This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Inch Upwards; Biocon, TAQA Price $ Bonds

October 3, 2024

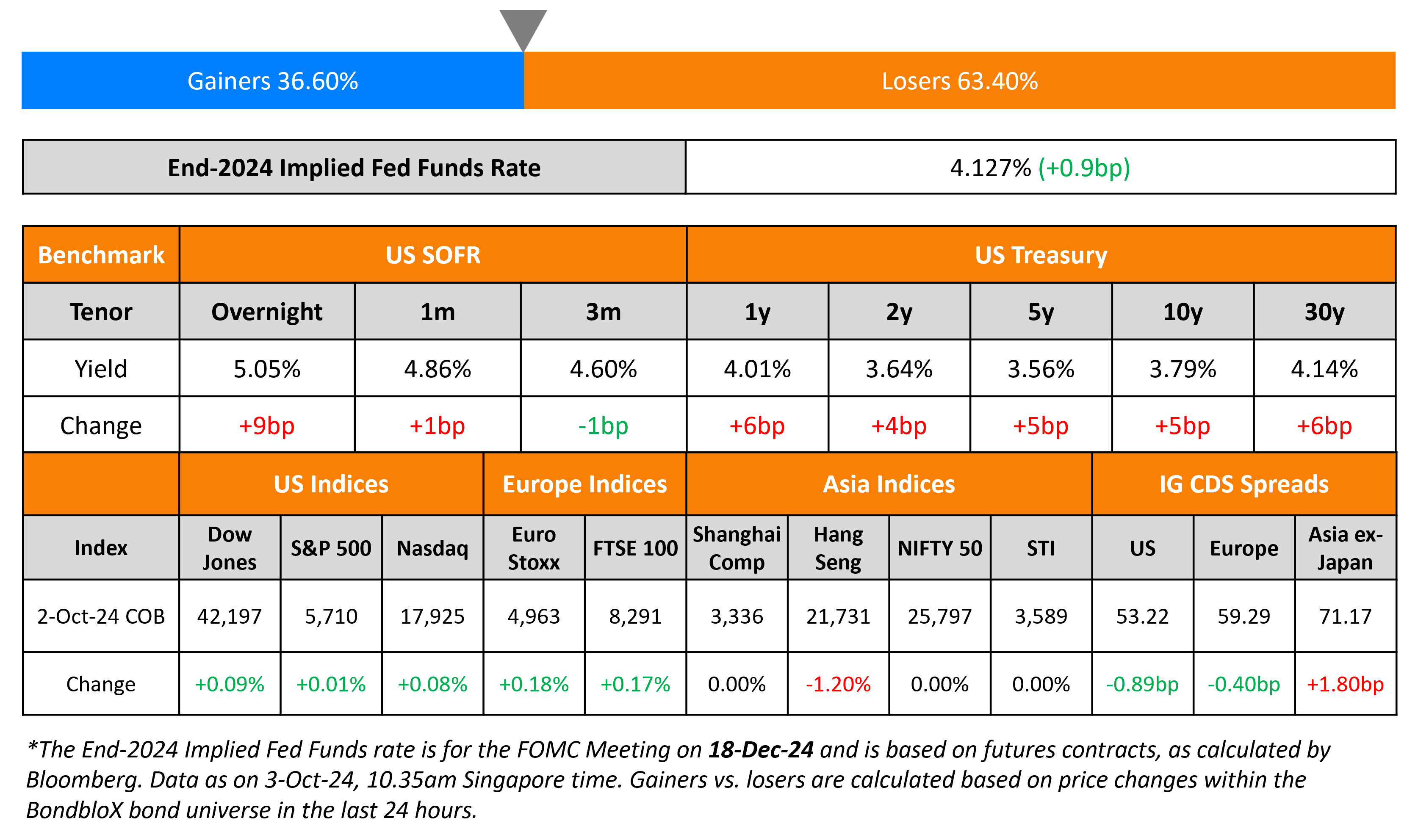

US Treasury yields inched upwards by 4-6bp across the curve on the back of the stronger employment data that was released last evening. ADP Employment Change for the month of September came in at 143K, higher than estimates of 125K (vs. 103K last month). The market will be closely watching Unemployment and NFP data for September, scheduled to be released tomorrow. Richmond’s Fed chief Thomas Barkin said that the benchmark rate might decrease by another 50bp by year-end, however, he was concerned about inflation remaining sticky next year, potentially limiting the Fed’s ability to cut rates as much as investors anticipate. US IG CDS and HY CDS tightened by 0.9bp and 3.6bp respectively. Looking at US equity markets, S&P and Nasdaq both closed relatively flat.

European equities on the other hand ended marginally higher. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.4bp and 1.3bp, respectively. Asian equity indices have opened broadly lower this morning. Asia ex-Japan CDS spreads widened by 1.8bp.

New Bond Issues

- Piramal Capital $ Tap at 7.8% area

Biocon Biologics raised $800mn via a 5NC2 bond at a yield of 6.9%, 35bp inside initial guidance of 7.25% area. The senior secured notes are rated BB/BB. The bond is callable at 103.335 from 9 October 2026, 101.668 from 9 October 2027, and at par from 9 October 2028. The deal was priced with a yield pick-up of 125bp over to Delhi International Airport’s (DIAL) 6.45% 2029s that currently yield 5.63% (rated B1/BB-/BB-). Proceeds will be used toward part repayment of outstanding syndicated loan facility which was originally taken for acquisition of Viatris’ global biosimilars business and other financial liabilities along with transaction-related costs and expenses.

Abu Dhabi National Energy Co. (TAQA) raised $1.75bn via a two-trancher deal. It raised $900mn via a 7Y bond at a yield of 4.494%, 35bp inside initial guidance of T+120bp area. It was priced at a new issue premium of 25bp compared to its 4.875% 2030s, which currently yields 4.24%. It also raised $850mn via a 12Y Green bond at a yield of 4.833%, 35bp inside initial guidance of T+140bp area. The bond was also priced at a new issue premium of 25bp compared to its 6.5% 2036s, which currently yields 4.58%. Both the senior unsecured bonds are rated Aa3/AA (Moody’s/Fitch). Proceeds will be used for general corporate purposes and financing Eligible Green Projects, respectively.

HDB raised S$500mn via a 10Y bond at a yield of 2.699%. The bond is rated AAA (Fitch). The bond was priced in-line with its 1.865% 2033s which currently yield 2.7%. Proceeds will be used to finance its development program and its working capital requirements, as well as to refinance existing borrowings.

New Bonds Pipeline

- Kazakhstan hires for $ 10Y bond

Rating Changes

- Moody’s Ratings takes action on Brazilian corporates following sovereign rating action

- Fitch Upgrades Chesapeake Energy’s LT IDR to ‘BBB-‘; Outlook Stable

- Lumen Technologies Inc. Downgraded To ‘SD’ (Selective Default) On Distressed Exchange

- Moody’s Ratings affirms UniCredit Bank GmbH’s A2 long-term deposit and senior unsecured debt ratings, changes outlook to positive from stable

Term of the Day

Distressed Debt Exchange

Distressed Debt Exchange (DDE) is an offer made by a company to its bondholders to avoid bankruptcy, improve liquidity, reduce debt, manage its maturity dates (by exchanging debt securities that are coming due for debt securities with an extended maturity) and to reduce or eliminate onerous covenants.

Talking Heads

On Risk of Aggressive Fed Cuts Backfiring

Marc Rowan, CEO at Apollo Global Management Inc.

“Financing is available. Real estate prices are going up. It is not clear we need more rate cuts. To the extent we accelerate the economy and have to go in the other direction, that would not be a good day.”

On Rates Not Returning to Levels Before Pandemic

Bernard Mensah, President of International operations at BofA

“I personally have been worried about just the underlying inflation pressures. My instinct has been that all of those things add inefficiencies in the system. And as we’re moving to a different, perhaps, type of globalization, we might find that the underlying trend inflation rate is a little bit higher than before.”

On Distressed Chinese Developers Soaring 200%

Raymond Cheng, head of China property research at CGS International Securities Hong Kong

“Resolute stance of rescuing property markets from top central government officials, coupled with wealth effect from recent strong rallies of stocks markets, should improve market sentiment and lead to a better sales ahead. The tier-one or top-tier cities will be the first batch of cities benefiting from strong sales recovery.”

Top Gainers & Losers 3-October-24*

Go back to Latest bond Market News

Related Posts: