This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

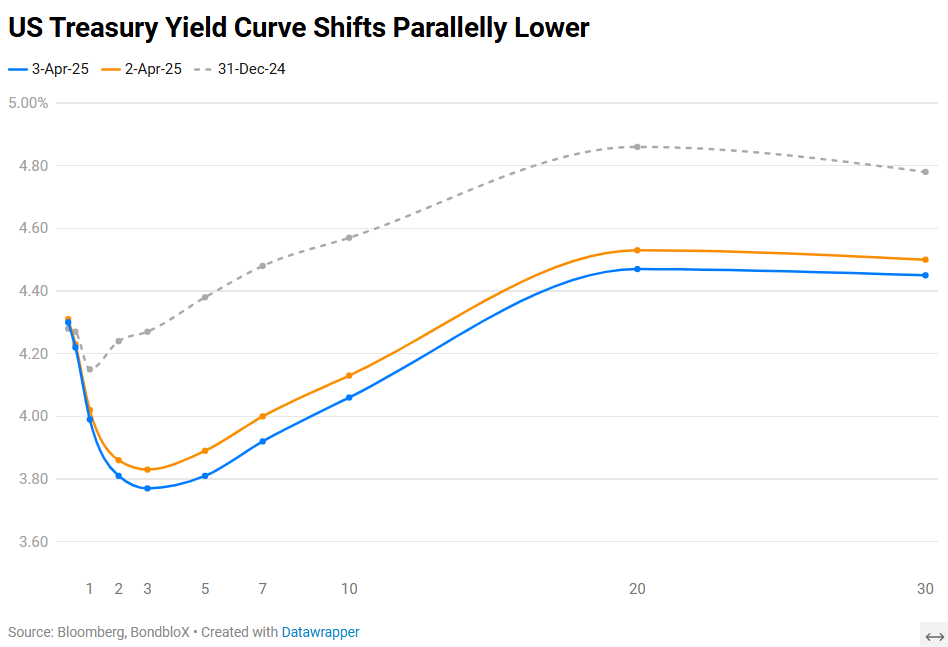

US Treasuries and Other Safe Haven Assets Gain After Tariff Announcement by US

April 3, 2025

US Treasuries moved parallelly lower by 9-13bp across the curve as investors flocked to safe haven assets after Trump announced much-anticipated tariffs. The 2Y and 10Y closed at 3.82% and 4.07% respectively, levels last seen in October 2024. Trump applied a minimum 10% tariff on all exports to the US and slapped additional duties on around 60 nations with the largest trade imbalances with the US. This included substantially higher rates on some of the country’s biggest trading partners, such as China, which now faces a 54% total tariff, the European Union and Vietnam. Concerns of a global trade war saw the dollar weakening while haven currencies including the yen and Swiss franc rose, along with gold which reached an all-time high. Fed Governor Adriana Kugler said that tariffs will affect all sectors through supply chain networks and it may take longer for that to filter through the economy.

US equity markets ended higher, with the S&P and Nasdaq up 0.7% and 0.9% respectively. Looking at credit markets, US IG and HY CDS spreads widened by 1.5bp and 12.7bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 0.3bp and 1.8bp respectively. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were tighter by 0.1bp.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Muthoot to Ba1; outlook remains stable

-

Moody’s Ratings downgrades OCI’s CFR to Ba2; ratings remain on review for further downgrade

Term of the Day

Haven Assets

Haven assets aka ‘safe havens’ refer to those class of assets/securities which are in demand when market conditions deteriorate. Examples of haven assets include US Treasury bonds, German Bunds, UK Gilts, Japanese Government Bonds (JGBs) and gold. These are in contrast to ‘risk assets’ which are generally those assets/securities that are in demand when market conditions are buoyant, like equities, real estate and high yield bonds.

Talking Heads

On PIMCO Turning More Cautious on Dollar

“We have become a little bit more cautious on the dollar. In fact we are, across portfolios, a little underweight the dollar. These types of debt levels… are going to cause more problems, create more volatility. We just think when we look at these debt levels, deficit levels, it does suggest the U.S. has time. But we also don’t see yet a willingness to aggressively address deficits.”

On Traders Rushing Into Safe Havens After US Tariffs

John Hardy – Saxo Bank

“Safe haven trades in the wake of the announcement will include the Japanese yen most definitely. Treasuries can be a safe haven, especially at the short end of the yield curve, I think would be the two chief trades. But even the longer-term Treasuries could do well.”

On Going Long on Automaker Bonds – JP Morgan

“We don’t believe any of the large automakers are likely to get downgraded to high yield in the coming months. As such, in the scenario where today’s announcements become a clearing event, autos have room to rally.”

Top Gainers and Losers- 03-April-25*

Go back to Latest bond Market News

Related Posts: