This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Government Shutdown Ends; DIB, Pluspetrol, MAF, NBO Price $ Bonds

November 13, 2025

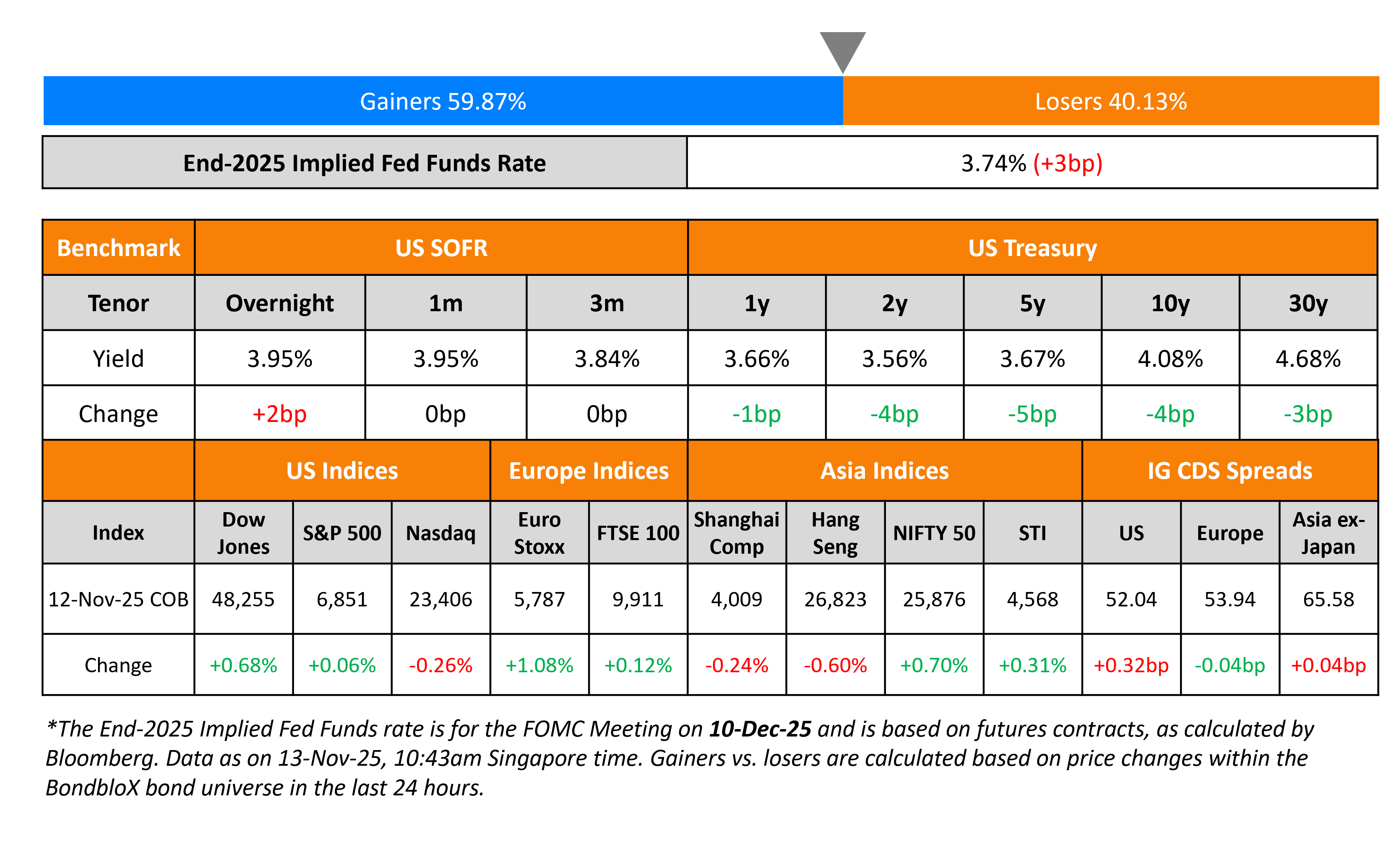

US Treasury yields eased by 4-5bp across the curve. The US House of Representatives voted 222-209 to pass an interim funding bill, and the bill was signed by President Donald Trump, formally ending the government shutdown. The bill will temporarily extend government funding until January 30. Boston Fed President Susan Collins said that she sees a “relatively high bar” for additional easing in the near term, citing worries about elevated inflation. Atlanta Fed Reserve President Raphael Bostic said that he too favors leaving interest rates unchanged until there is “clear evidence” that inflation is moving back to their 2% target.

Looking at the equity markets, the S&P closed higher by 0.1% while the Nasdaq was lower by 0.3%. US IG and HY CDS spreads were wider by 0.3bp and 2.9bp respectively. European equity indices ended higher. The iTraxx Main CDS spreads were flat while the Crossover spreads tightened by 0.9bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were nearly unchanged.

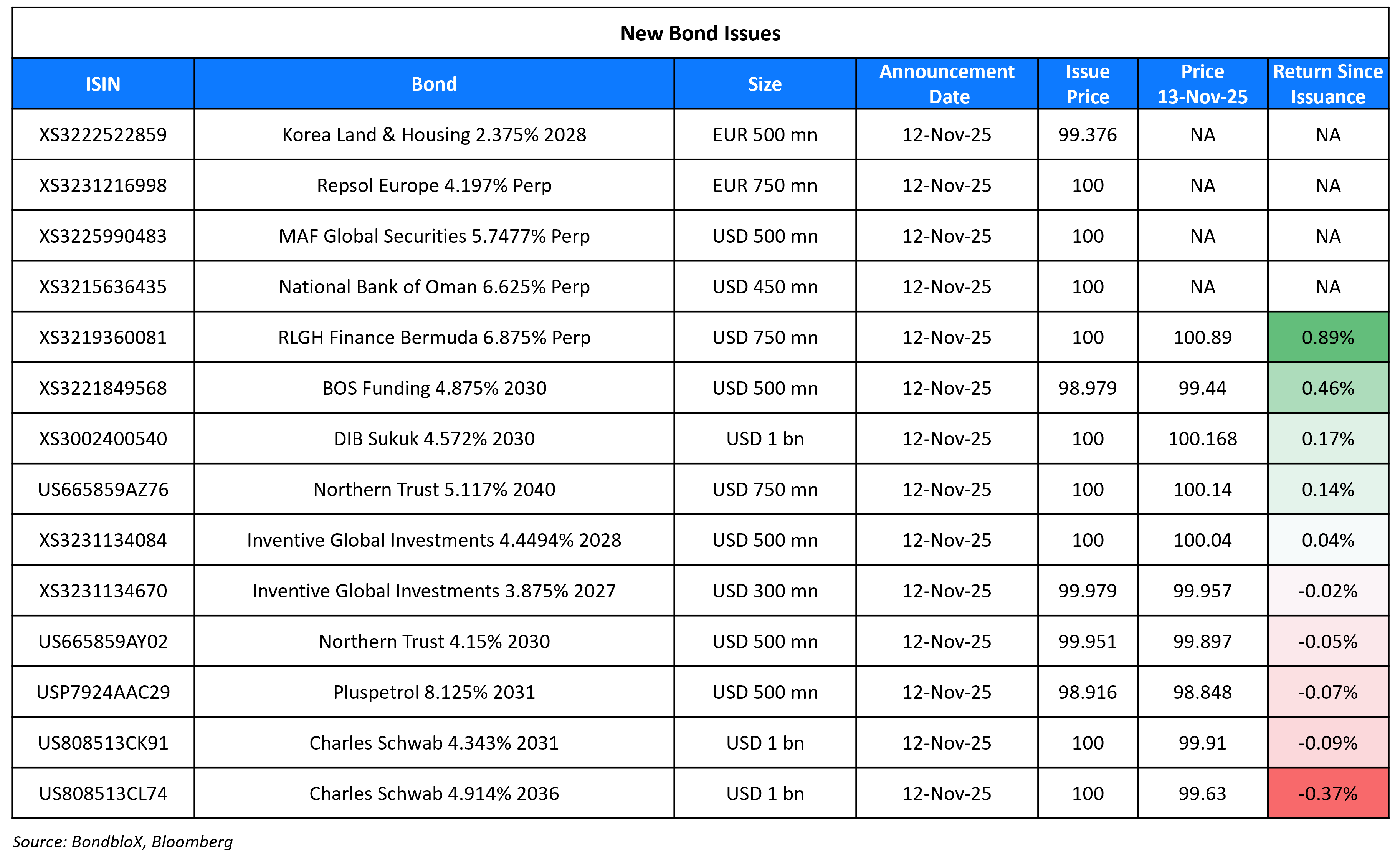

New Bond Issues

- China Resources Land $ 3Y at T+120bp area

Dubai Islamic Bank (DIB) raised $1bn via a 5Y bond at a yield of 4.572%, 30bp inside initial guidance of T+120bp area. The senior unsecured note is rated A3/A (Moody’s/Fitch), and received orders of over $1.9bn, 1.9x issue size. Proceeds will be used to finance/re-finance a portfolio of general corporate purpose sustainability-linked finance facilities in accordance with their framework.

Bank of Sharjah raised $500mn via a 5Y bond at a yield of 5.109%, 30bp inside initial guidance of T+175bp area. The senior unsecured note is rated BBB+ (Fitch), and received orders of over $1.3bn, 2.6x issue size. The issuer is BOS Funding Ltd.

Pluspetrol raised $500mn via a 5.5NC2.5 bond at a yield of 8.375%, inside initial guidance of mid-high 8% area. The senior unsecured note is unrated. Proceeds will be used to repay/refinance existing debt (for up to 40% of the nominal notes), invest in fixed assets/working capital, acquisitions of companies in Argentina, capital contributions in and/or the financing commercial activities of certain subsidiaries, and for general financing needs.

ABC International raised $800mn via a two-part deal. It raised $300mn via a 2Y bond at a yield of 3.886%, 53bp inside initial guidance of T+85bp area. It raised $500mn via a 3Y FRN at SOFR+48bp, 57bp inside initial guidance of SOFR+105bp area. The senior unsecured notes are rated A2 by Moody’s. Proceeds will be used for general corporate purposes.

National Bank of Oman raised $450mn via a PerpNC5.5 AT1 bond at a yield of 6.625%, 50bp inside initial guidance of 7.125% area. The subordinated note is unrated. If not called by 19 May 2031, the coupon will reset to the US 5Y Treasury yield plus 291.6bp. Proceeds wlll be used to manage its Tier-1 capital base, its overall capital adequacy, and for general corporate purposes.

Resolution Life raised $750mn via a PerpNC7 Anciliary Tier-1 bond at a yield of 6.875%, 50bp inside initial guidance of 7.375% area. The bond is rated Baa3/BBB (Moody’s/Fitch), and received orders of over $7.5bn, 10x issue size. If not called by 19 November 2032, the coupon will reset to the US 5Y Treasury yield plus 302.2bp. Proceeds will be used for general corporate purposes, including funding acquisitions, entry into reinsurance arrangements, debt repayment, working capital and other business opportunities.

Majid Al Futtaim (MAF) group raised $500mn via a PerpNC5.25 bond at a yield of 5.75%, 62.5bp inside initial guidance of 6.375% area. The subordinated note is rated BB+/BB+ (S&P/Fitch), and received orders of over $1.8bn, 3.6x issue size. If not called by 20 February 2031, the coupon will reset to the US 5Y Treasury yield plus 205.2bp. If not called by 20 February 2036, there is a coupon step-up of 25bp and an incremental 75bp if not called by 20 February 2051. The notes have an expected equity credit of 50% until the first reset date at S&P and Fitch. Proceeds will be used to repurchase certain outstanding bonds via a cash tender offer. The remaining portion will be lent to one or both of the guarantors or any other company controlled by the guarantors. Any further remaining proceeds will be used for general corporate purposes.

Charles Schwab raised $2bn via a two-trancher. It raised $1bn via a bond at a yield of 4.343%, 27bp inside initial guidance of T+95bp area. It also raised $1bn via a 11NC10 bond at a yield of 4.914%, 25bp inside initial guidance of T+110bp area. The senior unsecured notes are rated A2/A-/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Kuwait Finance House $ PerpNC5.5 AT1 Sukuk

Rating Changes

- Moody’s Ratings upgrades United Airlines’ CFR to Ba1; outlook stable

- State Oil Company of Azerbaijan Republic Upgraded To ‘BB’ On Improved Transparency And Financial Policy; Outlook Stable

- Ardagh Group Downgraded To ‘SD’ On Completion Of Debt Restructuring; AMP ‘CCC+’ Rating Unchanged

- Moody’s Ratings downgrades Newell’s CFR to B1; outlook is negative

- Fitch Affirms Santander Mexico’s ‘BBB+’; Upgrades ST IDR to ‘F1’; Downgrades Hybrids to ‘BB+’/’BB’

- Fitch Revises Outlook on Chailease Group to Negative; Affirms Ratings

- Fitch Revises Outlook on Yuexiu REIT to Stable, Affirms at ‘BBB-‘

- Moody’s Ratings places Baytex’s ratings under review for downgrade on sale of US assets

Term of the Day: Equity Credit

Equity credit refers to a dollar amount or a percentage of a security which will be treated as equity capital for leverage calculation purposes by rating agencies. For example, a security that has a 50% equity credit assigned by a rating agency implies that for the calculation of credit ratios, there would be a 50% equity treatment of the borrowing.

Talking Heads

On Investors Now Seeing Some Corporate Bonds as Safer Bets Than Government Debt

Pilar Gomez-Bravo, MFS International

“It’s the erosion of the perception of rule of law which keeps investors at bay… People prefer corporate balance sheets which are in better shape than some sovereigns”

Hans Mikkelsen, TD Securities USA

“For the government, it’s about getting reelected”

Steffen Ullmann, HAGIM

“Governments just sit there, carry on and nothing happens… Corporates have done their job. They de-levered and remain cost-disciplined.”

On Traders Ramping Up Bets on US Data Dump Sparking Treasuries Rally

White House Press Secretary Karoline Leavitt

Lack of data is “leaving our policymakers at the Fed flying blind at a critical period”

Gregory Faranello, AmeriVet Securities

“Inflation is going nowhere fast, jobs too and if I’m a policymaker, I’d play it cool with a bias lower”

On Fed to cut rates again in December on weakening job market: Economists

Abigail Watt, UBS

“The general sense is the labor market still looks relatively weak and that’s one of the key reasons why we think the FOMC will continue to deliver that December cut. But the risk to December will be potentially data dispelling that sense of weakness”

Josh Hirt, senior economist at Vanguard

“It could impact Fed credibility that we’ve had inflation above target for a long period of time… We will take a little bit more caution around viewing tariff inflation purely as temporary”

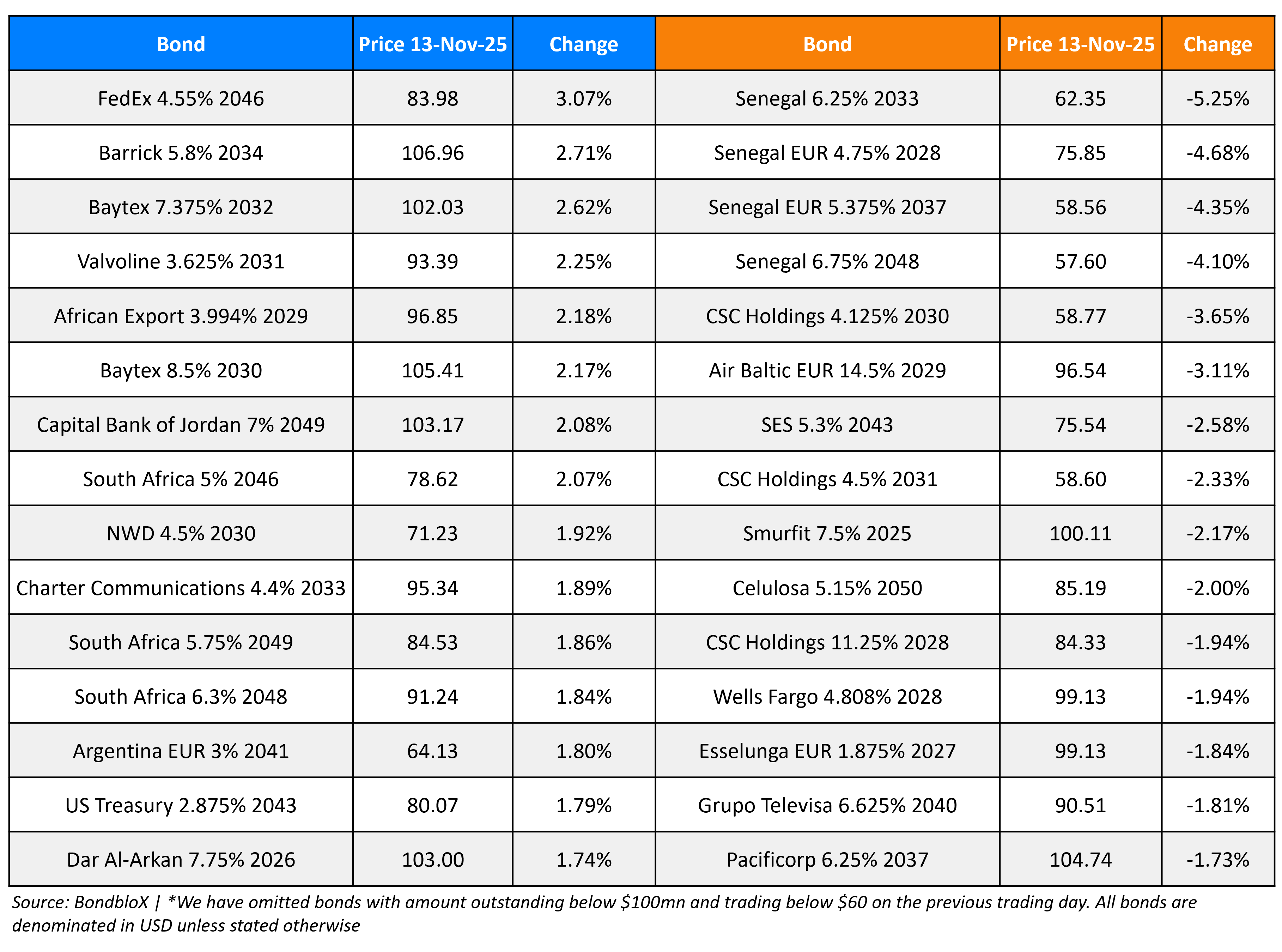

Top Gainers and Losers- 13-Nov-25*

Go back to Latest bond Market News

Related Posts: