This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US HY CDS Spreads Spikes to 4-month High; AXA Prices € Bonds

October 14, 2025

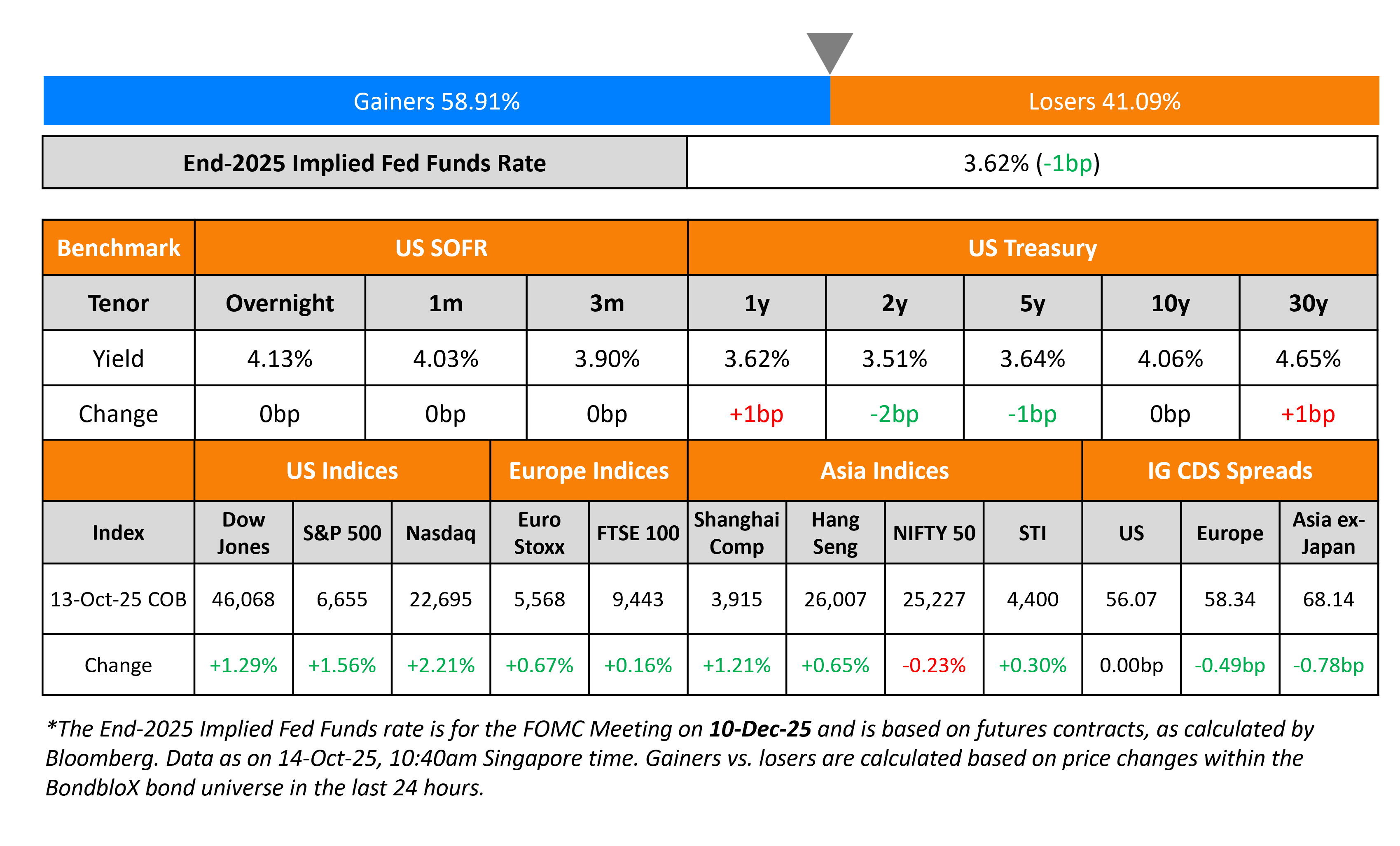

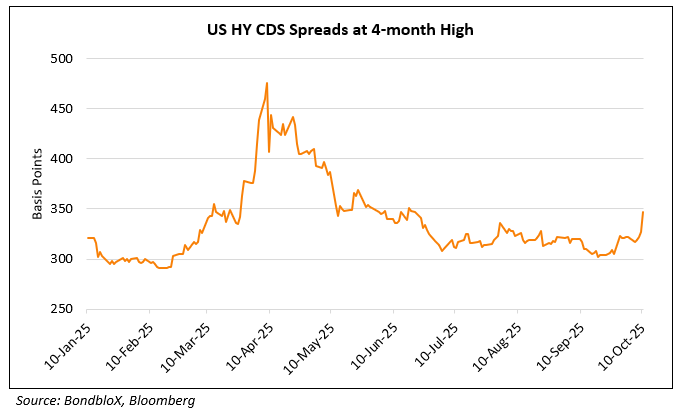

US Treasury yields were broadly stable. Yesterday, the US bond markets were closed on the occasion of Columbus Day. Separately, Philadelphia’s Fed President Anna Paulson signaled she favors two more 25bp rate cuts this year. She expects the US economy to continue growing above trend in the third quarter and doesn’t see conditions that would turn tariff-induced price increases into sustained inflation. On the back of the selloff in risk assets late last week, the US HY CDS spiked to its 4-month high of 347bp.

Looking at equity markets, both the S&P and Nasdaq recovered from Friday’s fall closing 1.6% and 2.2% higher respectively. European equity indices also closed higher. The iTraxx Main CDS spreads were 0.5bp tighter while the Crossover spreads were 2.6bp tighter. Asian equity markets have opened broadly weaker today. Asia ex-Japan CDS spreads were 0.8bp tighter.

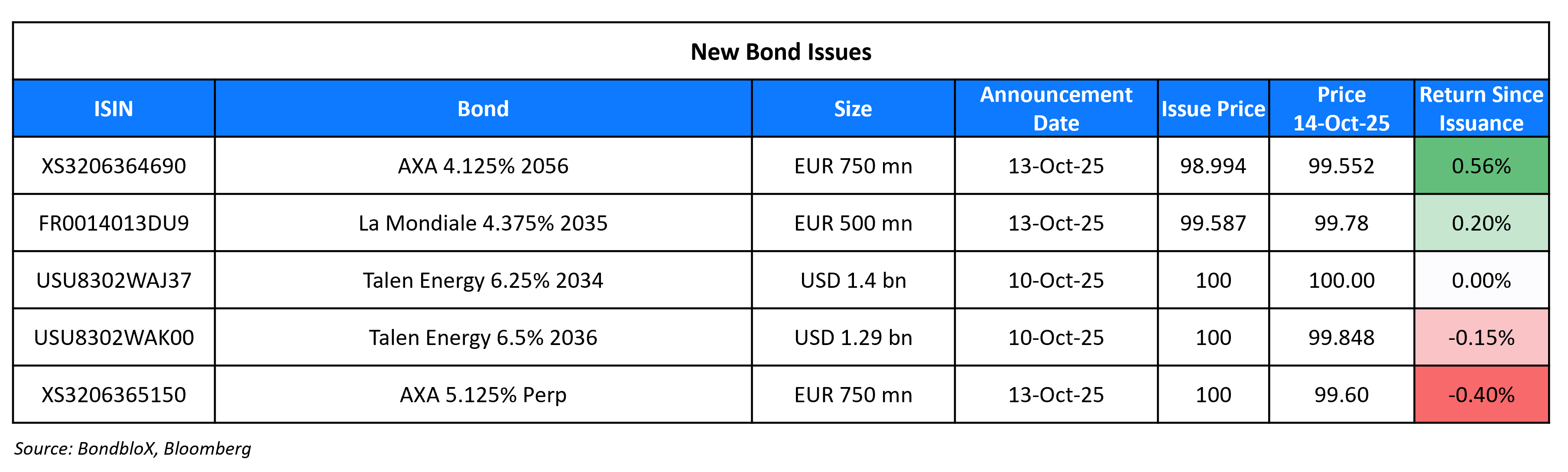

New Bond Issues

- Lendlease AUD PerpNC3 at ASW+220-270bp area

- KEB Hana Bank $ 3Y FRN, $5Y Green at SOFR+95bp, T+80bp area

AXA raised €1.5bn via a two-part deal. It raised:

- €750mn via a 30.8NC10.8 Tier-2 bond at a yield of 4.245%, 32bp inside initial guidance of MS+190bp area. The subordinated bond is rated A1/A-. If not called by 24 January 2036, then the coupon will reset to 3mnth Euribor plus margin, including 100bp step-up.

- €750mn via a PerpNC6.4 RT1 bond at a yield of 5.125%, 25bp inside initial guidance of 5.375% area. The junior subordinated bond is rated A3/BBB+. If not called by 16 March 2032, the coupon will reset to 5Y Mid Swaps plus 278.4bp. Trigger Event will occur if in case: (i) the Issuer’s solo Solvency Capital Requirement (SCR) ratio or the Group SCR ratio is equal to or less than 75%; (ii) the Issuer’s solo Minimum Capital Requirement (MCR) ratio or Group MCR ratio is equal to or less than 100%; or (iii) the solo SCR ratio or the Group SCR ratio has been less than 100% but more than 75% for a continuous period of three months (a “Special Trigger Event”)

Proceeds will be used for general corporate purposes, including the refinancing of part of the AXA Group’s outstanding debt.

New Bonds Pipeline

- Avation $300-400mn, up to 5.5NC2 Bond

- China Water Affairs $5NC3 Blue Bond

Rating Changes

- Fitch Upgrades Topaz Solar Farms, LLC’s Senior Notes to ‘BBB-‘; Outlook Stable

- Xerox Holdings Corp. Downgraded To ‘B-‘ From ‘B’ On Business Challenges; Outlook Negative

- Moody’s Ratings affirms ZhongAn’s ratings; changes outlook to positive from stable

- Moody’s Ratings changes Stellantis outlook to negative, affirms Baa2

- Moody’s Ratings affirms ASK Chemicals’ CFR at B3; outlook changed to stable

- Owens & Minor Inc. Ratings Placed On CW Neg On Definitive Agreement To Sell Products & Healthcare Services Segment

Term of the Day

Risk Weighted Assets

Risk Weighted Assets (RWA) is a calculation used in banking that helps determine the minimum amount of capital (capital adequacy ratio) that a bank should keep as reserves against unexpected losses arising out of its assets turning sour or insolvency/bankruptcy. Riskier assets like unsecured loans, high yield securities etc. that carry a higher risk of default are given a higher risk weightage and safer assets like Treasuries are given a lower weightage since high risk assets require higher capital adequacy ratios (CAR).The minimum capital requirements as a percentage of RWAs are set by regulatory agencies with banks required to keep a minimum of 10.5% of RWA as Tier 1 and Tier 2 capital under Basel III. According to Fitch, BBVA’s earnings performance remains among the best in its peer group, with operating profit projected to approach 4% of risk-weighted assets in 2025–2026.

Talking Heads

On Debasement Debate Rippling Across Markets

Stephen Miller, consultant at GSFM

“The debasement trade still has some way to run. US Treasuries just aren’t the unimpeachable safe harbor asset that they once may have appeared and it’s a phenomenon repeated across other bond markets.”

On Introducing Disaster Debt Breaks for EM

Samy Muaddi, T. Rowe Price Associates

“We’re trying to get ahead of the next crisis. We’ve seen lower income countries are subject to the vagaries of macroeconomic volatility. So what we’re introducing here is more resilient contracts.”

Abby McKenna, Emerging Markets Investors Alliance

“There would be fewer defaults in the long term. The hope is that this standardized liquidity solution offers a predictable, quantifiable tool for managing risks that will benefit both issuers and investors.”

On Leveraged ETFs Worsening Friday Selloff

Steve Sosnick, Interactive Brokers

“We’d seen customers selling volatility going into Friday in general, and that came back to bite them. There are plenty of potential culprits, whether that approach to volatility came through leveraged ETFs”.

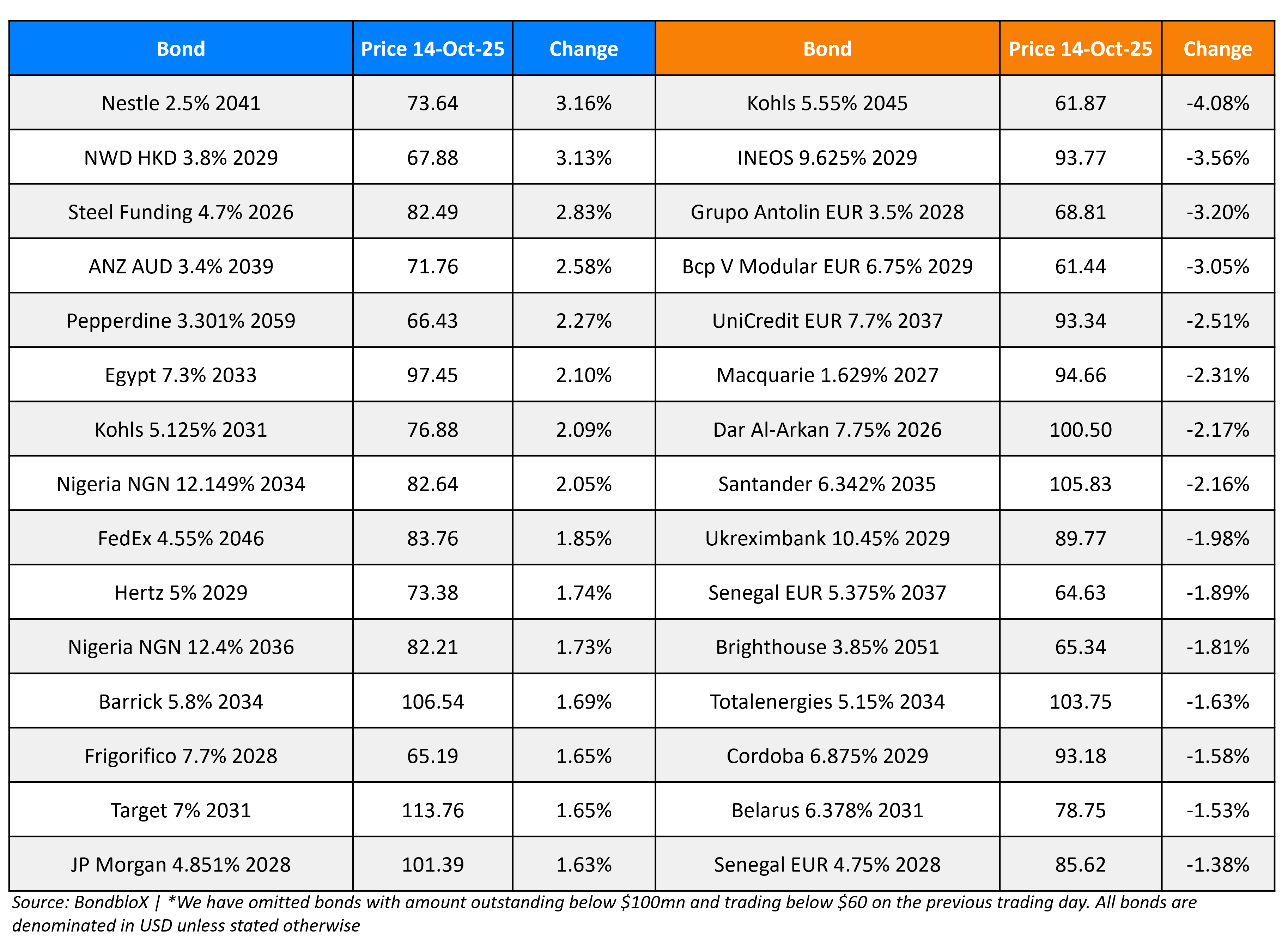

Top Gainers and Losers- 14-Oct-25*

Go back to Latest bond Market News

Related Posts: