This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Government Shutdown Nears a Potential End; Consumer Sentiment at Lowest Since June 2022

November 10, 2025

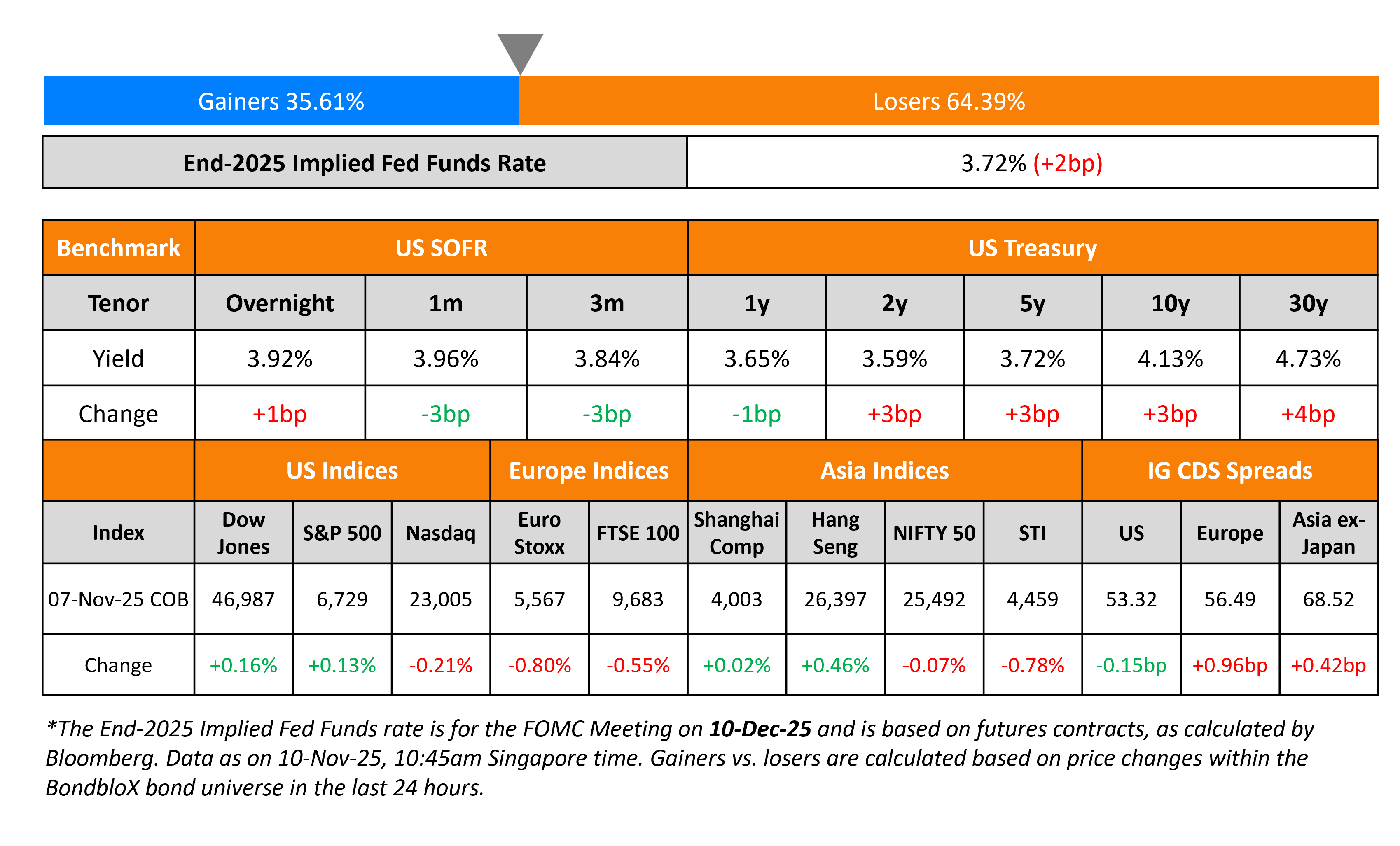

US Treasury yields are higher by 3-4bp, with a group of senators having voted to reach an agreement in order to reopen the government amid the prolonged shutdown. If the bill passes, it would then proceed to the House of Representatives for approval before being sent to the US President Donald Trump for his signature. Separately, the Fed’s Vice Chair Philip Jefferson said interest rates continue to have a “somewhat restrictive” effect on the economy. He added that it makes “sense to proceed slowly as we approach the neutral rate”. Further, he justified the recent rate cuts as “appropriate” due to the increasing downside risks to employment. On the data front, the University of Michigan Consumer Sentiment Index fell to 50.3 from 53.6 in October, and was also worse than expectations of 53.2. This was its lowest reading since June 2022, with the government shutdown weighing on the index.

Looking at the equity markets, the S&P closed higher by 0.2% while the Nasdaq ended 0.2% lower. US IG and HY CDS spreads tightened by 0.2bp and 1.6bp respectively. European equity indices ended lower. The iTraxx Main CDS spreads were 1bp wider and the Crossover CDS spreads were wider by 3.6bp. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads widened by 0.4bp.

New Bond Issues

- CDL Hospitality REIT S$ PerpNC5 at 4% area

- Hong Kong Digitally Native Notes HKD 2Y/USD 3Y/EUR 4Y/CNH 5Y at 2.5%/T+3bp/MS+23bp/1.9% areas

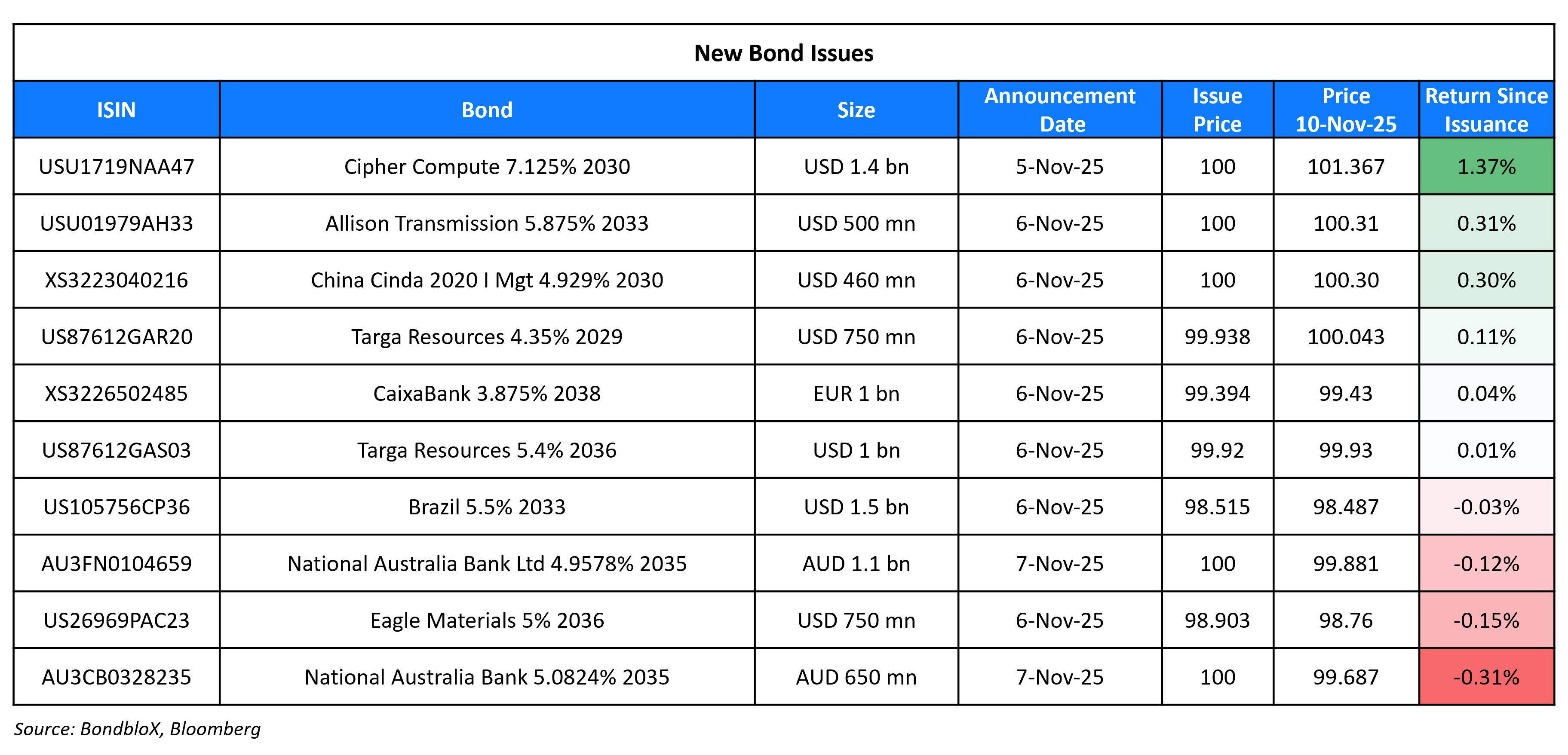

National Australia Bank (NAB) raised A$1.75bn via a two-part deal. It raised A$1.10bn via a 10NC5 bond at 3m BBSW+130bp, ~12.5bp inside initial guidance of 3m BBSW+140/145bp area. It also raised A$650mn via a 10NC5 bond at a yield of 5.0824%, ~12.5bp inside initial guidance of ASW+140/145bp area. The subordinated notes are rated A3/A-/A-.

New Bonds Pipeline

- Bank of Sharjah $ 5Y bond

- Dubai Islamic Bank (DIB) $ sustainability bond

- Airservices Australia A$ 12Y bond

Rating Changes

- Ghana Upgraded To ‘B-/B’ On Improving Fiscal And Balance of Payments Performance; Outlook Stable

- Moody’s Ratings upgrades Banca Transilvania’s long-term deposit ratings to Baa1 and long- and short-term issuer ratings to Baa2/P-2

- Fitch Downgrades Arcelik to ‘B+’; Outlook Negative

- Citycon Downgraded To ‘B+’ On Takeover By G City; On Watch Negative

- PacifiCorp Downgraded To ‘BBB-‘ On Disclosed Surety Bond Concerns; Outlook Negative

- Beazer Homes USA Inc. Downgraded To ‘B’ On Higher-Than-Expected Leverage; Outlook Revised To Stable

- Uganda Outlook Revised To Positive On Resilient Growth; ‘B-/B’ Ratings Affirmed

- Israel Outlook Revised To Stable From Negative; ‘A/A-1’ Ratings Affirmed

- Fitch Revises Vodafone’s Outlook to Stable; Affirms IDR at ‘BBB’

- Fitch Places Blue Owl Capital Corporation II on Rating Watch Positive on Planned Merger

Term of the Day: K-Shaped Economy/Recovery

A K-shaped economy (recovery) refers to an economic situation where different segments of society or industries recover at very different rates. Here, some segments improve rapidly while others continue to decline or stagnate. The term comes from the shape of the letter “K,” where one line moves upward (representing those who are doing well) and the other moves downward (representing those who are struggling).

An example of this is the post pandemic recovery, which many economists has identified as being K-shaped — Large corporations and digital firms thrived while small businesses and low-wage sectors struggled. Some economists are referring the economy as currently undergoing a K-shaped move where consumer confidence is declining for those making an annual income of less than $75k, while those earning more than $200k a year are more upbeat.

Talking Heads

On Rare Inflation Flip Giving EMs Edge on Rich Nations

Jitania Kandhari, MSIM

“The implication is that monetary policy can be more supportive in emerging markets”

Grant Webster, Ninety One

“The higher yielding markets have room to rally: South Africa and much of Latam where inflation concerns have dissipated yet policy remains elevated”

On stock market hitting speed bump but investors staying on bullish path

Raheel Siddiqui, Neuberger Berman

“It’s a speed bump. It’s not a wall that you’re going to ram the car into and have a bit more damage than anyone is planning for”

Chris Dyer, Eaton Vance

“I don’t really see a significant change in positioning; I don’t see a significant change in sentiment”

On Seing Soft Jobs Market, Wanting Fed Funds Rate at 3% – Rick Rieder, BlackRock

“We have a softening of the labor market that is quite significant… The funds rate should be at three… think we can get it there and then take another view on where are we today”

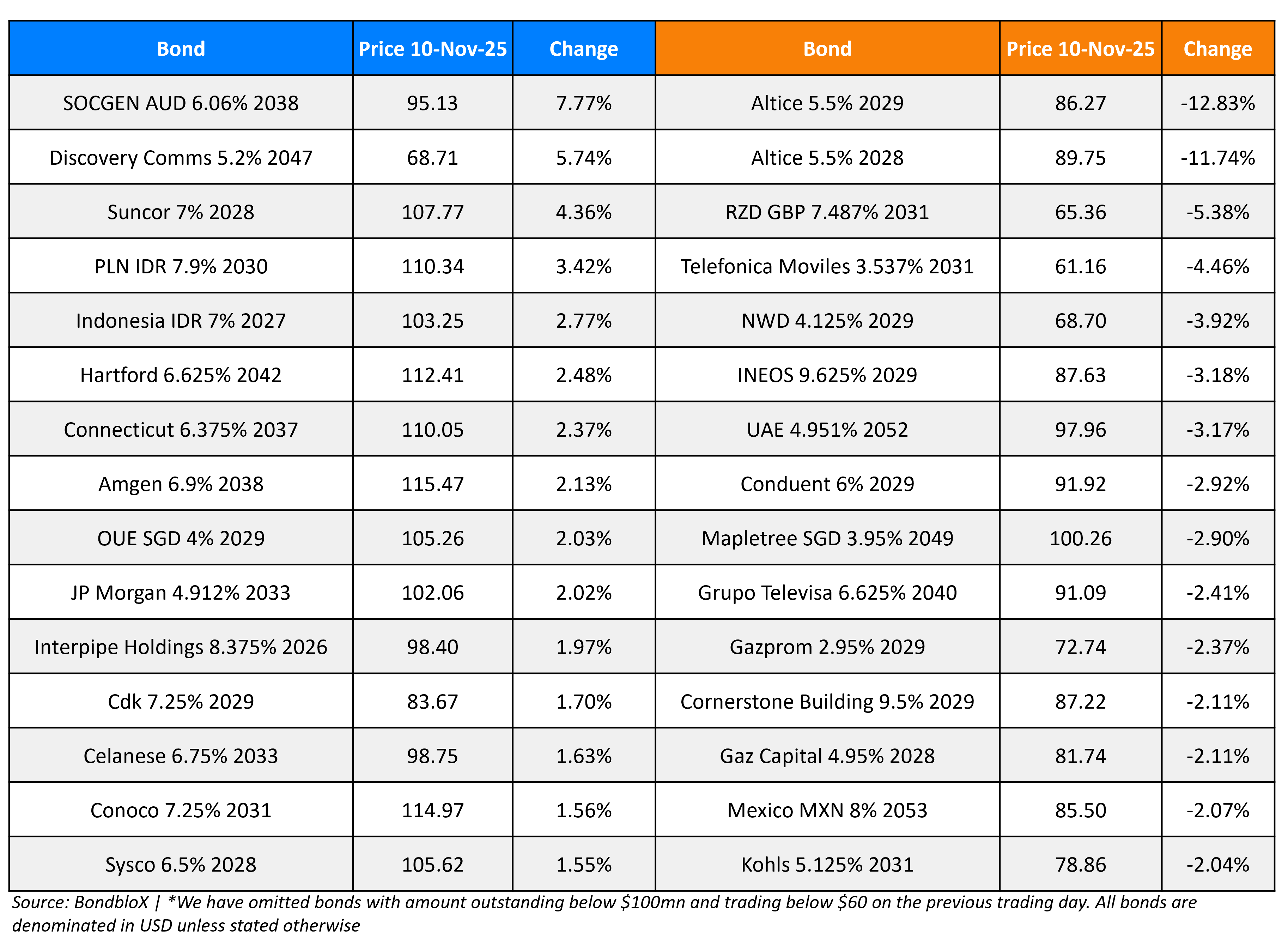

Top Gainers and Losers- 10-Nov-25*

Go back to Latest bond Market News

Related Posts: