This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US ISM Manufacturing Continues to Contract

December 2, 2025

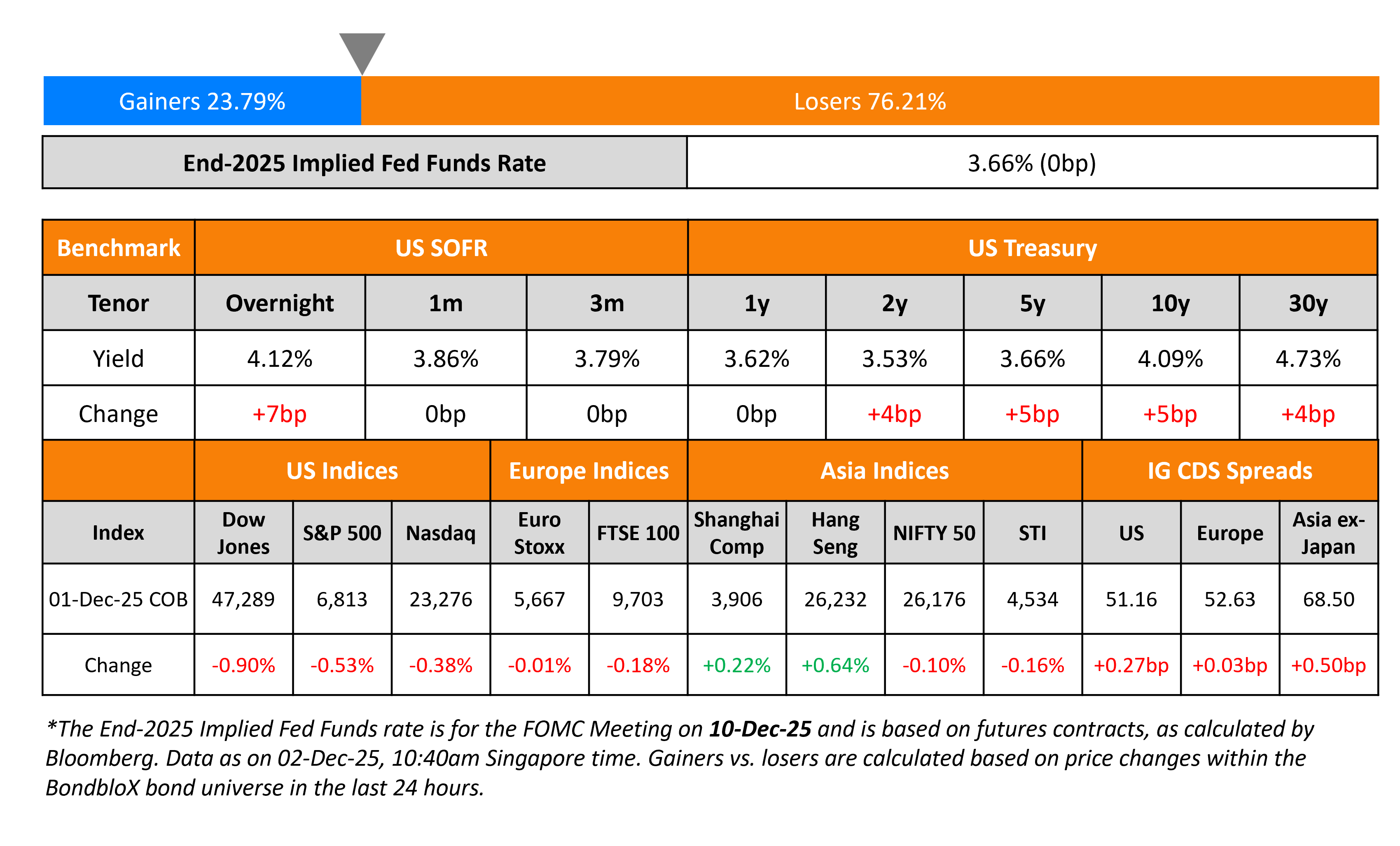

US Treasury yields jumped higher by 4-5bp. On the data front, the US ISM Manufacturing PMI for November came-in at 48.2, softer than expectations of 49.0 and the prior month’s 48.7. The reading was impacted by a drop in the new orders and employment sub-components.

Looking at US equity markets, the S&P and Nasdaq were lower by 0.5% and 0.4% respectively. US IG and HY CDS spreads widened by 0.3bp and 1bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads were almost unchanged while the Crossover CDS spreads were 0.6bp wider. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were 0.5bp wider. BOJ Governor Kazuo Ueda said that they would look at the “pros and cons of raising the policy interest rate and make decisions as appropriate”. Analysts believe that the comments essentially indicate the possibility of a December rate hike.

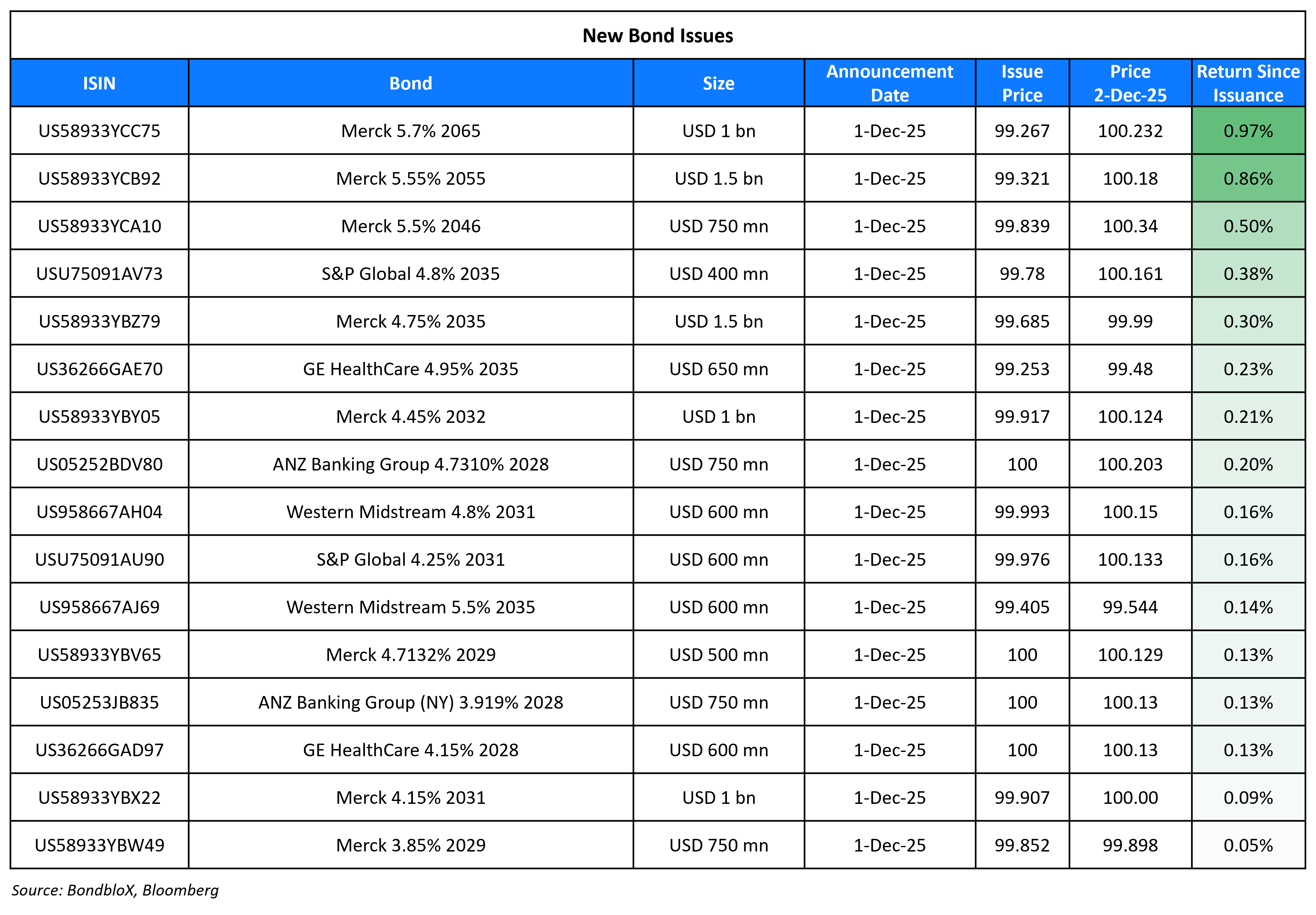

New Bond Issues

ANZ Banking Group raised $2bn via a three-trancher. It raised:

- $750mn via a 3Y bond at a yield of 3.919%, 28bp inside initial guidance

- $750mn via a 3Y FRN at SOFR+59bp vs. initial guidance of SOFR equivalent area

- $500mn via a 5Y FRN at SOFR+68bp, 22bp inside initial guidance of SOFR+90bp area

The notes are rated Aa2/AA-/AA-. Proceeds will be used for general corporate purposes.

GE Healthcare raised $1.25bn via a two-trancher. It raised $600mn via a 3Y bond at a yield of 4.15%, 30bp inside initial guidance of T+90bp area. It also raised $650mn via a 10Y bond at a yield of 5.046%, 30bp inside initial guidance of T+125bp area. The senior unsecured notes are rated Baa2/BBB/BBB. Net proceeds together with borrowings under their new term loan facility, cash on hand, and borrowings under its bridge loan facility if needed, will be used to pay the purchase price and expenses related to its acquisition.

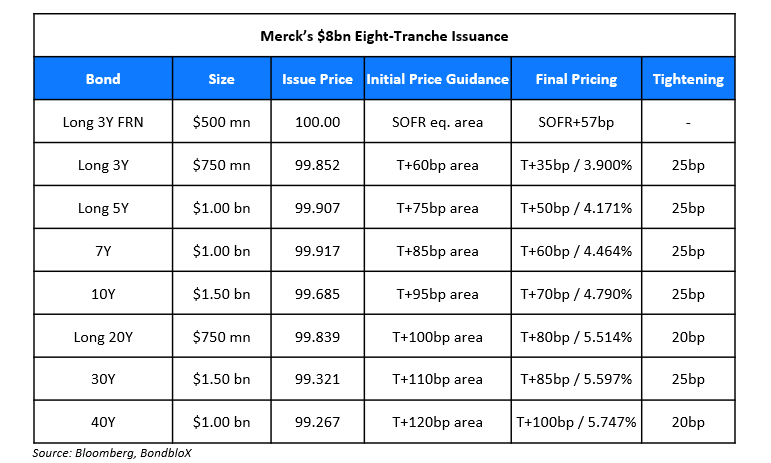

Merck raised $8bn via an eight-part offering.

The senior unsecured notes are rated Aa3/A+. Proceeds will be used for general corporate purposes including repaying debt, and potentially funding a portion of the cash consideration and related expenses payable in connection with its Cidara acquisition.

Rating Changes

- Fitch Revises TBC Insurance’s Outlook to Stable; Affirms at ‘BB’

- Moody’s Ratings upgrades Eutelsat ratings to Ba3; stable outlook

- Vedanta Resources Outlook Revised To Positive On Improving Operating Performance; ‘B+’ Rating Affirmed

Term of the Day: Drop-Down

A drop-down (in bond/loan agreements) is a move where a company shifts valuable assets out of the group that backs existing creditors and into an unrestricted subsidiary. Because an unrestricted subsidiary is not bound by the old debt covenants and usually does not guarantee the old bonds/loans, those transferred assets stop serving as collateral for current creditors.

After the assets are “dropped down,” the company can raise new debt at that unrestricted subsidiary and secure it with those assets, making the new lenders effectively senior to the old creditors with respect to those assets.

Talking Heads

On Flurry of Fed dissents in coming meetings could pose market, political risks

Christopher Waller, Fed Governor

“You might see the least ‘groupthink’ you’ve seen … in a long time”

Thomas Barkin, Richmond Fed President

“If it gets really down to seven-to-five … then one person switches and the whole trajectory changes. That’s kind of a danger with these kind of razor-thin, one-vote things. It doesn’t give people confidence”

Ed Al-Hussainy, Columbia Threadneedle

“A 7-5 split would be a mess for rates markets trying to price the appropriate path of rates over the next 12 to 18 months. And it would be a mess for risk assets looking for some degree of certainty around Fed strategy”

On Interest Rates Currently in a ‘Good Place’ – Joachim Nagel, ECB GC Member

“Our projections also suggest that interest rates are currently in a good place. Eurosystem monetary policy is broadly neutral right now… Based on these forecasts, we will be able to determine whether we are still on track to meet our medium‑term inflation target”

On Blue Owl’s teachable moment for investors and asset managers chasing yield and ‘hot money’

Morningstar analysts

“The wild ride of Blue Owl Capital Corporation II schooled the firm and holds lessons for would-be semi-liquid fund investors”

Craig Packer, Blue Owl co-president

“We have done extra calls to make sure folks understand how their funds are performing. And many do want to understand what’s going on with this fund”

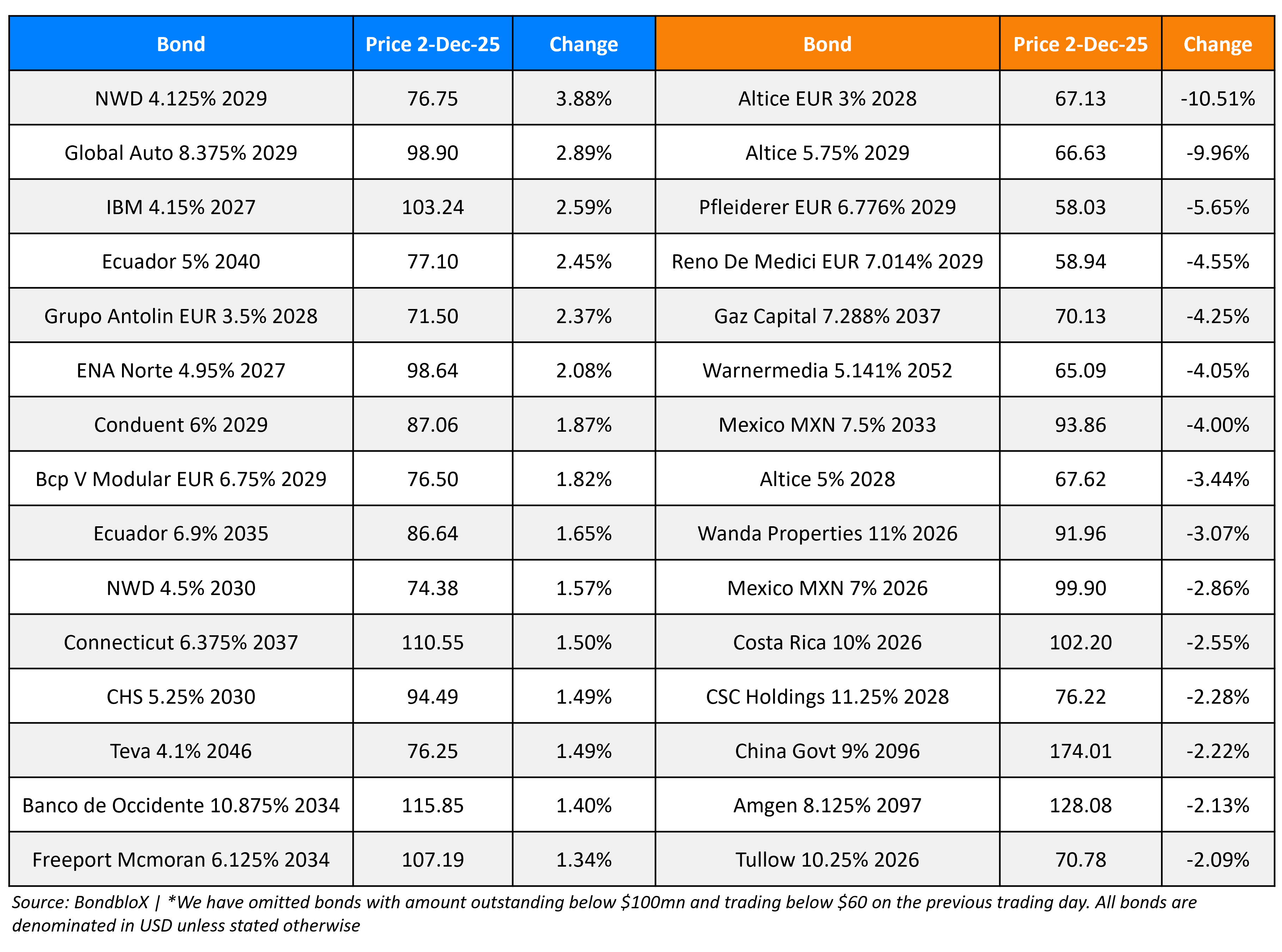

Top Gainers and Losers- 02-Dec-25*

Go back to Latest bond Market News

Related Posts: