This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Inflation Stronger than Expected; Indonesia, Shangri-La Launch Bonds

July 16, 2025

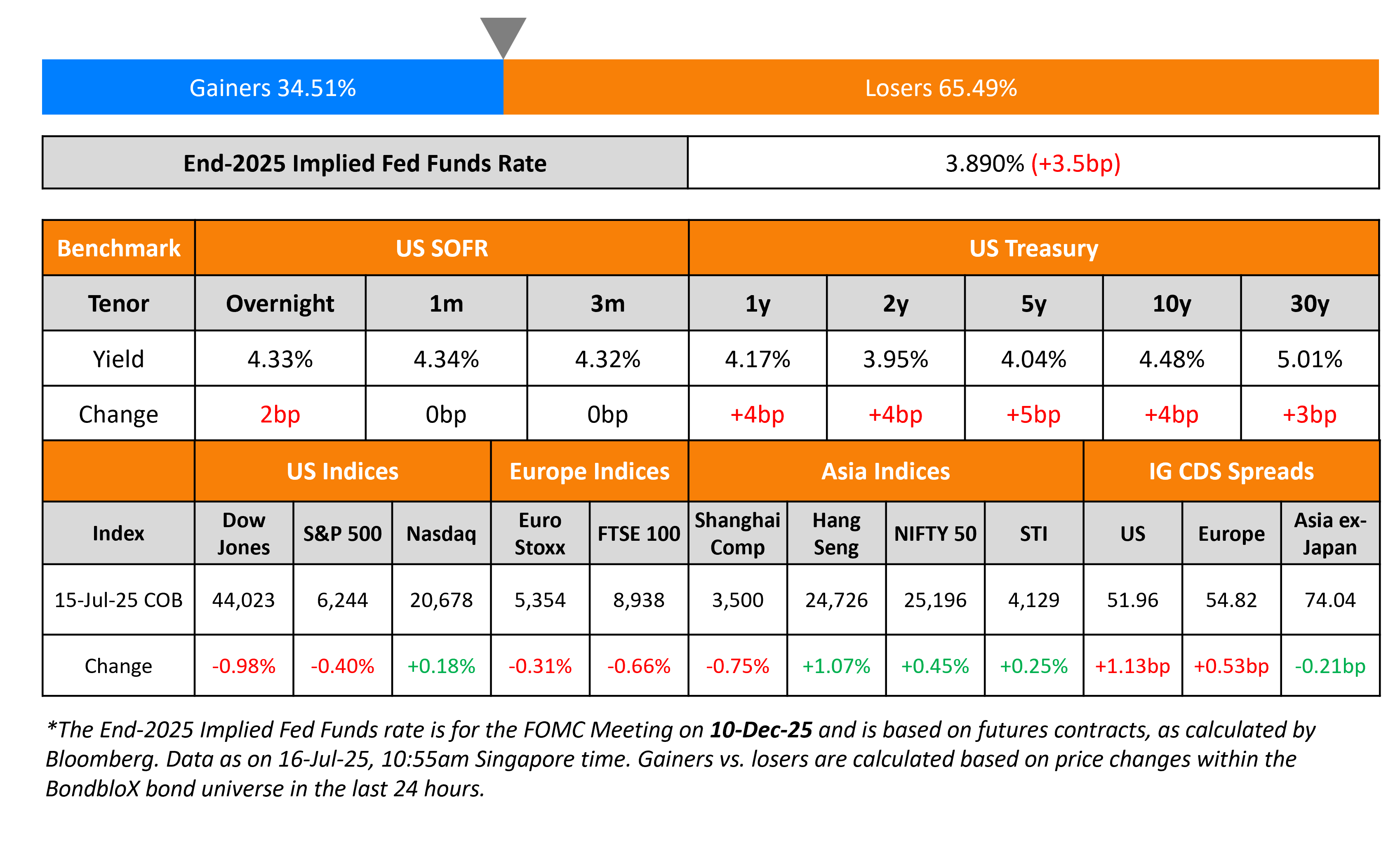

US Treasury yields rose across the curve by 4-5bp. US CPI YoY for June came-in at 2.7%, stronger than expectations of 2.6% and the prior month’s reading of 2.4%. Core CPI came-in at 2.9%, in-line with expectations and higher than the prior month’s reading of 2.8%. Markets are currently pricing-in about 40bp in Fed rate cuts by year end.

Looking at US equity markets, the S&P was down 0.4% while Nasdaq closed 0.2% higher. US IG and HY CDS spreads widened by 1.1bp and 0.6bp respectively. European equity markets ended lower . The iTraxx Main CDS spreads widened by 0.5bp while Crossover CDS spreads widened by 6.6bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 0.2bp.

New Bond Issues

- Indonesia $ 5Y/10Y Green at 4.85/5.5% area

- Shangri-La Hotel S$ 7Y at 3.7% area

Rating Changes

- Fitch Upgrades Hidrovias’ Ratings; Outlook Stable

- GCI LLC Upgraded To ‘BB-‘, Removed From CreditWatch Negative On USF Supreme Court Ruling

- Fitch Upgrades Shinhan Indo Finance to ‘AA+(idn)’; Outlook Stable

Term of the Day: Exchangeable Bonds

Exchangeable bonds are a type of debt that gets converted into the common stock of a target firm in which the issuing firm has an ownership position. It signifies a potential change in the issuing company’s asset composition via the divesting of its ownership stake in the target firm.

Malaysia’s sovereign wealth fund Khazanah is considering raising $500mn from an exchangeable dollar bond sale to help fund its overseas investments, as per sources.

Talking Heads

On Bond Sellers Speeding Up Deals to Dodge Market Swings Spurred by Trump

Teddy Hodgson, Morgan Stanley

“Companies have a strong desire to price earlier in the day where there’s still more active trading in Treasuries”

Scott Kimball, Loop Capital Asset Management

“The market is in a race against headlines…Fiscal policy and trade policy have been changing day-to-day, putting markets between extreme pessimism and euphoria within 24 hours of each other.”

On Bridgewater Growing More Bullish on China Stocks After 14% Return

Bridgewater in a letter

“Looking ahead, we expect the supportive policy stance to continue, providing a backstop for overall risk asset prices…As a result, we are increasing our allocations to a basket of risk assets.”

On Fed independence ‘absolutely critical’ – JPMorgan CEO Jamie Dimon

“The independence of the Fed is absolutely critical, and not just for the current Fed chairman, who I respect, but for the next Fed chairman…Playing around with the Fed can often have adverse consequences, absolutely opposite of what you might be hoping for”

Top Gainers and Losers- 16-Jul-25*

Go back to Latest bond Market News

Related Posts: