This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI Meets Expectations, Weekly Jobless Claims Weakest in 4 Years

September 12, 2025

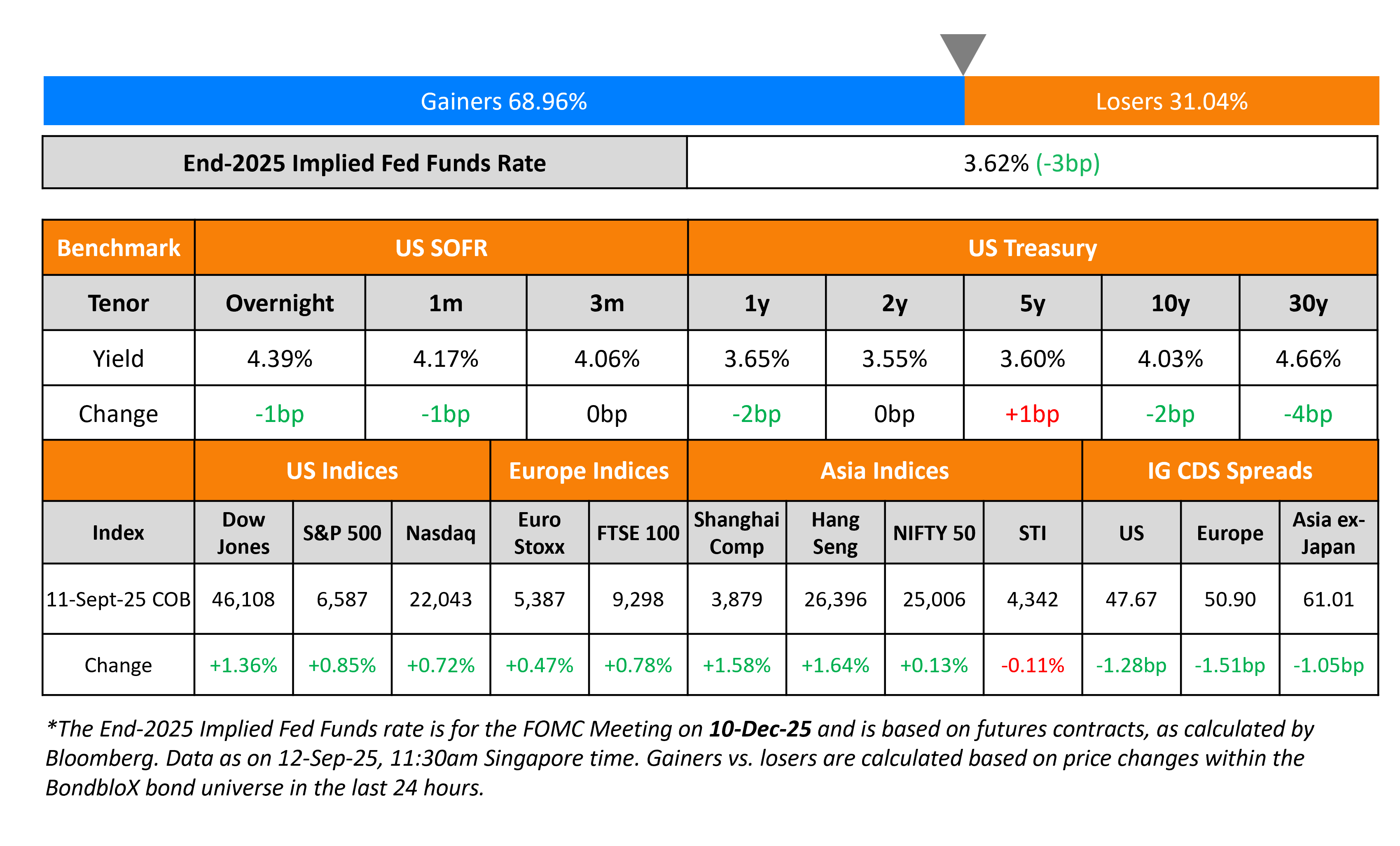

US Treasury yields held steady on Thursday after the Headline and Core CPI for August were in-line with expectations, showing a 2.9% and 3.1% YoY rise respectively. However, the labor market continued to show signs of weakness, with the initial jobless claims for the previous week rising by 263k. This was significantly worse than expectations of a 235k print and was the worst reading in four years. Separately, the IMF warned that the US economy was showing some strains on the back of a moderation in domestic demand and slowing job growth. It also added that tariffs could pose inflationary risks.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.9% and 0.7% respectively. US IG and HY CDS spreads were tighter by 1.3bp and 7.1bp respectively. European equity markets ended higher too. The ECB kept its policy rates on hold as expected, stating that the economy is still in a “good place”. The iTraxx Main CDS spreads were 1.5bp tighter while the Crossover spreads were 6.7bp tighter. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 1.1bp tighter.

New Bond Issues

.png)

BNP Paribas raised €1.5bn via an 8NC7 bond at a yield of 3.494%, 25bp inside initial guidance of MS+130bp area. The senior non-preferred note is rated Baa1/A-/A+. Net proceeds will be used to finance/refinance eligible green assets under its green bond framework.

New Bond Pipeline

- Transurban $ long 10Y

- Bank AlJazira $ PerpNC5.5 AT1 Sukuk

Rating Changes

- Moody’s Ratings upgrades AIB’s deposit ratings to Aa3, stable outlook

- Fitch Upgrades Banco Montepio to ‘BBB-‘, Outlook Stable

- Citycon Oyj Downgraded To ‘BB’ On Management & Governance; Outlook Stable

- Moody’s Ratings downgrades Sinochem HK’s ratings to Baa1, revises outlook to stable

Term of the Day: Deposit Facility Rate

The deposit facility rate (DFR) is one among the three key interest rates set by the ECB. This rate defines the interest rate that banks receive on the surplus liquidity that they deposit overnight in an account with a national central bank. The Eurosystem has several national central banks with ECB being the prime central bank that works with the other national central banks of all EU countries. There are two other key interest rates that the ECB governs – the rate on main refinancing operations (MROs) and the rate on the marginal lending facility (MLF). The MRO rate refers to the cost of borrowing for banks from the central bank for a period of one week. The MLF rate refers to the overnight rate that banks can borrow at from the central bank.

Talking Heads

On Fed Seen on Track for Rate Cuts as Job Worries Eclipse Inflation Fears – James Knightley, ING

“Inflation remains hotter than hoped, but the Fed’s focus is jobs…On the face of it, unemployment claims hint at a pick-up in the pace of layoffs in an environment of already weak hiring and will reaffirm expectations of a 25-bp Fed rate cut next week.”

On Treasury Yields Nearing 2025 Lows as More Fed Easing Is Priced In

Tiffany Wilding, Pacific Investment

“The more concerning news from the data this morning is jump in claims…The data confirms the 25 basis points cut. There is probably going to be discussions around 50 basis points,”

Robert Tipp, PGIM Fixed Income

“The overarching conclusion of the market is that the Fed is going look at the jobs side of the equation…Even a cautious approach to easing would still seem to be pretty much in line with, say, 100 basis points of cuts in the next year.”

On Pimco Backing Away from a Bond Trade That Delivered Big Gains

“It’s performed so well that our conviction level has come down…This is just an environment where we have to be careful of surprises…there’s other possibilities to consider. A Trump-backed Fed could start buying up longer-dated bonds to drive down yields, as it did after the pandemic struck. Or the Treasury Department could try to bring down long yields on its own”

Top Gainers and Losers- 12-Sep-25*

Go back to Latest bond Market News

Related Posts: