This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US ISM Services Inches Higher, ADP at 3.5Y Lows

September 6, 2024

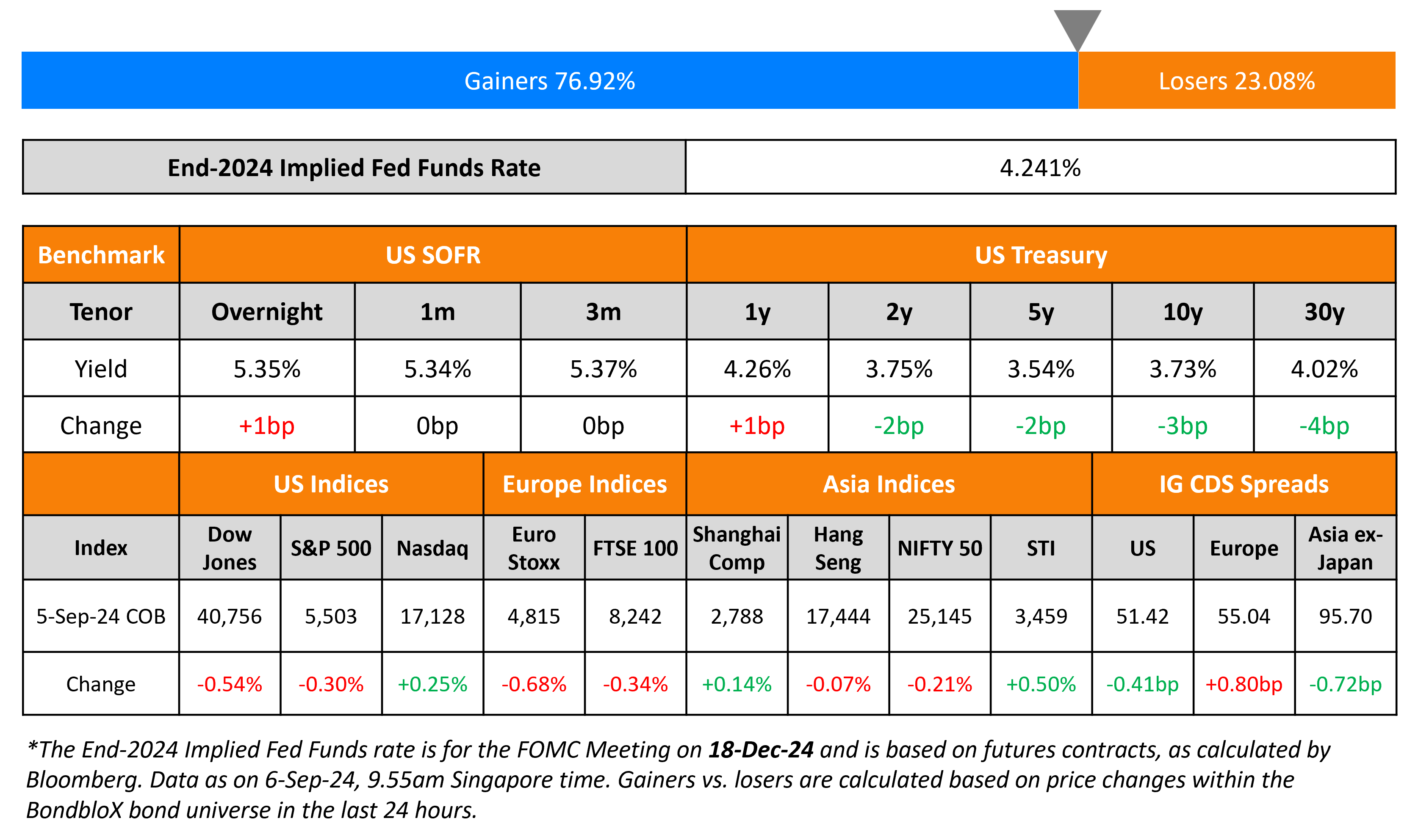

US Treasury yields were marginally lower, by 2-3bp across the curve. The US ISM Services Index inched higher to 51.5 in August vs. the prior reading and surveyed 51.4. Among its sub-components, the Prices Paid Index climbed to 57.3 vs. the surveyed 56.0 and prior reading of 57.0. However, the Employment Index declined to 50.2 vs. the surveyed 50.5 and prior month’s 51.1. Separately, the ADP Employment print showed an addition of 99,000 jobs in the private sector, much lower than expectations of 145,000 and the prior month’s revised 111,000 print. This was its lowest figure since January 2021. Initial jobless claims for the prior week ended eased slightly to 227k vs. expectations of 230k. US IG CDS spreads tightened by 0.4bp and HY CDS spreads were flat. Looking at US equity indices, the S&P was down 0.3% while the Nasdaq was up 0.3%.

European equity markets ended lower. Looking at Europe’s CDS spreads, the iTraxx Main spreads were wider by 0.8bp while Crossover spreads widened by 3.5bp. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads tightened by 0.7bp.

New Bond Issues

Korea Housing Finance Corp (KHFC) raised $500mn via a 3.5Y social bond at a yield of 4.275%, 22bp inside initial guidance of T+85bp area. The senior unsecured bonds are rated Aa2/AA. Net proceeds will be used to facilitate access to housing finance for end users in Korea through diverse range of mortgage loan products as detailed in KHFC’s sustainable financing framework.

Pampa Energia raised $410mn via a 7NC3 bond at a yield of 8.25% 12.5bp inside initial guidance of 8.375% area. The senior unsecured notes are rated CCC/B. Proceeds will be used to purchase the 2027s under its tender offer and related expenses thereunder, and for other general corporate purposes.

New Bonds Pipeline

- Vedanta hires for $ 5NC2/7NC3 bond

Rating Changes

- Fitch Upgrades Ukraine’s LTLC IDR to ‘CCC+’; Affirms LTFC IDR at ‘RD’

- Diamond Offshore Drilling Inc. Upgraded To ‘BB-‘ On Acquisition By Noble Corp. PLC; Issuer Credit Rating Withdrawn

- Moody’s Ratings upgrades JD.com’s ratings to A3; revises outlook to stable

- Moody’s Ratings upgrades Intelsat’s CFR to B1; ratings remain on review for further upgrade

- Harbour Energy PLC Ratings Raised To ‘BBB-‘ And Removed From CreditWatch On Wintershall Dea Acquisition; Outlook Stable

- Frontier Communications Holdings LLC ‘B-‘ Rating Placed On CreditWatch Positive On Pending Acquisition By Verizon

- Moody’s Ratings affirms Medco Energi’s B1 ratings; revises outlook to positive

Term of the Day

Dividend Pusher

Dividend pushers are a common covenant seen in perpetual bonds issued by both banks and corporates that require the issuer to make a coupon payment if it has paid a dividend on its shares. These covenants can be found in a bond’s prospectus or offering circular. Dividend pushers are included in a bond’s terms to provide confidence to bond investors that they would be paid coupons if the issuer’s stockholders are paid a dividend. Dividend pushers are sometimes used along with dividend stoppers, which prohibit issuers from paying a dividend on its stock if it has not made a coupon payment on its perpetual bonds.

Talking Heads

On Turkish Debt and Lira Facing a Bumpy Road – AllianceBernstein

“We haven’t added Turkish lira bonds in material size across our fixed-income platform as we think the upcoming two quarters will be bumpy for Turkey. Political pressure to ease is likely to be high, and premature easing could result in a weaker lira.”

On US Election a Top Global Risk But Tricky to Forecast – BofA

“It’s too early to really see what the different platforms will look like in reality. he market is not trading the election yet. The market has been focusing a lot on the behavior of the US economy… Between now and the election there will be other shocks… The downside risks are more important now than three months ago”

On cash could stay attractive for months despite rate cuts – JP Morgan

“As liquidity investors tend to be yield investors, this implies that it could take at least three months before cash meaningfully begins to shift out, regardless of how the upcoming easing cycle unfolds… We wouldn’t be surprised if MMF AUMs continue to rise into year-end, even if the Fed begins the easing cycle this month”

Top Gainers & Losers-06-September-24*

Go back to Latest bond Market News

Related Posts: