This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US President Pauses Tariffs on Mexico and Canada for 30-days

February 4, 2025

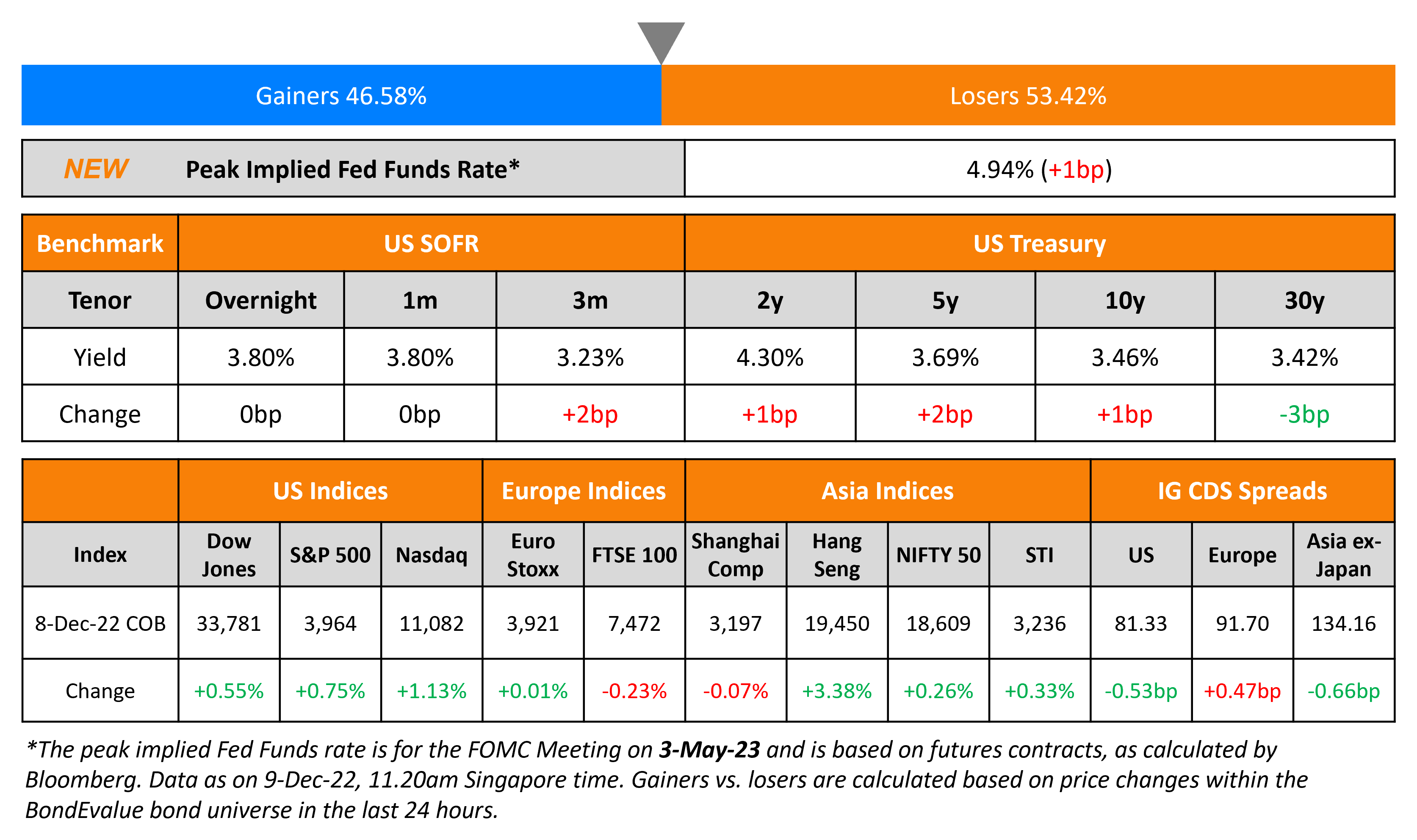

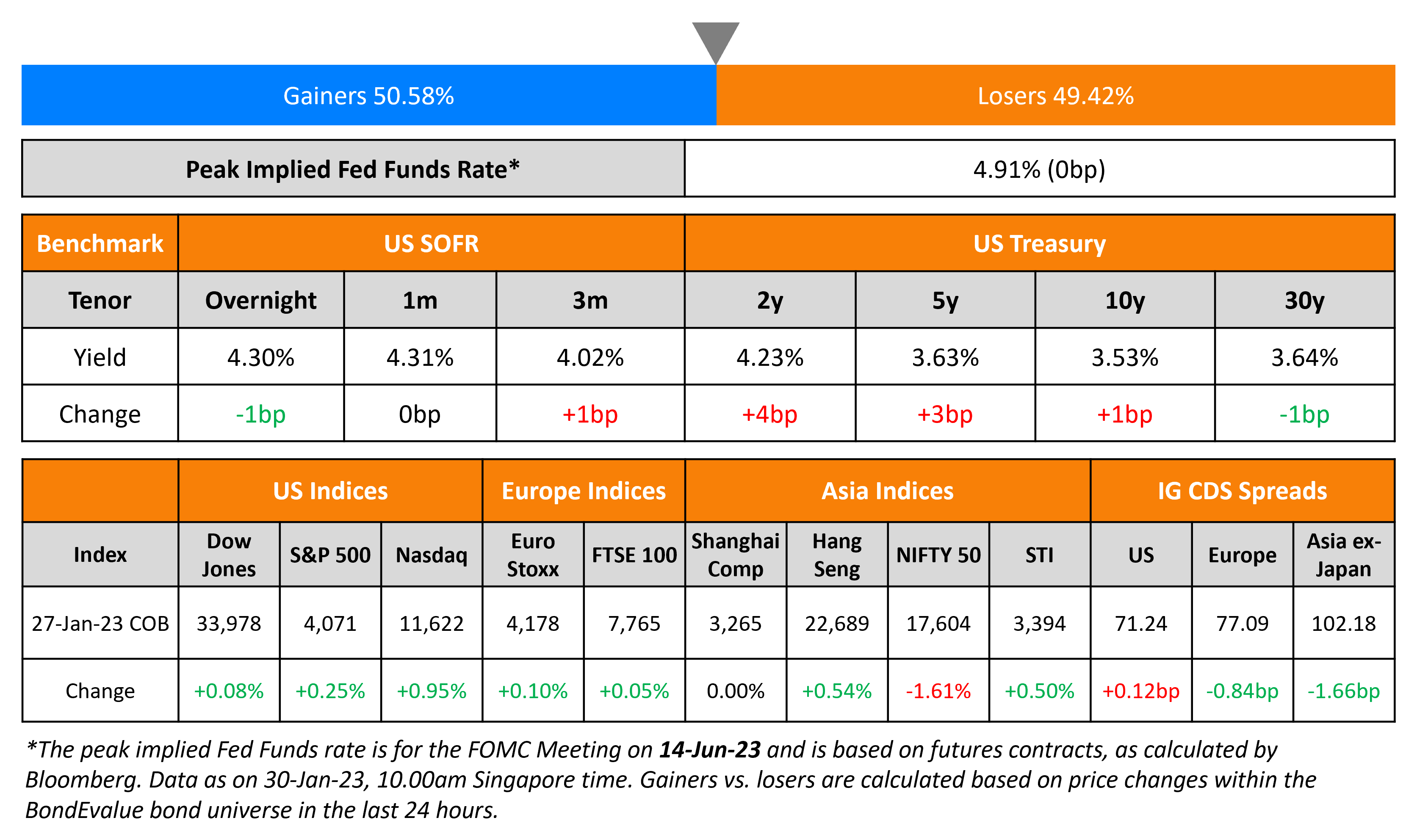

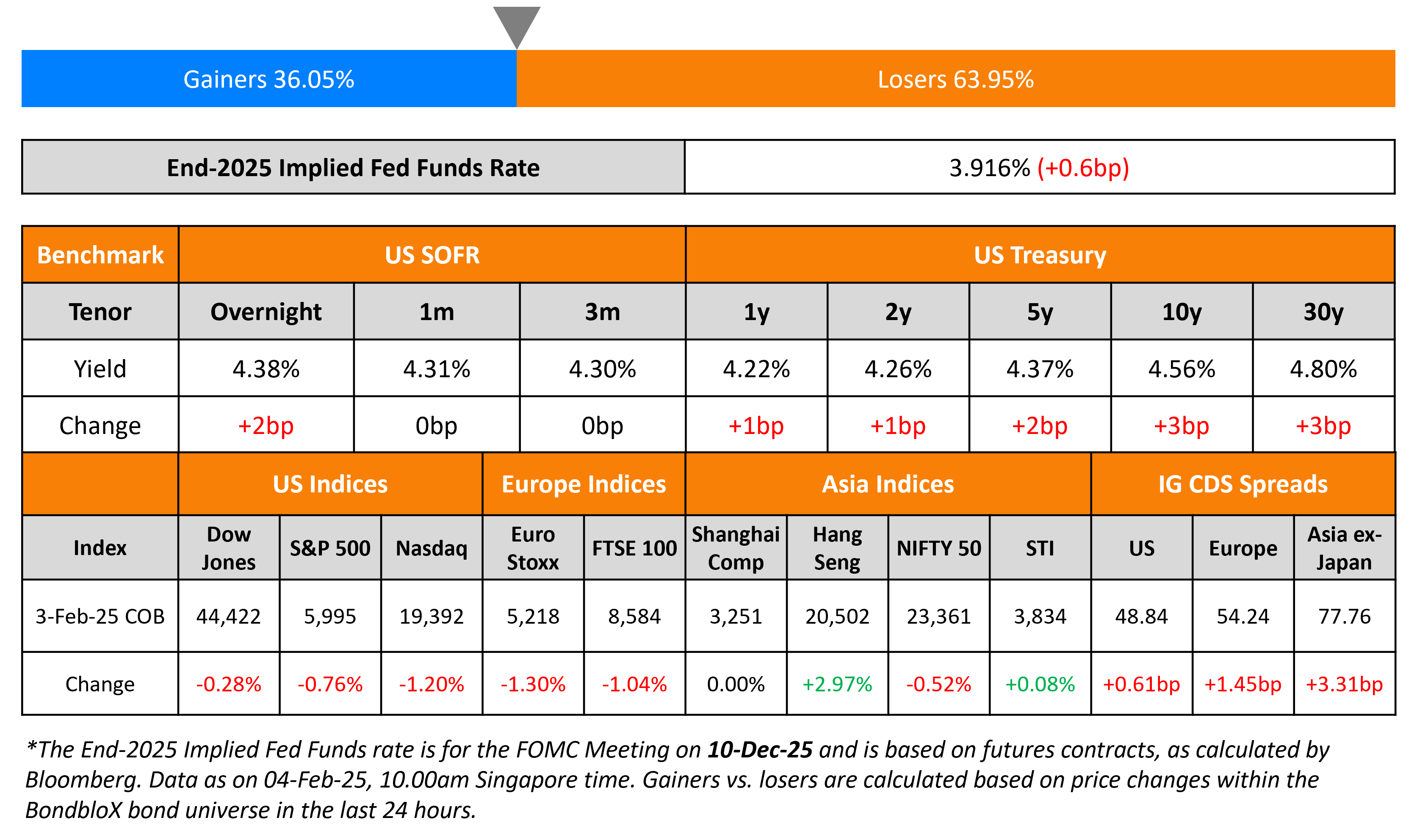

The US Treasury curve steepened, with the 2Y yield higher by 1bp and the 10Y higher by 3bp. For the month of January, the ISM manufacturing index came in at 50.9, slightly better than expectations of 50.0 and the prior month’s figure of 49.3. However, the ISM Employment Index came in at 47.8, worse than expectations of 50.3. S&P Global manufacturing PMI index came in at 50.1, in line with the prior month’s figure, but worse than expectations of 51.2. US President Donald Trump agreed for a 30-day pause on the tariffs imposed on Mexico and Canada after agreements were reached on border security.

US equity markets dropped, with the S&P and Nasdaq lower by 0.8% and 1.2% respectively. US IG and HY CDS spreads widened by 0.6bp each respectively. European equities ended lower too. In terms of Europe’s CDS spreads, the iTraxx Main widened by 1.5bp, while Crossover spreads widened by 7.2bp. Asian equity markets have opened broadly mixed this morning. Asia ex-Japan CDS spreads were 3.3bp wider.

New Bond Issues

Romania raised $1.25bn via a 12Y bond at a yield of 7.547%, 25bp inside initial guidance of T+325bp area. It also raised €2.8bn via a two trancher. It raised €1.4bn via a 5Y bond at a yield of 5.288%, 25bp inside initial guidance of MS+330bp area. It also raised €1.4bn via a long 9Y bond at a yield of 6.337%, 20bp inside initial guidance of MS+420bp area. All the senior unsecured bonds are rated Baa3/BBB-/BBB. Proceeds will be used for budget deficit financing and redemption of public debt.

DirecTV raised $2.074bn via a 6NC2 bond at a yield of 10%, 25bp wider than initial guidance of 9.75% area. The senior secured bond is rated B1/BB-/BBB-. Proceeds, together with a new Term Loan will be used to repay debt maturing 2027 (including potential open market repurchases of the 2027s), fund previously disclosed special distribution and for general corporate purposes.

Cleveland-Cliffs raised $850mn via a 6.6NC3 bond at a yield of 7.5%, in-line with its initial guidance of 7.5%. The senior unsecured guaranteed bond is rated Ba3/BB-. Proceeds will be used for general corporate purposes, including the repayment of borrowings under its asset-based credit facility.

New Bonds Pipeline

- Kepco hires for $ bond

Rating Changes

-

Moody’s Ratings upgrades Delta Air Lines’ senior unsecured rating to Baa2; outlook is stable

-

Fitch Upgrades Levi Strauss to ‘BBB-‘; Outlook Stable; Removes UCO

-

Fitch Downgrades AZUL to ‘RD’; Upgrades to ‘CCC’ and Assigns Positive Outlook

Term of the Day

TIPS

TIPS or Treasury Inflation-Protected Securities are fixed income securities issued by the US Treasury whose returns are linked to the inflation rate. TIPS provide investors protection against inflation by adjusting the principal higher with inflation and lower with deflation, as measured by the Consumer Price Index (CPI). At maturity, investors are paid the higher of the adjusted principal or the original principal. Interest on TIPS is fixed, paid out twice a year and is applied to the adjusted principal. As investors expect inflation in the US to climb higher, demand for TIPS is likely to increase.

.

Talking Heads

On Credit Investors Weighing to Sell Bonds in Tariff Response

Viktor Hjort – Global head of credit and equity derivatives strategy at BNP Paribas

“Where this could become bearish is if you can project a strategic rise in inflation that would force the Fed’s hand and result in rate hikes. However, if tariffs don’t change anything strategically, credit investors will step back in.”

On High Yield Bonanza Being Over

Guillermo Marin – Head of national assets at Grupo Security’s asset management

“It is difficult to repeat the success of 2024 for this fund because there has already been a strong correction in the market. Risk premiums began correcting themselves quite strongly last year.”

On Bond Dealers Locking Horns With TIPS Supply

William Marshall – Strategist at Goldman Sachs

“We think there’s sufficient appetite globally for incrementally more long-dated linker supply to support the boost.”

Steven Zeng – Interest rate strategist at Deutsche Bank

“We think it’s worth signaling that Treasury remains committed to supporting 30Y TIPS tenor, which is lagging behind the growth of outstanding TIPS as well as regular Treasury debt.”

Top Gainers & Losers 04-February-25*

Other News

Go back to Latest bond Market News

Related Posts: