This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Dip Lower; New Bond Issues; Rating Changes

May 31, 2024

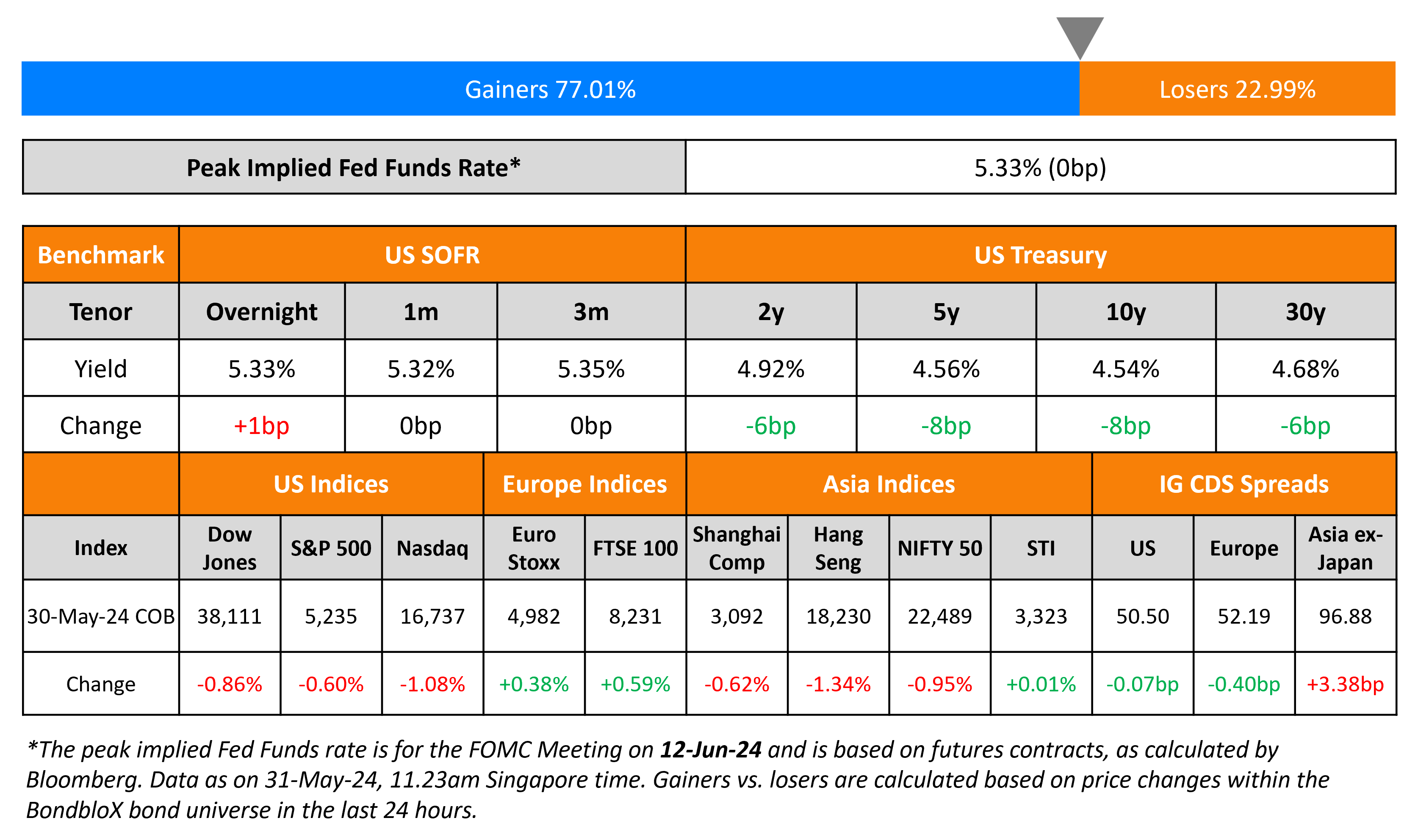

US Treasury yields dipped lower by 6-8bp on Thursday. The second reading of US Q1 GDP came at 1.3%, in-line with expectations, but lower than the preliminary reading of 1.6%. Personal consumption growth was revised lower to 2.0% from 2.5%, while the GDP price index was revised down to 3.0% from 3.1%. Initial jobless claims for the prior week rose slightly to 219k vs. expectations of 217k. Equity markets saw the S&P and Nasdaq fall by 0.6% and 1.1% respectively. US IG CDS spreads tightened 0.1bp and HY spreads were flat.

European equity markets ended in the green. Europe’s iTraxx main CDS spreads were 0.4bp tighter and crossover spreads were tighter by 1.9bp. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads widened 3.4bp.

New Bond Issues

- China Orient Asset Management $ 5Y at T+180bp area

- Krakatau Posco $ 3Y/5Y at T+200/220bp area

China Orient Asset Management raised $650mn via a 5Y bond at a yield of 5.894%, 50bp inside initial guidance of T+180bp area. The senior unsecured notes are rated BBB/A- (S&P/Fitch). The issuer is Joy Treasure Assets Holdings Inc and China Orient Asset Management International Holding Ltd is the guarantor. Proceeds will be used for repaying offshore debts. The bonds have a change of control put at 101. The new bonds are priced roughly in-line with its existing 4.5% 2029s that currently yield 5.87%.

Krakatau Posco raised $700mn via a two-tranche issuance. It raised $300mn via a 3Y bond at a yield of 6.437%, 32bp inside initial guidance of T+200bp area. It also raised $400mn via a 5Y bond at a yield of 6.47%, 32bp inside initial guidance of T+220bp area. The senior unsecured notes are rated BBB- (S&P).

Bank of Bahrain And Kuwait raised $500mn via a 5Y bond at a yield of 6.875%, inside initial guidance of low-7%s. The senior unsecured bonds are rated B2/B+ (Moody’s/Fitch).

National Bank of Kuwait raised $500mn via a 6NC5 green bond at a yield of 5.522%, 35bp inside initial guidance of T+135bp area. The senior unsecured bonds are rated A1/A+ (Moody’s/Fitch). Proceeds will be used to finance and/or refinance Eligible Green Assets in line with NBK’s Sustainable Financing Framework.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Continuum Green Energy India hires for $ green bond

- Mashreq bank hires for $ PerpNC5.5 bond

- Paratus Energy Services hires for $ 5Y bond

Rating Changes

- Moody’s Ratings upgrades NIBC Bank N.V.’s long-term deposit and senior unsecured debt ratings to A2 from A3; outlook stable

- Moody’s Ratings upgrades Eldorado’s CFR to B1; outlook stable

- AMC Entertainment Holdings Inc. Downgraded To ‘SD’ From ‘CCC+’ Following Debt Exchange

- Under Armour Inc. Downgraded To ‘BB-’ On Brand Strength Challenges; Outlook Stable; Debt Ratings Lowered

- Fitch Affirms Sprint BidCo’s (Accell) IDR at ‘CCC’; Downgrades Senior Secured Debt to ‘CCC-‘

- Fitch Revises Airbus’s Outlook to Positive; Affirms IDR at ‘A-‘

Term of the Day

Phillips Curve

The Phillips Curve refers to a graph highlighting the relation between the unemployment rate and wage inflation. The graph shows a curve with an inverse relationship between the two. As the unemployment rate falls, it would imply an increase in the demand for labor thereby leading to an upward pressure on wages. This translates to increasing inflation. The Phillips curve is named after economist A.W. Phillips, who examined U.K. unemployment and wages from 1861-1957. Phillips found an inverse relationship between the level of unemployment and the rate of change in wages.

Chicago Fed President Austan Goolsbee said that inflation could still fall without rising unemployment

Talking Heads

On Asian dollar bond rally possibly extending its run

Cary Yeung, co-head of emerging market corporate and head of Greater China debt at Pictet Asset

“We expect Asia dollar bonds’ credit spreads to hold up well”

Nigel Foo, head of Asian fixed income at First Sentier

“It’s a very interesting entry point for people to start looking at bonds, especially for investment grade bonds”

On Fed Needing to ‘Slay the Inflation Dragon’ – Goldman Sachs President, John Waldron

“If you are the Fed, you have to slay the inflation dragon. Inflation is clearly moderating but it’s still sticky. We all agree it’s still there in the system… getting a little more benign and fairly constructive. Soft landing remains the base case and still the most likely”

On BOJ May Raise Rates Two More Times in 2024

Columbia University’s Takatoshi Ito

“It’s possible that the rate goes up to 0.25% and then 0.5% this year. BOJ is in a rate hike cycle of not too fast or too slow. If inflation is 2%, it’s natural for the rate to go up toward 2%… not sure if QT is something to declare. The BOJ won’t probably announce how much they will reduce it each month”

Top Gainers & Losers- 31-May-24*

Go back to Latest bond Market News

Related Posts: