This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US IG Spreads at Historic Tight Levels; Hutchison Ports, Mongolia, SMFG Launch $ Bonds

February 18, 2025

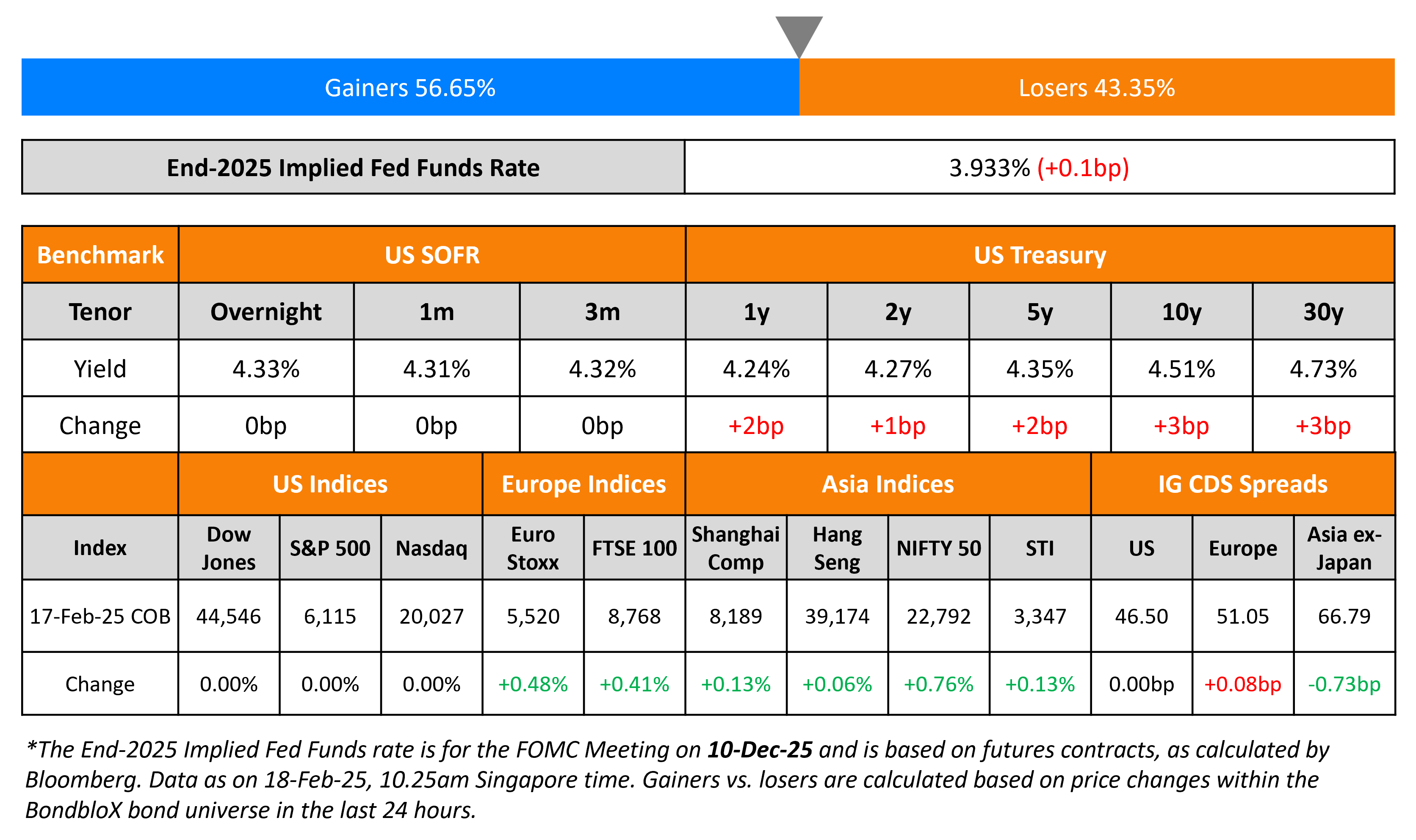

US Treasuries were closed yesterday on account of President’s Day. Philadelphia’s Fed President Patrick Harker sounded optimistic on the state of the US economy and saw no reason to change interest rate policy right now. He added that inflation will continue on a downward path and that the policy rate will be able to decline over the long run. However, Fed Reserve Governor Michelle Bowman wanted increased conviction that inflation will decline further this year before lowering interest rates again, particularly given the uncertainty around the Trump administration’s new trade and other policies. Another Fed Reserve Governor, Christopher Waller too favored a pause on interest rate cuts until the uptick in inflation, based on recent economic figures, eases.

US equity and credit markets were closed yesterday. US IG CDS spreads have tightened to ~78.9bp levels, close to their historic low of 2021s and levels seen previously in 2004-2005, as seen in the chart below.

European equity markets ended higher. The iTraxx Main and and Crossover CDS spreads widened by 0.1bp and 0.8bp respectively. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were tighter by 0.7bp.

New Bond Issues

- Hutchison Port Holdings $ 5Y @ T+110bp

- Mongolia $ 5Y @ 7.125% area

- SMFG $ PerpNC10.25 AT1 @ 6.875% area

Guocoland raised S$180mn via a PerpNC5 bond at a yield of 4.35%, 30bp inside initial guidance of 4.65% area. The subordinated bond is unrated. If not called by end of 5 years, the coupon will reset to SGD 5Y SORA-OIS +180.3bp plus the step-up Margin. The bond has a Dividend Pusher and a Dividend Stopper clause. Proceeds will be used to finance general working capital and corporate requirements of the Group.

BPCE raised €1.25bn via a 11NC10 bond at a yield of 3.883%, 30bp inside initial guidance of MS+175bp area. The senior non-preferred note is rated Baa1/BBB+/A.

BBVA raised €1bn via a 12NC7 Tier 2 bond at a yield of 4.015%, 35bp inside initial guidance of MS+200bp area. The subordinated note is rated Baa2/BBB/BBB-. The bond is callable at par on 25 February, 2032. If not redeemed, the coupon will reset to 5Y Mid-Swap + 165bp.

ABN Amro raised £775mn via a two-trancher. It raised £500mn via a 5Y bond at a yield of 4.827%, 15bp inside initial guidance of UKT+95bp area. It also raised £275mn via a 2Y FRN note at SONIA+58bp, at par with initial guidance. The senior preferred notes are rated Aa3/A/A+.

New Bonds Pipeline

- Emirates NBD hires for $ PerpNC6 bond

- Saudi Real Estate hires for $ 3Y/10Y bond

- Damac hires for $ 3.5Y Sukuk bond

- Sharjah Islamic Bank hires for $ 5Y Sukuk bond

- Macquarie Bank hires for € 5Y WNG bond

Rating Changes

- Fitch Upgrades Santander Bank Polska’s IDR to ‘A-‘ Following Banco Santander’s Upgrade

- Argentina Local Currency Sovereign Rating Lowered To ‘SD’ After Debt Exchanges; ‘CCC’ Foreign Currency Rating Affirmed

- Moody’s Ratings downgrades Telefonica del Peru to Caa3; outlook changed to negative

- Fitch Revises Allwyn’s Outlook to Positive; Affirms IDR at ‘BB-‘

Term of the Day

Catastrophe Bonds

Catastrophe bonds also referred as Cat bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies for the issuer against natural disasters, where they pay regular coupons (premium) in exchange for protection. In the event of a natural disaster trigger, issuers will receive a payout from the proceeds of the bond and the principal repayment and interest payments are either deferred or cancelled. If a trigger event doesn’t occur, the issuer continues to pay the coupons as scheduled, similar to a regular bonds and proceeds are returned to the investors at maturity. Cat bonds are generally purchased by governments, insurance and reinsurance companies. These bonds have gained traction as the frequency of natural disasters is on the rise.

Talking Heads

On Seeing Dangers in Credit Market’s Calm

Nicolas Trindale – AXA

“Yields are high because sovereign yields are high, not because of credit spreads. But a lot of investors are just all-yield buying. Investors think the Fed will cut, they think Trump won’t do all the things he said he would on the campaign trail.”

David Zahn – Franklin Templeton

“When everybody becomes complacent that everything’s just fine, it normally isn’t. The chances of a policy mistake in multiple jurisdictions is incredibly high.”

Mohit Kumar – Jefferies International

“Whichever way the peace process goes, it is clear that Europe will need to increase more spending on defense to provide security to Ukraine. That outlook implies upward pressure on European rates and steeper curves.”

On UK Requiring Radical Shift From Longer Debt

Moyeen Islam – Barclays Plc

“The last part of the UK macroeconomic framework that needs to be reviewed is debt issuance. The interest-rate costs of issuing long gilts offer poor value for taxpayers.”

Top Gainers and Losers- 18-February-25*

Other News

Go back to Latest bond Market News

Related Posts: