This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Jobs Report Remains Solid, NFP at 275k

March 11, 2024

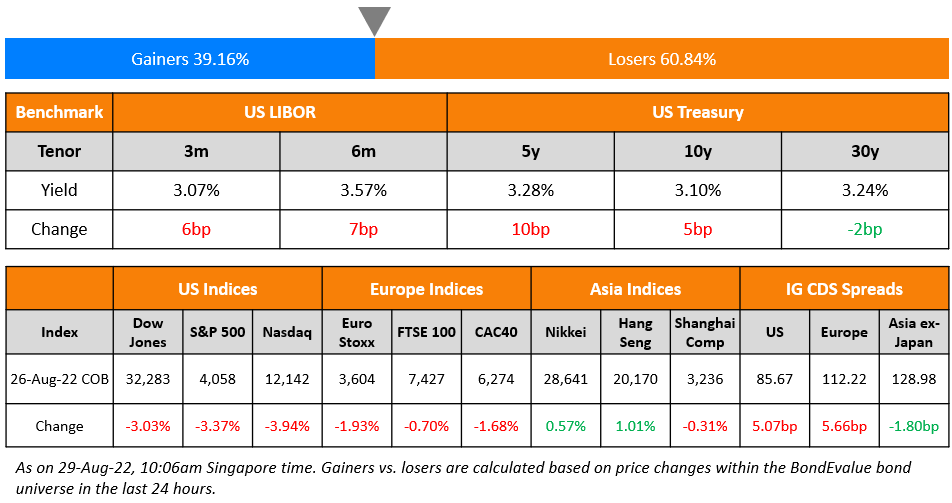

US Treasury yields moved ~3-4bp lower across the curve on Friday. US Non-Farm Payrolls (NFP) for February 2024 came at 275k, higher than the expected 200k. However, January’s NFP print was revised down to 229k from 353k. Average Hourly Earnings (AHE) YoY rose by 4.3%, inline with expectations of 4.3%. The unemployment rate rose to 3.9%, higher than the expected 3.7%. Separately, New York Fed President John Williams said that “the neutral rate is still quite low” in a remark whilst not commenting on monetary policy or the economic outlook. Looking at credit markets, US IG CDS spreads tightened 0.4bp and HY CDS spreads were 1bp tighter. Equity markets closed higher with the S&P and Nasdaq down 0.7% and 1.2% respectively.

European equity markets ended slightly lower. Credit markets in the region saw the European main CDS spreads tighten 0.5bp and crossover spreads tighten by 1.6bp. Asian equity markets have opened slightly higher today. Asia ex-Japan IG CDS spreads were 2.5bp tighter. China CPI increased 0.7% YoY in February, rebounding from the -0.8% seen in January which was its biggest drop since 2009. The CPI print was also higher than estimates of a 0.3% increase.

New Bond Issues

- ANZ $ 2Y/2Y FRN/10.5NC5.5 at T+70bp area/SOFR Equiv/ T+190bp area

Capitaland Ascott raised S$120mn via a 5Y bond at a yield of 3.69%. The senior unsecured bonds are rated BBB (Fitch). The guarantors for the notes are DBS Trustee Ltd, in its capacity as trustee of and Capitaland Ascott Real Estate Investment Trust. Proceeds will be used to refinance existing debt, of CapitaLand Ascott Reit and subsidiaries. The bonds are priced 8bp wider to Capitaland Treasury Ltd’s 3.15% 2029s that currently yield 3.61%.

New Bond Pipeline

- Avic International Leasing hires for $ bond

- EHi Car Services hires for $ bond

Rating Changes

- Fitch Upgrades Turkiye to ‘B+’; Outlook Positive

- Fitch Downgrades Credivalores’ IDR to ‘RD’ on Uncured Missed Coupon Payment

- Fitch Downgrades Pan Brothers to ‘RD’ and ‘RD(idn)’ on Uncured Missed Coupon Payment

Term of the Day

Regulation S

A Regulation S or Reg S bond is one that is issued in the international bond market and is usually cleared through Euroclear and Clearstream. These bonds cannot be sold in the US, except to qualified institutional buyers (QIBs) under the SEC 144A Rule. The 144A Rule, issued in 1990, modified a two-year holding period rule on privately placed securities by permitting (Qualified Institutional Buyer) QIBs to trade in these securities among themselves. Thus, a 144A bond, with a unique identifier, is privately placed to US based QIBs and usually clears through DTCC.

Talking Heads

On US job market data bolstering Fed’s ‘no rush’ rate cut view

Regions Financial, Chief Economist Richard Moody

“It is clear that the pace of hiring is cooling, which was to have been expected. There is, however, nothing in the data, including the higher jobless rate, that tells us the labor market is on the verge of rolling over”

On Traders Being on Alert for a Hotter-Than-Expected Inflation Print

Thomas Martin, senior PM at Globalt Investments

“The economic data is starting to raise more questions than answers over just how long it will take the Fed to gain more confidence about inflation improving”

Michael Sheldon, ED at RDM Financial Group

“CPI data has mostly improved in recent months, though the rate of decline has slowed somewhat”

On Default Risk Fading in EMs as Riskiest Bonds Soar

Anders Faergemann, PM at Pinebridge

“We don’t see any major defaults in EM sovereign high yield this year”

Valentina Chen, co-head EM at Mackay Shields

“The value lies in the single Bs and the triple Cs”

Oren Barack, MD fixed income at Alliance Global Partners

“There is some opportunity in Argentina, in the Bahamas and even beaten-down Venezuela and PDVSA”

On Debt Markets Priced for Perfection Risk a Stumble

Jose Mosquera, CIO at Quadriga Rho Investments

“Investors are moving further down the credit spectrum into less-frequent borrowers”

Richard Hodges, global dynamic bond fund at Nomura Asset Management

The biggest risk for credit “is that the Fed and all other central banks walk back totally the interest rate cuts that they’ve indicated to us already”

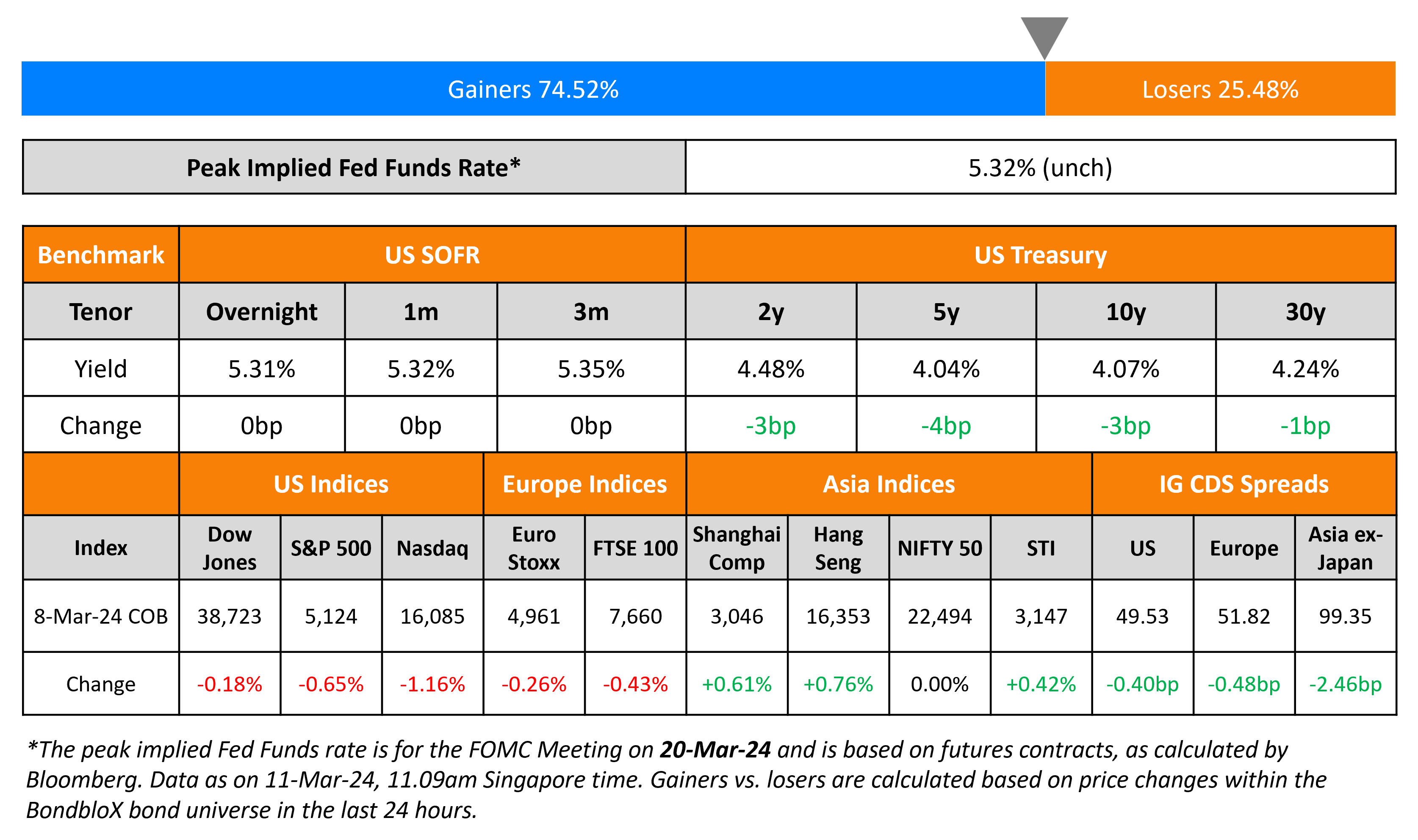

Top Gainers & Losers- 11-March-24*

Go back to Latest bond Market News

Related Posts: