This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI Shows Moderation; Wynn Macau, Swedbank, Svenska Handelsbanken Price Bonds; Intel Downgraded to Baa2

August 13, 2025

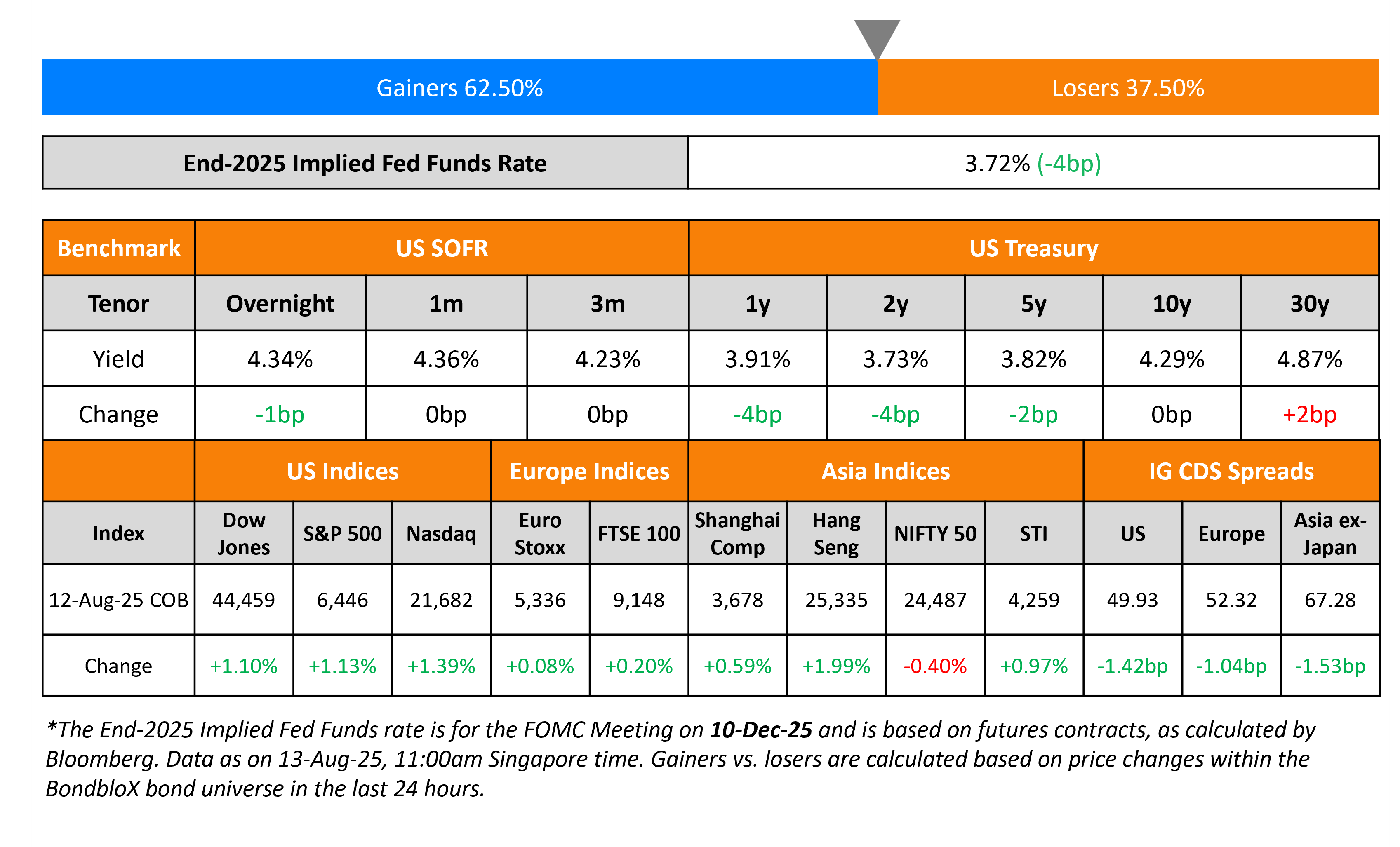

The US Treasury curve bull steepened on Tuesday, with the 2Y yield down by 4bp while the long-end remained steady. The Headline and Core CPI reading showed a moderation in inflation. US CPI YoY for July rose by 2.7%, softer than expectations of 2.8% and in-line with the prior month’s print. Core CPI rose by 3.1%, higher than the surveyed 3.0% and previous month’s 2.9% print. With this, markets continue to price-in ~60bp in rate cuts by the end of the year. As per CME interest rate probabilities, there is a 94% chance of a 25bp rate cut in the September FOMC meeting. However, Kansas City Fed President Jeff Schmid said that he favored keeping rates on hold for the time being, noting that he could change his view if demand growth started “weakening significantly”.

Looking at US equity markets, the S&P and Nasdaq closed higher by 1.1-1.4%. US IG CDS spreads were 1.4bp tighter and HY CDS spreads tightened by 6.9bp. European equity markets ended higher too. The iTraxx Main CDS spreads were 1bp tighter and Crossover spreads tightened by 0.8bp. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 1.5bp tighter.

New Bond Issues

Wynn Macau raised $1bn via a 8.5NC3 bond at a yield of 6.75%, 25bp inside initial guidance of 7.00% area. The senior unsecured bond is rated B1/BB-/BB-. The bond has a change of control put at 101. Proceeds will be used for general corporate purposes, and for repaying outstanding debt. This is Wynn Macau’s first bond issuance in five years. Wynn Resorts recently missed its Q2 earnings expectation, owing to a sluggish Macau business. In comparison, its peers, Las Vegas Sands and MGM Resorts reported strength in their Macau businesses.

Swedbank raised €500mn via a 10NC5 Tier 2 bond at a yield of 3.523%, 32bp inside initial guidance of MS+150bp area. The subordinated note is rated Baa1/BBB+/A and received orders of about €1.1bn, 2.2x the issue size.

Svenska Handelsbanken raised €750mn via a 7Y Green Bond at a yield of 3.25%, 28bp inside initial guidance of MS+105bp area. The senior non-preferred bond is rated A2/A/AA and received orders about €1.55bn, ~2x the issue size. Proceeds will be used for activities eligible under Green Bond framework.

Rating Changes

- Nasdaq Inc. Upgraded To ‘BBB+’ From ‘BBB’ On Lower Leverage; Outlook Stable

- Moody’s Ratings downgrades Intel’s senior unsecured ratings to Baa2; outlook changes to stable

Term of the Day: Green Bonds

Green bonds are bonds whose proceeds are used towards financing projects that have a positive environmental impact such as renewable energy. The first green bond was issued by the European Investment Bank in 2007. Since then, the bond markets have seen green bond issues from supranationals such as The World Bank, sovereigns and corporates.

Talking Heads

On Rates at ‘Very Good Level’ and ECB Can Act Flexibly – Joachim Nagel, ECB

“Key interest rates are currently at a very good level… From here, we can monitor how the economy develops. And we can react flexibly if necessary…American tariffs are significantly higher than before…And we’ve seen with the US government: What applies today may no longer apply tomorrow.”

On Betting on Short-Duration South Africa Bonds – Bastian Teichgreeber, CIO, Prescient

“The case for South African government bonds, I think it’s quite strong… The front end of the yield curve looks very, very safe…We assess more compression to come as yield curve components related to inflation and its priced expectation continues to moderate toward 3%”

On Investors Doubling Down on September Fed Cut After CPI

Andrew Szczurowski, Morgan Stanley Investment

“I think that the market coming in was quietly expecting a hotter number, and it didn’t…When you factor in the other side of the Fed’s mandate, then all of a sudden it looks like they’re missing their labour target more than they’re missing their inflation target”

Joseph Lavorgna, Counselor to Treasury Secretary Scott Bessent

“You’ve had six months in a row where the numbers have disappointed to the downside. Effectively, where you thought there would be inflation, there isn’t”

Tiffany Wilding, Economist, PIMCO

“It’s going to take time for these tariffs to really show up in earnest…Anyone waiting for this to show up in sort of one big move higher in any given month, that’s not how it’s going to be”

Top Gainers and Losers- 13-Aug-25*

Go back to Latest bond Market News

Related Posts: