This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI Higher at 3.7%, Treasuries Sell-Off

October 13, 2023

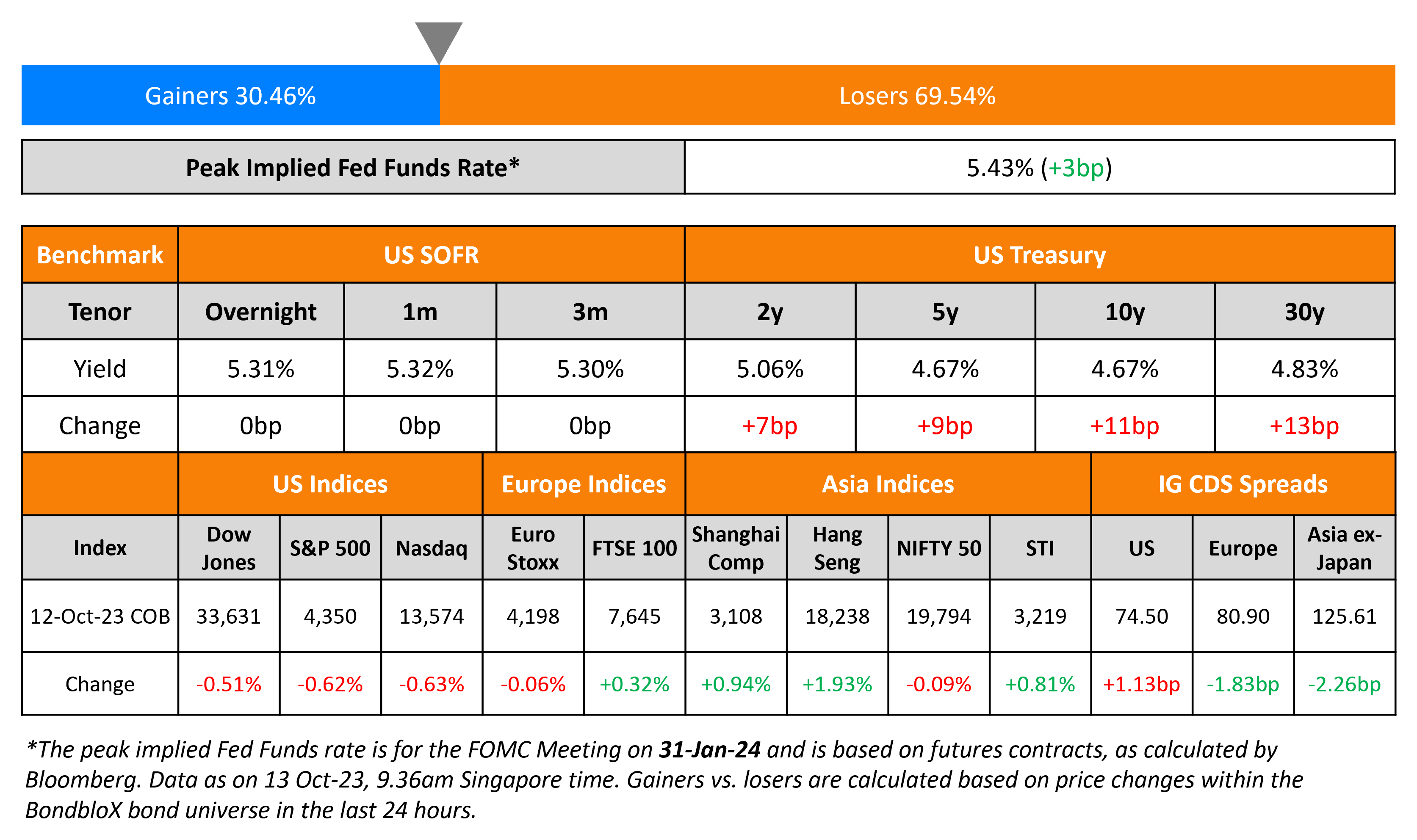

US Treasury yields surged across the curve after September’s higher than expected CPI print and a weak auction of 30Y bonds. The 2Y yield rose 7bp and the 10Y was up 11bp. US Headline CPI came at 3.7% YoY for September, higher than estimates of 3.6% while Core CPI was in-line with estimates at 4.1%. Besides, the US Treasury sold $20bn of 30Y bonds in its auction, with dealers taking up 18% of the supply, more than the average of 11%. The US Treasury’s 30Y sale tailed (auction take-up yield was higher than the expected yield at the bidding deadline) by 3.7bp at 4.837%, implying that investors sought a yield premium for the new notes. Separately, US initial jobless claims came in at 209k, slightly below estimates of 210k. US credit markets saw IG CDS spreads widening 1.1bp and HY spreads wider by 9bp. US equities moved lower with the S&P and Nasdaq down by 0.6%.

European equity markets were mixed. In credit markets, European main CDS spreads were tighter by 1.8bp and crossover spreads tightened 8bp. Asian equity markets have broadly opened in the red today morning. Asia ex-Japan IG CDS spreads tightened 2.3bp.

New Bond Issues

- Zhejiang Kunpeng $ 364-Day at 7.3% area

BOC Luxembourg raised €300mn via a 3Y Green Transition bond at a yield of 4.125%, 20bp inside initial guidance of MS+80bp area. The senior unsecured bonds have expected ratings of A1/A/A, and received orders over €550mn, 1.8x issue size. Proceeds will be used to finance/refinance eligible transition projects as defined in Bank of China transition bonds management statement.

Shinhan Bank raised $500mn via a 5Y Social FRN at a yield of 6.425%. The floating coupons will reset at the overnight SOFR plus a spread of 108bps and will be paid quarterly. The senior unsecured bonds have expected ratings of Aa3/A+/A. Proceeds will be used for the financing/refinancing of projects in eligible social categories in accordance with the issuer’s sustainable development goals financing framework.

New Bond Pipeline

-

- Medco Energi hires for $ 5.5NC2 bond

- Oman Telecom hires for $ 7Y sukuk bond

Rating Changes

- Fitch Upgrades Tupras to ‘B+’; Outlook Stable

- Moody’s changes outlook on Tajikistan to stable from negative, affirms B3 ratings

Term of the Day

Macro Linked Bonds

Macro Linked Bonds are a type of sovereign bond being planned by Sri Lanka as part of its debt restructuring process. Here, the bond’s coupon payments automatically reduce beginning in 2027 if Sri Lanka fails to meet some of the economic targets linked to its IMF program, a step-down in payments. Holders of the MLBs would then agree to grant additional debt relief if needed to achieve the IMF’s Debt Sustainability Analysis target. In the case of Sri Lanka, this would be either the ratio of its gross financing needs (GFN)-to-GDP or debt-to-GDP. Sources said that if the GFN/GDP ratio rises above 4.5% in 2027, coupons will adjust downwards. They also noted that other countries like Ghana were also considering including MLBs as part of their restructuring.

Talking Heads

On High-Grade Bond Refinancing Risk Rising With $1.3tn Due – Moody’s

“Maturities within our five-year scope rose amid higher issuance and shifted earlier in that window, with companies opting for shorter tenors and high rates dissuading refinancing… Average investment-grade rates as of September are up 183bp against a 10Y rolling average.. expect investment-grade companies to maintain good bond market access and have sufficient cash flow to absorb higher interest costs”

On $100bn Quant Firm Entering Lucrative World of Credit

Scott Richardson, Systematic Credit at Acadian Asset Management

“If an asset owner gives us a dollar and says we want a high-yield or an investment-grade allocation, our job should be to give them a beta-one exposure to that benchmark and then provide some active risks and tracking error”

On Seeing Trouble for Over $1tn of Maturing Junk Debt – Moody’s

“Companies rated Caa and lower will likely find it difficult to refinance maturities at an interest rate they can afford… Companies are also resorting to strategies such as extending loans or issuing new debt with pay-in-kind interest, often at onerous rates that raise debt and add to future default risk

Top Gainers & Losers- 13-October-23*

Go back to Latest bond Market News

Related Posts: