This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Headline and Core PCE at 3.4% and 3.7%

October 30, 2023

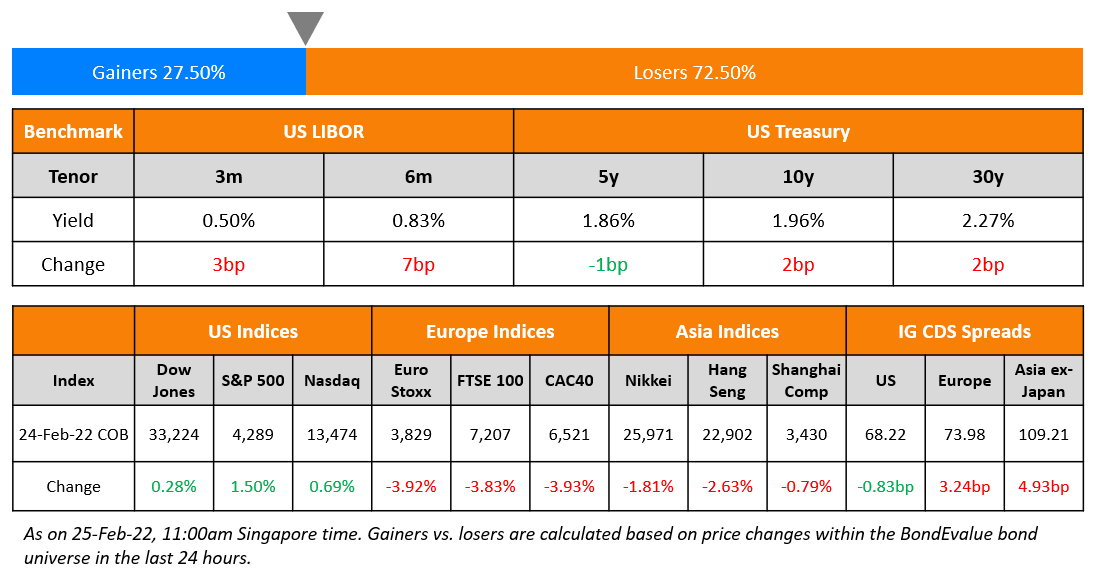

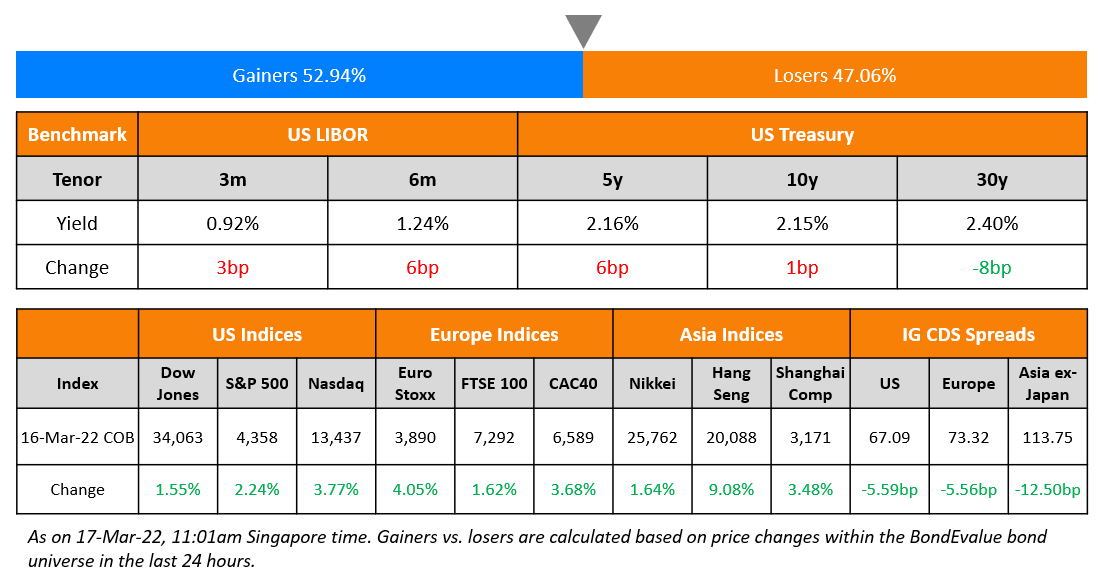

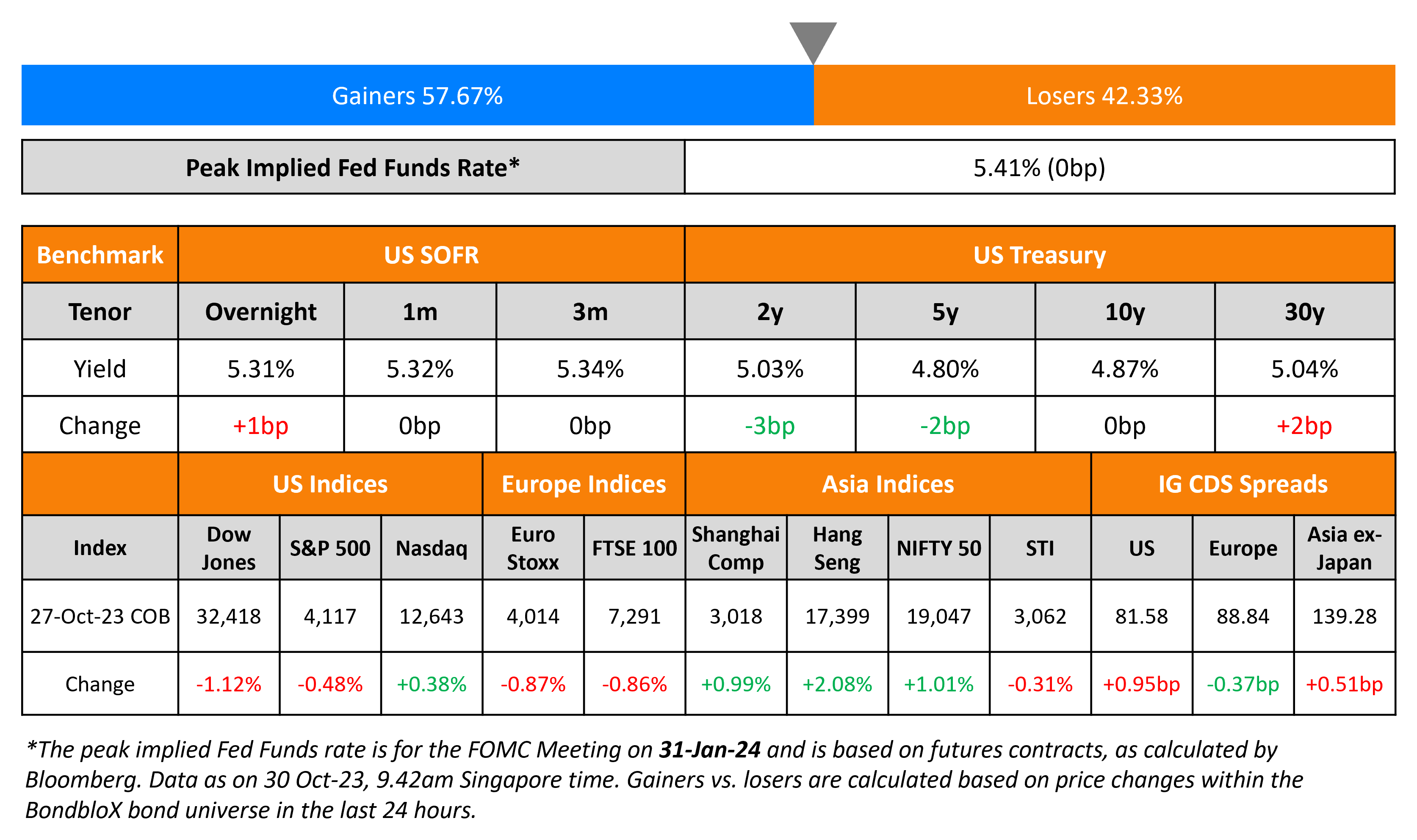

US Treasury yields were steady on Friday. On the economic data front, US headline PCE came at 3.4% and Core PCE at 3.7% in September, both, in-line with forecasts. US credit markets saw IG CDS spreads widen 1bp and HY spreads wider by 4.1bp. US equity markets were mixed, with the S&P down 0.5% and the Nasdaq up 0.4%. LSEG data showed that Q3 earnings in the US are expected to have increased 4.3% YoY. This is much higher than initial estimates that expected a 2.6% rise during this period. The data also noted that about 78% of the quarterly earnings are beating expectations vs. an average of 74% over last four quarters.

European equity markets closed lower. In credit markets, European main CDS spreads were tighter by 0.4bp and crossover spreads tightened by 0.9bp. Asian equity markets have opened in the red today. Asia ex-Japan IG CDS spreads widened 0.5bp.

New Bond Issues

- Korea Investment & Securities $ 3Y at T+260bp area

- Hyundai Capital $ 2Y FRN/ 2Y/ Long 5Y at SOFR/T+145/205bp area

Rabobank raised €1.75bn in a two-tranche senior preferred deal. It raised €1bn via a 3Y bond at a yield of 3.913%, 25bp inside initial guidance of MS+75bp area. It also raised €750mn via a 3Y FRN at a yield of 4.545%. The coupon will reset at the 3M EURIBOR plus a spread of 59 bps and will be paid quarterly. The bonds have expected ratings of Aa2/A+/AA-. The fixed rate notes received orders over €1.85bn, 1.9x issue size while the floaters received orders over €1.25bn, 1.7x issue size.

New Bond Pipeline

- Changde Economic Construction hires for € 364-day bond

- Ziraat Katilim hires for $ 3Y sukuk bond

- Oman Telecom hires for $ 7Y Sukuk

- Korea Investment & Securities hires for $ 3Y bond

Rating Changes

- Moody’s changes Ferguson’s rating outlook to positive

Term of the Day

Bond Vigilantes

Coined by Edward Yardeni, ‘Bond Vigilantes’ are bond market players who sell bonds in large quantities pushing up interest rates if they believe that the government isn’t protecting the currency. For example, if inflation rises, deficits grow, or a country’s creditworthiness is at risk, the bond vigilantes sell government bonds, which would lead to rising yields and therefore a higher borrowing cost for the government.

Episodes of bond vigilantes selling bonds have been seen in the 1980s during the Clinton administration and also during the Obama administration as per Bloomberg. Bond vigilantes are said to have come back as the 10Y yield has risen.

Talking Heads

On 35% Yield Would Make It Bullish on Lira Bonds – JPMorgan

“Bond yields continue to march higher, but we think further adjustment is needed to turn bullish…. intervention in secondary markets for fixed-rate bonds directly from the CBT has ceased, which is putting upward pressure on yields, especially in the back-end”

On Emerging-Market Companies at Risk With $400bn of Debt Due

Sergey Dergachev, PM and EM corporate debt chief at Union Investment

“I see in particular some corporates out of China, Argentina, Brazil and Ukraine vulnerable to refinance debt in this environment.”

Warren Hyland, a money manager at Muzinich

“High yield is the area of concern… we should expect weaker credit matrix companies to underperform and when funding becomes restrictive, allocation to single B/CCC and frontier markets should be reduced”

Peter Varga, senior PM at Erste Asset Management

“I am very selective now. Weak names which survived with low refinancing costs will drop out”

One Last Make-or-Break Week of 2023 Has Treasury Traders on Edge

Amar Reganti, fixed-income strategist at Hartford Funds

“We’re going through a period of volatility… data is uncertain, there’s uncertainty about the composition of Treasury supply, and then there’s a shift among the buyer base”

Stephen Bartolini, fixed income Pm at T. Rowe Price

“The more they do away with yield-curve control, that’s a bearish impulse on the back end of the Treasury curve… Getting off of yield-curve control could lead to the sort of the final impulse in this cycle”

Spencer Hakimian, the CEO of Tolou Capital

“The risks to consumption are materially to the downside. An allocation to longer-duration government debt, therefore, makes sense in our eyes”

Top Gainers & Losers- 30-October-23*

Go back to Latest bond Market News

Related Posts: