This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasuries Continue Their Down Move; GLP China Launches $ Bond

October 28, 2024

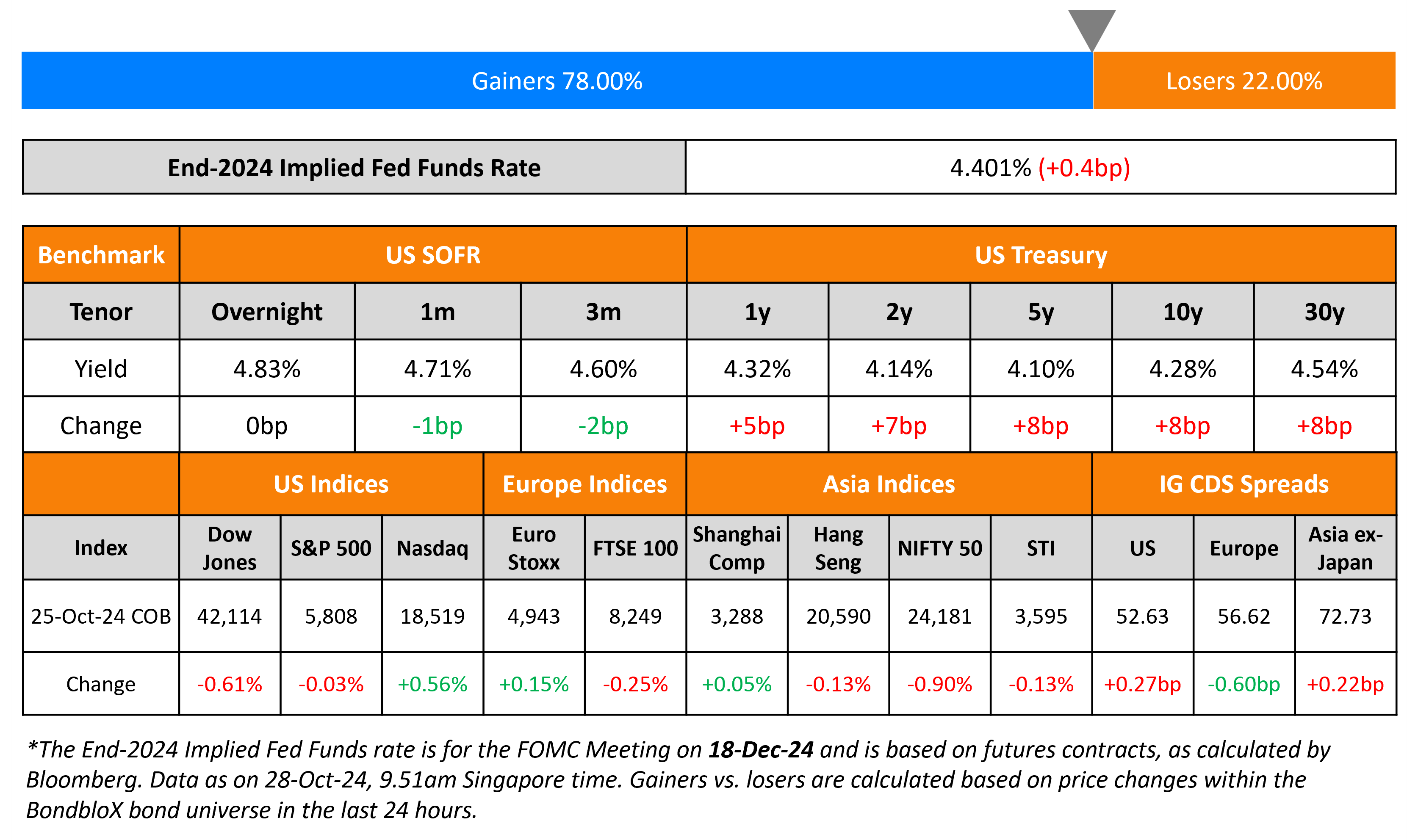

US Treasuries continued their down move after a day of pullback with yields up by 7-8bp across the curve. The move came on the back of investors doubling down on the “Trump trade”, as they begin pricing in greater odds of increasing fiscal deficits leading to more government borrowing, as well as tariffs that would significantly add to inflationary pressures. Aside from this, preliminary durable goods orders data came in strong for the month of September at -0.8%, higher than the estimates of -1.0%. The value excluding transportation came in at 0.4%, greater than the expected 0.1% drop. US IG and HY CDS spreads widened by 0.3bp and 2.1bp respectively. Looking at US equity markets, the S&P closed largely stable, while Nasdaq closed higher by 0.6%.

European equity markets ended broadly mixed. Looking at Europe’s CDS, the iTraxx Main and Crossover spreads tightened by 0.6bp and 1.9bp respectively. Asian equity indices have opened broadly mixed today morning. Asia ex-Japan IG CDS spreads widened by 0.2bp.

New Bond Issues

-

GLP China $ 3Y at 10.375% area

Rating Changes

- Moody’s Ratings upgrades Vedanta Resources’ CFR to B3 and bonds to Caa1; outlook stable

- Fitch Upgrades Banca Monte dei Paschi di Siena to ‘BB+’; Outlook Positive

- Fitch Upgrades Ethiopia’s LTLC IDR to ‘CCC+’; Affirms LTFC IDR at ‘RD’

- Fitch Upgrades Boparan to ‘B’ on Announced Refinancing; Resolves Rating Watch Positive

- Alfa Debt Rating Raised To ‘BBB-‘, All Ratings Put On CreditWatch Positive On Nearing Completion Of Corporate Overhaul

- Moody’s Ratings changes France’s outlook to negative from stable, affirms the Aa2 rating

- Fitch Revises Outlook on Seplat to Positive; Affirms at ‘B-‘

Term of the Day

Structural Subordination Risk

Structural subordination risk refers to the risk that most of the claims of the holding company are at its operating subsidiaries where these claims have a priority over the claims at the holding company in the event of a bankruptcy. Essentially, a lender to a parent is structurally subordinated to other lenders who have lent money to the subsidiary. Hence, lenders to the parent company will not have access to the subsidiary’s assets until the subsidiary’s creditors have been paid back first.

Talking Heads

On US Elections Driving Pressures on Long Term Interest Rates

Roberto Campos Neto, Brazil’s Central Bank Chief

“Markets are increasingly factoring in the “highly” inflationary impacts of the U.S. election on long-term interest rate futures. Both U.S. campaigns include fiscal expansion elements. Proposals for protectionism and shifts in immigration policy also could have inflationary implications.”

On Bets on Gold Rising Before US Election – Michael Hartnett, BofA

“Investors are continuing to load up on gold ahead of the US election as a hedge against inflation and populism. The gold trade is part of a wider investor strategy to position portfolios against a possible win for Donald Trump in the election.”

On Chinese Banks Facing Liquidity Struggle – Analysts at Huaxi Securities Co.

“The recent rise in NCD issuance costs shows large banks’ continued need to raise debt and improve their liquidity indicators. NCD rates will likely stay elevated near term because big banks were the first to slash deposit rates and will face potential government bond supply pressure in the fourth quarter.”

Top Gainers & Losers 28-October-24*

Other News

Go back to Latest bond Market News

Related Posts: