This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Government Shutdown Averted; Michigan Consumer Sentiment Drops

March 17, 2025

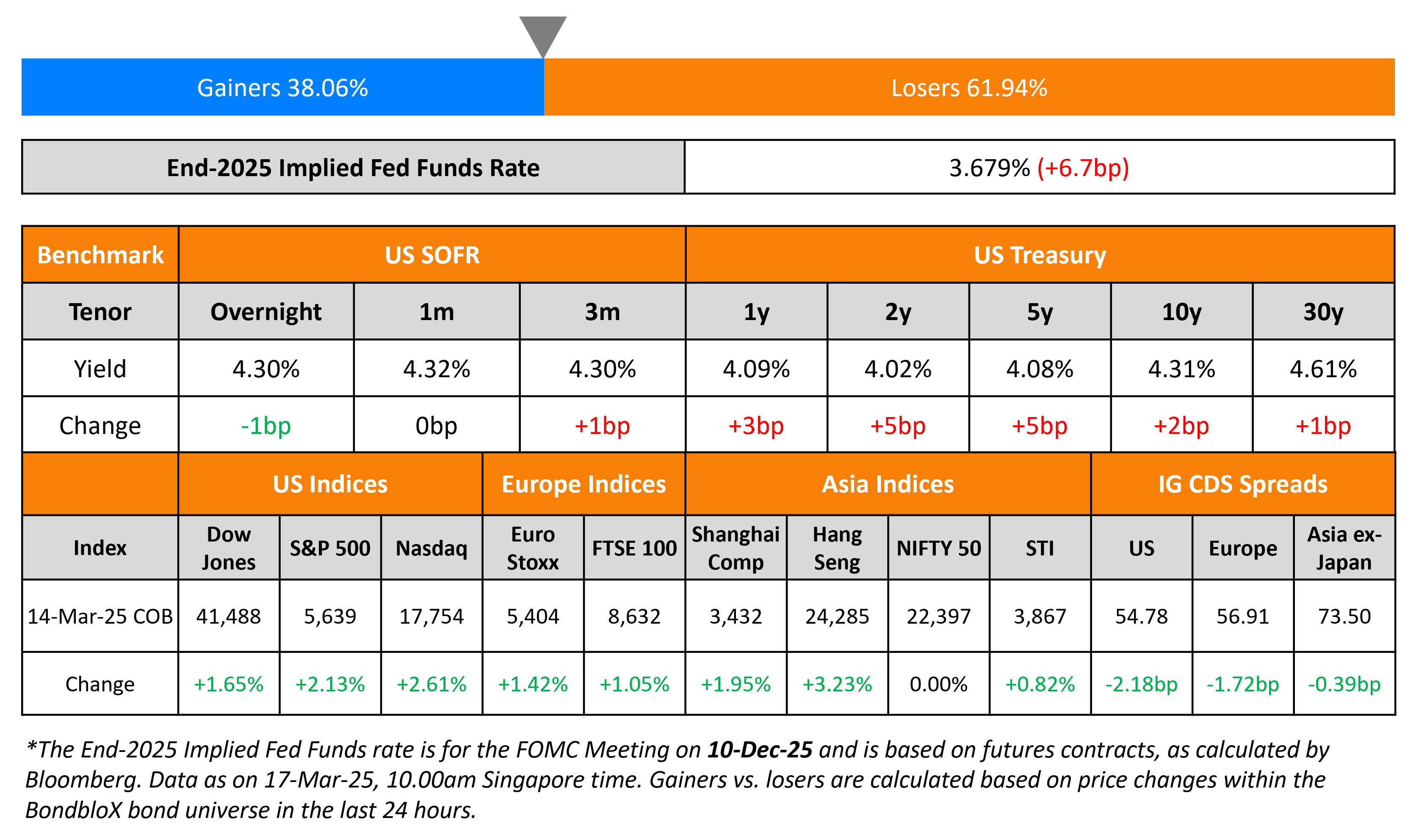

The US Treasury curve bear flattened, with short-end yields higher by 5bp while the long-end of the curve moved up by ~2bp. The Michigan Consumer Sentiment reading for March fell to 57.9 from 64.7, and was also lower than expectations of 63.0. This marked the third consecutive decline in the reading and also its lowest level since November 2022. Separately, the US Senate voted on Friday, passing a funding bill in time to avert a government shutdown. This will see sufficient funds being provided to keep the government operational until end-September.

US equity markets soared on Friday, with the S&P and Nasdaq higher by 2.1% and 2.6% respectively. Looking at credit markets, US IG and HY spreads CDS spreads tightened 2.2bp and 9bp respectively. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads tightened by 1.7bp and 6bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 0.4bp. China’s credit growth expanded during the first two months, helped by growth in aggregate social financing and higher government bond issuances. However, new yuan loans and foreign direct investment declined.

New Bond Issues

- PT Bank Mandiri $ 3Y at T+145bp area

CapitaLand India Trust raised S$200mn via a 5Y bond at a yield of 3.2%, in-line with inside initial guidance of 3.2% area. The senior unsecured note is rated BBB- by Fitch. Proceeds will be used to refinance existing borrowings or repay loans, finance business activities, acquisitions and for general working capital purposes.

New Bonds Pipeline

- Tata Capital hires for $ long 3Y bond

- Shinhan Bank hires for $ bond

- BTN Indonesia hires for $ 5Y Tier 2

- Bangkok Bank hires for $ 15NC10 bond

Rating Changes

-

Moody’s Ratings upgrades Reliance, Inc.’s ratings to Baa1; stable outlook

-

Saudi Arabia Ratings Raised To ‘A+’ On Sustained Socioeconomic And Capital Market Reforms; Outlook Stable

-

Abu Dhabi Commercial Bank Upgraded To ‘A+’ On Improving Asset Quality; Outlook Stable

-

Fitch Affirms France at ‘AA-‘; Outlook Negative

-

Fitch Revises Aston Martin’s Outlook to Negative; Affirms IDR at ‘B-‘

Term of the Day: Cost of Risk

Cost of Risk refers to the losses that arise out of ‘expected losses’ and the ‘cost of losses over and above the average loss’. Expected losses are those that arise on average due to defaults and depend on the credit risk of the borrower. The cost of losses over and above the average loss are measured by either Basel related regulatory capital or risk based capital.

Talking Heads

On German Bond Selloff Reignitng as Merz Strikes Debt Package Deal

Ugo Lancioni, Neuberger Berman

“If this goes through, it will change the perception of Germany. For ages, it’s been the country that has been reluctant to increase debt”

Ralf Preusser, BofA strategist

“Core Europe duration longs collapsed as future economic growth and bond supply get priced in”

Brad Bechtel, head of FX at Jefferies

“Game on again for the euro”

On Wall Street Ripping Up Credit Forecasts as Policy Woes Snowball

Barclays analysts

“Credit spreads are not pricing in enough risk… uncertainty about the magnitude and speed of the tariff implementation is a key driver of this change…. Our forecast implies spreads pricing in about 20% recession risk, though still trading below their long-term medians”

Neha Khoda, BofA

“Cracks that appeared in the credit market last week culminated into a fracture this week… HY entered this period of volatility priced to perfection, and a perfect economy it is not”

On Uncertainty Now Higher Than During Covid – ECB’s Luis De Guindos

“We need to consider the uncertainty of the current environment, which is even higher than it was during the pandemic… Real wages have increased, inflation is declining, interest rates are coming down and financing conditions are better”

Top Gainers and Losers- 17-March-25*

Go back to Latest bond Market News

Related Posts: