This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US IG Spreads at Multi-Decade Lows; UBS, AT&T, Credit Agricole Price $ Bonds

September 19, 2025

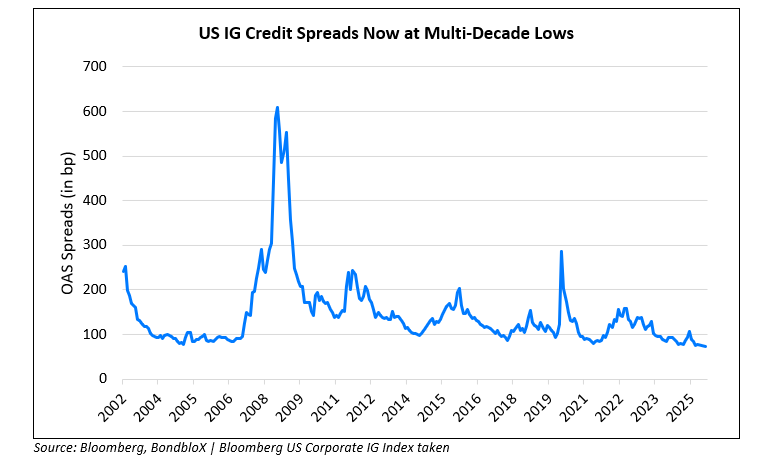

US Treasury yields ticked higher by 3-4bp, continuing the move following the FOMC meeting late-Wednesday. Initial jobless claims for the previous week came-in at 231k, better than expectations of 240k. It was also a significant positive reversal of the prior week’s 264k print, calming any fears about a sharp labor market slowdown. Looking at US equity markets, the S&P and Nasdaq closed higher by 0.5% and 0.9% respectively. US IG and HY CDS spreads were tighter by 0.8bp and 5.4bp respectively. US Investment Grade credit spreads (as measured by the OAS) are now at their tightest levels in more than two decades, as seen in the chart above.

European equity markets ended higher. The iTraxx Main CDS and Crossover spreads were 0.9bp and 3.2bp tighter respectively. Asian equity markets have opened weaker today. Asia ex-Japan CDS spreads were 0.1bp tighter. The BOJ kept its policy key rate on hold at 0.5%, inline with market expectations.

New Bond Issues

.png)

UBS raised $5bn via a five-part deal:

The senior unsecured notes are rated A2/A-/A.

AT&T raised $5bn via a four-part deal:

The senior unsecured notes are rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes, which may include upcoming debt maturities and pending acquisitions. The new 10Y is priced at a new issue premium of ~7bp over its existing 4.5% 2035s that currently yield 4.87%.

Credit Agricole raised $1.5bn via an 8NC7 bond at a yield of 4.818%, 28bp inside initial guidance of T+125bp area. The senior non-preferred note is rated A3/A-/A+.

BAT Capital raised $750mn via a long 7Y bond at a yield of 4.707%, 30bp inside initial guidance of T+115bp area. The senior unsecured note is rated Baa1/BBB+/BBB+. Proceeds will be used for general corporate purposes, including the repayment of existing debt. The new bond is priced ~13bp tighter to its existing 7.75% 2032s that currently yield 4.84%.

Turk Eximbank raised $600mn via a 5Y bond at a yield of 6.50%, ~68.75bp inside initial guidance of 7.125%-7.25% area. The senior unsecured note is rated Ba3. Proceeds will be used for general corporate purposes. The new bond offers a yield pick-up of 49bp over the Türkiye sovereign’s 5.95% bonds due January 2031, which are also rated Ba3, that currently yield 6.01%. However, the Turkey Wealth Fund’s recent 5Y (6.875% 2031s) issuance rated Ba3 and yielding 6.62%, offers a yield pick-up of 12bp over the new Turk Eximbank bond.

FS KKR Capital raised $400mn via a long 5Y bond at a yield of 6.359%, 17.5bp inside initial guidance of T+287.5bp area. The senior unsecured note is rated Baa3/BBB-. Proceeds will be used for general corporate purposes, including the repayment of outstanding debt.

New Bond Pipeline

- Seazen plans $250mn issuance

- China Ping An $ bond issuance

- Mirae Asset Securities $ 3Y/5Y

Rating Changes

-

Buckeye Partners LP Upgraded To ‘BB’ From ‘BB-‘ On Lower Consolidated Leverage; Outlook Stable

-

Braskem S.A. Downgraded To ‘B+’ On Reduced Financial Flexibility; Outlook Negative

-

Moody’s Ratings downgrades Kronos’ CFR to Caa1, outlook stable

-

Bayer AG Outlook Revised To Negative On Increased Risks To Growth; ‘BBB’ Ratings Affirmed

Term of the Day: New Issue Premium

A new issue premium refers to the incremental higher yield (yield premium) on an issuer’s newly issued bond over bonds by the same issuer with a similar maturity. A newly issued bond by an issuer typically offers a higher yield to its own comparable bond to entice investor demand in the security. Sometimes, if an issuer does not have a comparable bond with a similar maturity, but does have a yield curve (i.e., other bonds issued across different maturities), analysts can interpolate and arrive at an estimated yield for a hypothetical comparable. However, while new issue premiums are typically the case, it is not necessary that an issuer’s new bond would always have a new issue premium.

Talking Heads

On Miran’s Fed Dissent Making a splash, Fails to Sway the Outcome

Jerome Powell, FOMC

“The only way for a voter to really move things around…is to make really strong arguments based on the data and one’s understanding of the economy…that’s how it’s going to work. That’s in the DNA of the institution”

TD Securities Analysts

“His 2025 dot at 2.875% is reflective of President Trump’s push for bringing policy rates rapidly back to a more neutral setting…Trump appointees Bowman and Waller did not join Miran in supporting a larger rate cut, which in our view reflected a show of support for Fed independence.”

Brian Jacobsen, Annex Wealth Management

“Miran’s dots stand out like a sore thumb, so those are going to be perceived more as signaling than any sort of indicator of where policy might actually head,”

On Fed’s Rate Cut Coming with Caveats, Leaving Investors Lukewarm

Larry Hatheway, Franklin Templeton Institute

“We’ve had a rather cautious, not necessarily fully defensive… view here for a while,”

Dan Siluk, Janus Henderson Investors

“Markets may welcome the easing bias, but the messaging remains nuanced and far from a full pivot”

Jack McIntyre, Brandywine Global

“The Fed is in a tough spot…They expect stagflation, or higher inflation and a weaker labor market. That is not a great environment for financial assets.”

On Fed Rate Hikes Would Widen Treasury Spreads -Kevin Zhao, UBS Asset Management

“If you have growth going up, unemployment going down, and inflation staying high, I think the justification for rate hikes will become evident by the middle of next year”

Top Gainers and Losers- 19-Sep-25*

Go back to Latest bond Market News

Related Posts: