 30-September-24*

Other News

Adani’s Kenya Dealings Spark Protests, Lawsuits and Hearings

Zambia Agrees to $1.5 Billion Debt Revamp with Chinese Lenders

Go back to Latest bond Market News

Related Posts:

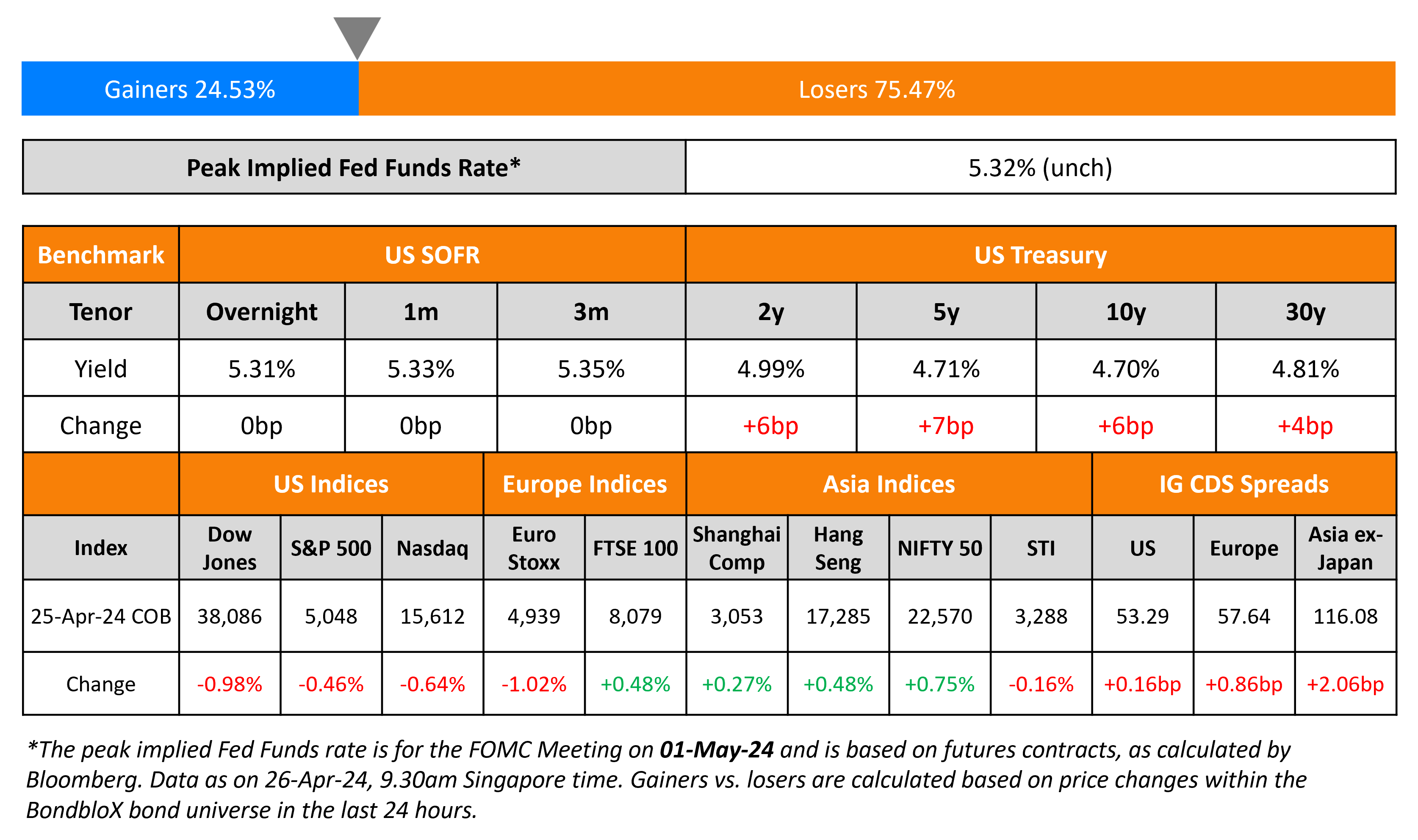

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024