This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Retail Sales Comes in Strong for August; Sep FOMC Meeting Kicks Off

September 18, 2024

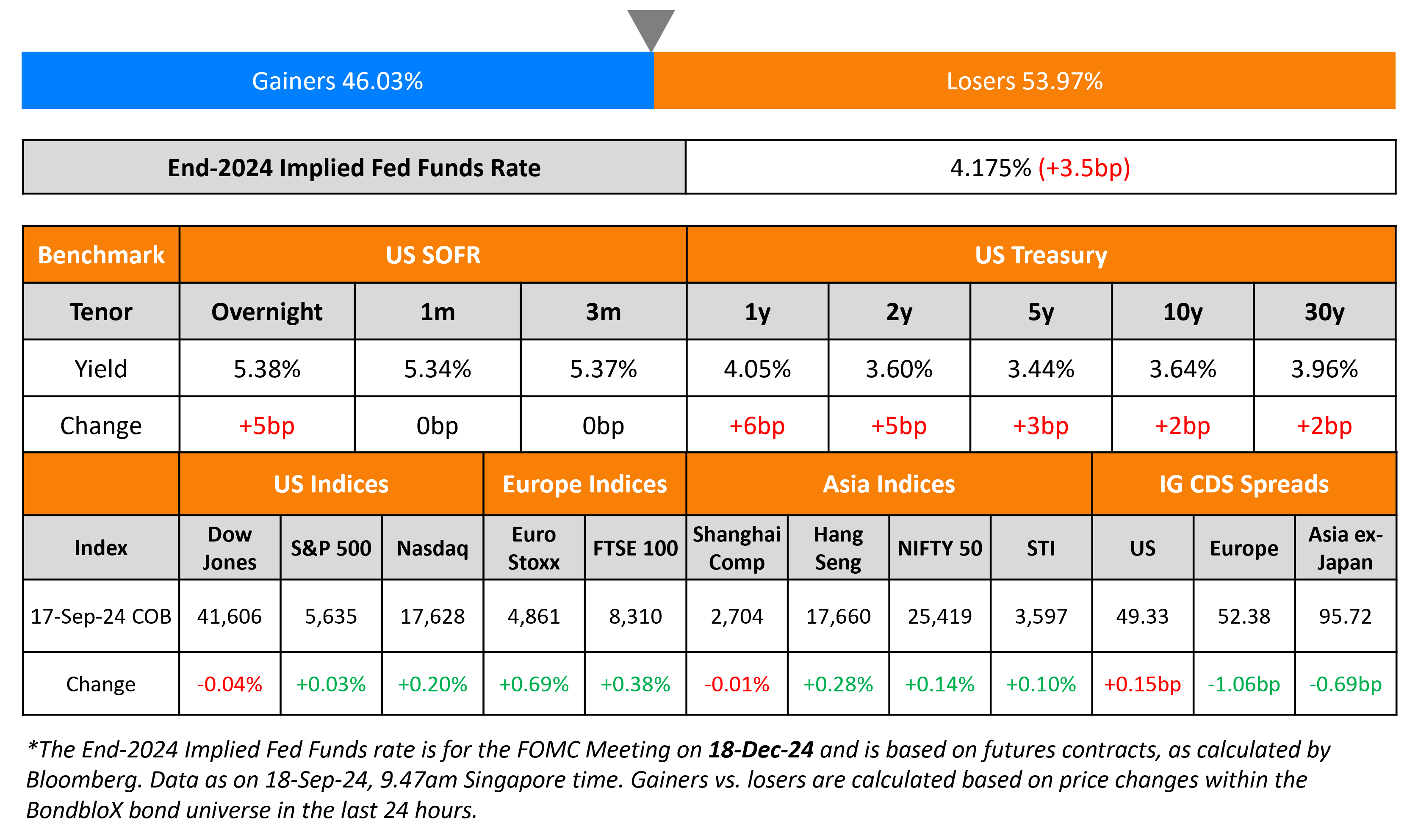

US Treasury yields were broadly up by 2-5bp across the curve. US Retail Sales for the month of August came in strong, increasing by 0.1% MoM, beating estimates of a 0.2% decline. The core retail sales figure, which excludes auto and gas, came in at 0.2%, roughly in-line with the estimates. The FOMC meeting kicked-off yesterday evening, with markets pricing in close to 65% probability for a 50bp rate cut. US IG spreads widened by 0.2bp while HY CDS tightened by 1.4bp. In US equity markets, S&P was flat while Nasdaq ended higher by 0.2%.

European equity markets also ended higher. Looking at Europe’s CDS spreads, the iTraxx Main tightened by 1.1bp and Crossover spreads tightened by 3.8bp. Asian equity indices have opened broadly mixed today morning. Asia ex-Japan IG CDS spreads tightened by 0.7bp.

New Bond Issues

Comision Federal (CFE) raised $1.5bn via a two-part offering. It raised $500mn via a 5Y bond at a yield of 5.75%, 40bp inside initial guidance of 6.15% area. These bonds are priced at a new issue premium of 24bp over its existing 4.688% 2029s that currently yield 5.51%. It also raised $1bn via a 10Y bond at a yield of 6.5%, 45bp initial guidance of 6.95% area. The senior unsecured notes are rated Baa2/BBB/BBB-. The proceeds will be used to finance or refinance, in whole or in part, new or existing Eligible Green Projects or Eligible Social Projects under the Sustainable Financing Framework.

Rating Changes

- Fitch Upgrades 24 Turkish Banks on Sovereign Upgrade

- Navient Corp. Upgraded To ‘BB’ After Resolving CFPB Litigation With Manageable Financial Penalty; Outlook Stable

- Fitch Upgrades Alternatifbank’s IDR to ‘BB-‘, Outlook Stable; Upgrades VR to ‘b’

- Fitch Ratings Upgrades Burgan Bank A.S.’s IDR to ‘BB-‘, Outlook Stable; Upgrades VR to ‘b’

- Haitong Bank Outlook Revised To Developing From Negative After Similar Action On Parent, ‘BB/B’ Ratings Affirmed

- Fitch Affirms Provident at ‘B’; Outlook Revised to Stable; Unsecured Notes Upgraded to ‘B’/’RR4’

Term of the Day

Viability Ratings (VRs)

Viability Ratings (VRs) are ratings assigned by Fitch to be internationally comparable and show their view of the intrinsic creditworthiness of an issuer. VRs are a key component of a bank’s Issuer Default Rating (IDR), as per Fitch. VRs are assigned primarily to banking companies with certain factors that could be indicative of a bank likelihood of failing or becoming non-viable. These factors include defaulting on senior obligations, entering a resolution regime/bankruptcy/administration receivership etc., triggering non-viability clauses embedded in the instrument, execution of a distressed debt exchange as defined by Fitch’s criteria and receiving extraordinary support such that a default or other event of non-viability is avoided.

Talking Heads

On Fed Rate Cuts Pulling Billions In Emerging Market Debt

Pierre-Yves Bareau, Head of EM debt at JPMorgan Asset Management

“Duration will become the target. Asia is of interest when we talk about engaging in duration.”

David Austerweil, EM money manager at Van Eck

“There’s little money to be made betting on policy rate cuts at the front ends of curves as they are largely priced, but plenty of potential for profits from market rates rallying along their yield curves.”

On Investors Betting on Hong Kong Property Stocks

Raymond Cheng, head of China property research at CGS International Securities

“A US rate cut will help boost the attractiveness of high-yield plays such as Link REIT and Kerry Properties.”

On Health of US Economy Determining Market Path

James Reilly, Senior market Analyst at Capital Economics

“Based on previous easing cycles, our expectation for aggressive rate cuts and no recession would be consistent with strong returns from U.S. equities.”

Top Gainers & Losers-18-September-24*

Go back to Latest bond Market News

Related Posts: