This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Tax Bill Receives House Approval

May 23, 2025

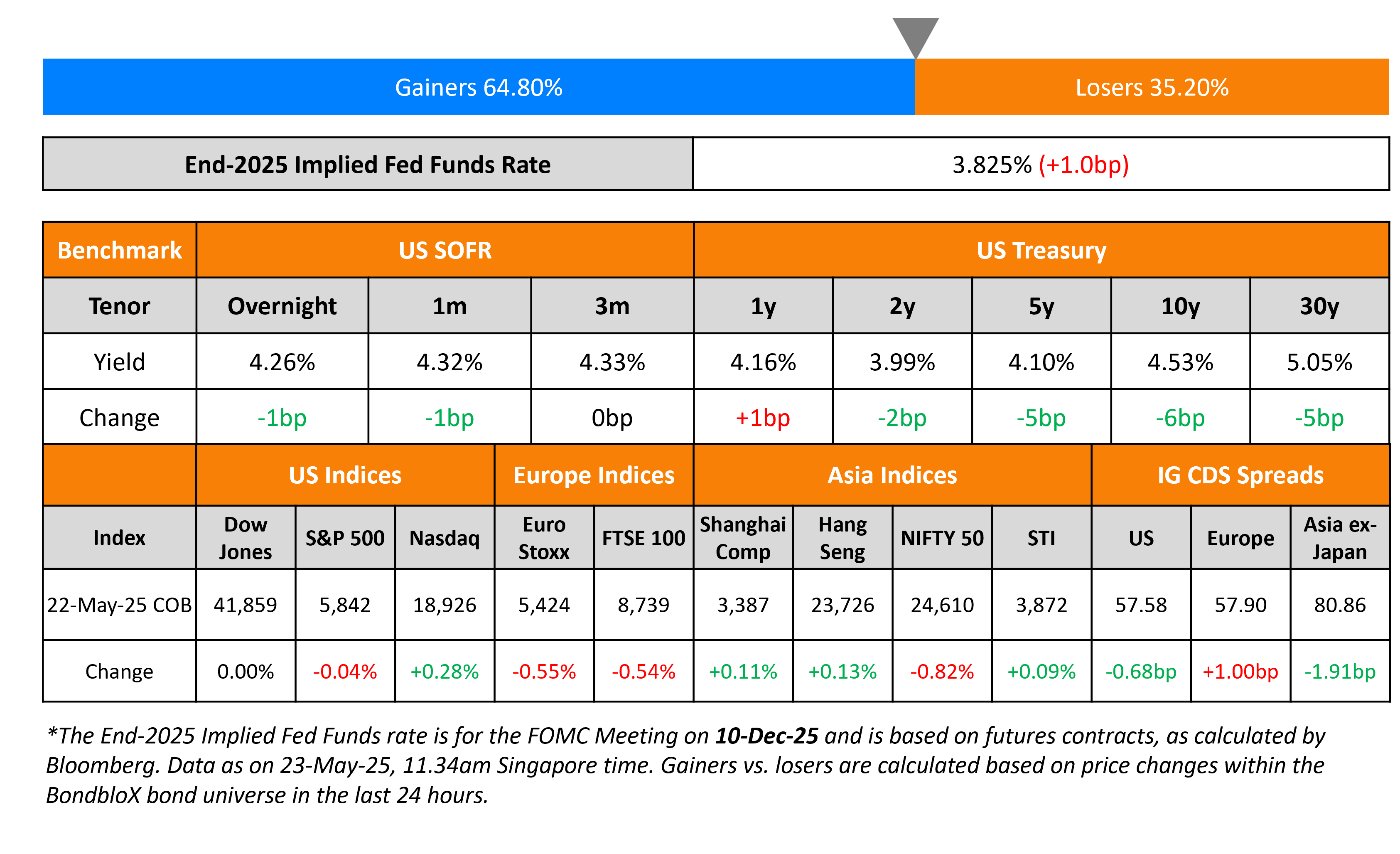

US Treasury yields pulled back across the curve after having jumped higher over the three prior sessions. On Thursday, the 10Y yield eased by 6bp to 4.53% and the 2Y eased by 2bp to 3.99%. On the data front, initial jobless claims for the previous week rose by 227k, better than expectations of 230k. The preliminary S&P US PMIs came-in better than expected – both the Manufacturing and Services PMI came-in at 52.3 each vs. estimates of 49.9 and 51.0 respectively. Separately, US President Donald Trump’s tax-cut bill was approved in the House with a 215-214 vote. Regarding the next stages, it also requires an approval in the Senate before being signed into law.

Looking at the equity market, the S&P ended flat while Nasdaq rose by 0.3%. Looking at credit markets, US IG and HY CDS spreads tightened by 0.7bp and 2.5bp respectively. European indices ended lower. The iTraxx Main CDS spreads and iTraxx Crossover CDS spreads widened by 1bp and 4bp respectively. Asian equity markets have opened in the green today. Asian ex-Japan IG CDS spreads tightened by 1.9bp.

New Bond Issues

Rating Changes

- Moody’s Ratings upgrades Grifols’ rating to B2; outlook remains positive

-

Fitch Upgrades Ingersoll Rand to ‘BBB+’; Outlook Stable

-

Telefonica Moviles Chile Downgraded To ‘BB’ On Pressured Performance And Revised Group Support; Outlook Negative

- Moody’s Ratings changes outlook on Kongsberg Automotive ASA to negative from stable; affirms B2 ratings

Term of the Day: Scheme of Arrangement (SoA)

Scheme of Arrangement (SoA) is a legal mechanism used by a company in financial difficulty to reach a binding agreement with its creditors to pay back all, or part, of its debts over an agreed timeline. Typically, the company draws up scheme proposals for its creditors and sends it to them with notice of a creditors meeting. During the meeting, the company explains the proposals and creditors decide to vote in (or against) favor of the scheme. The scheme is then approved by a High Court, after which debts are written down as per the SoA. SoAs go through a court approval, making it different from consent solicitations.

Talking Heads

On US Treasuries orderly sell-off – IMF

“Although there has been some volatility in markets, market functioning, including in the U.S. Treasury market, has so far been orderly…The reduction in tariffs and the easing of tensions does provide some upside risk to our global growth forecast…the outlook, the global outlook in general, does remain one of high uncertainty, and so that uncertainty is still with us”

On the need to stay cautious despite inflation reaching 2% – ECB’s GC member, Joachim Nagel

“We will reach our inflation target of 2% in the euro zone this year…., we should therefore remain cautious in our monetary policy….. I don’t believe in predetermining whether there might be further interest-rate cuts”

On route to rate cut in second half of the year – Fed Waller

“If we can get the tariffs down closer to 10% and then that’s all sealed by July…Then we’re in a good position at the Fed to kind of move with rate cuts through the second half of the year”

Top Gainers and Losers- 23-May-25*

Go back to Latest bond Market News

Related Posts: