This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI Eases; Warba, Sobha Price $ Bonds

May 14, 2025

US Treasury yields jumped higher by 10-12bp across the curve. US CPI YoY for April came-in at 2.3%, softer than expectations and the prior month’s reading of 2.4%. Core CPI came-in at 2.8%, in-line with expectations. As part of US President Donald Trump’s visit to the Gulf, Saudi Arabia committed a $600bn investment initiative in the US.

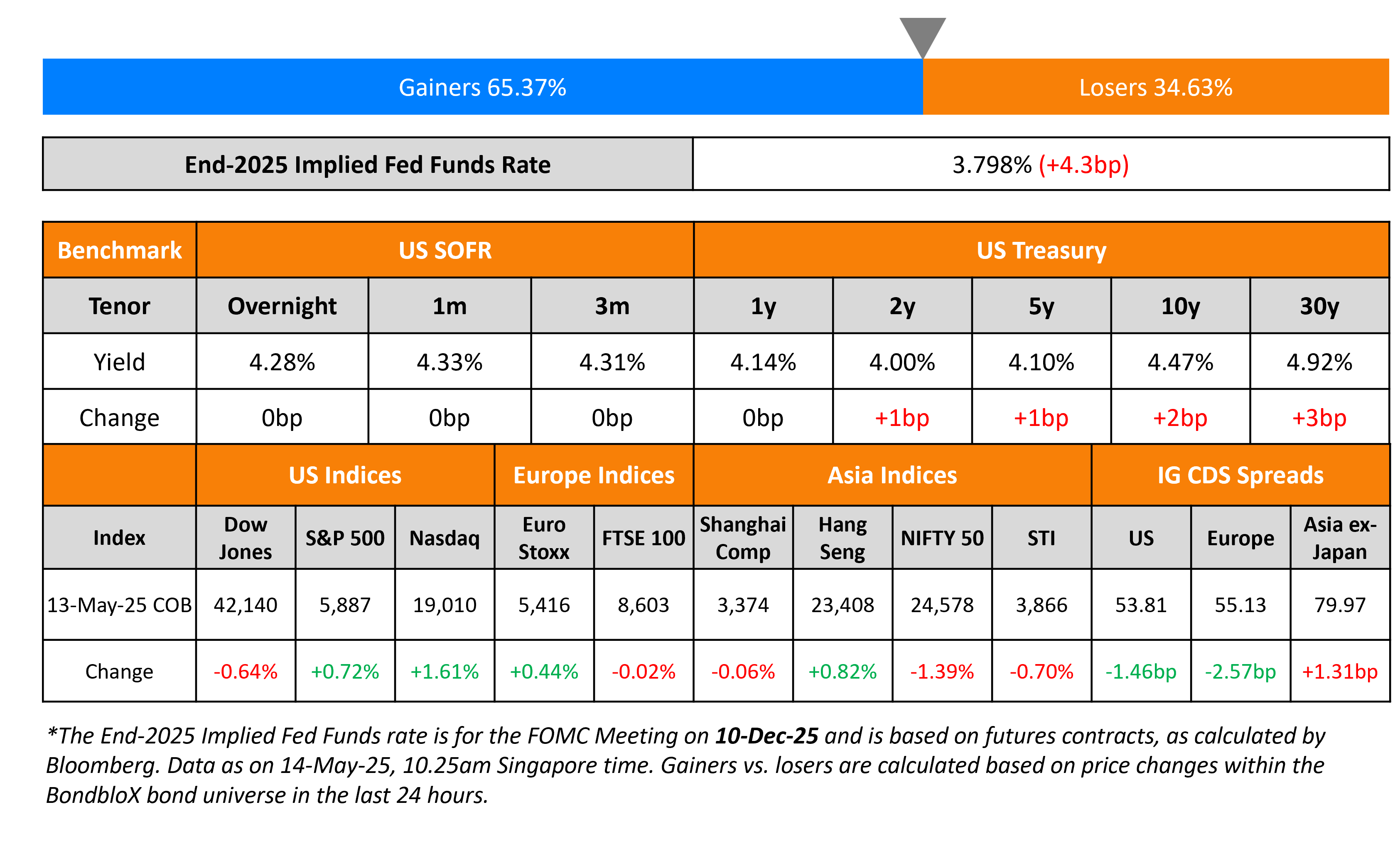

Looking at equity markets, the S&P and Nasdaq were both higher by 0.7% and 1.6% respectively. Looking at credit markets, US IG CDS spreads were tighter by 1.5bp, while HY CDS spreads tightened by 9.2bp. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 2.6bp and Crossover CDS spreads tightened by 11.2bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were wider by 1.3bp.

New Bond Issues

- ICBC Singapore $ 3Y Green at T+85bp area

- PT Pertamina Hulu Energi $ 5Y at 5.55% area

- Korea Water $ 2Y Green at T+100bp area

- ICBC Hong Kong $ 3Y Green at SOFR +105bp area

- Perennial Holdings Tap of SGD 2028s at 5.5% area

Warba Bank raised $250mn via a PerpNC5.5 AT1 sukuk at a yield of 6.25%, 25bp inside initial guidance of 6.5% area. The junior subordinated note is unrated. If not called by 20 November 2030, the profit rate will reset to the 5Y US Treasury rate plus 210.2bp. There is no coupon step-up.

Sobha Realty raised $500mn via a long 3Y sukuk at a yield of 8%, 37.5bp inside initial guidance of 8.375% area. The senior unsecured note is rated Ba2/BB, and received orders of over $1.45bn, 2.9x issue size. Proceeds will be used for general corporate purposes and to settle existing financings.

Sabadell raised €1bn via a PerpNC6 AT1 bond at a yield of 6.5%, 50bp inside initial guidance of 7% area. The junior subordinated note is rated BB. If not called by 20 May 2031, the coupon will reset to the 5Y Mid-Swap plus 428.1bp. Proceeds will be used for general corporate purposes. A trigger event will occur if the CET1 ratio of the bank and/or the group falls below 5.125%.

ING Groep raised €1.25bn via a 11NC6 green Tier 2 bond at a yield of 4.171%, 30bp inside initial guidance of T+210bp area. The subordinated note is rated Baa2/BBB/A-. Net proceeds will be specifically used for financing and/or refinancing of specified green projects/activities under its framework.

Rating Changes

-

Moody’s Ratings upgrades Hyderabad Airport’s ratings to Ba1; changes outlook to stable

-

Moody’s Ratings downgrades Kohl’s CFR to B2; rates proposed secured notes Ba3

-

Moody’s Ratings downgrades Tullow’s ratings to Caa2; negative outlook

-

Neogen Corp. Downgraded To ‘BB-‘ From ‘BB+’ On Elevated Leverage; Outlook Negative

Term of the Day: Margin Call

In leveraged trades, a trader essentially borrows money from the brokerage firm to upsize the position. Due to the leverage given by a broker, the trader is required to put up a certain sum of money up to a threshold in a margin account so that the broker has some collateral. The threshold is known as ‘maintenance margin’. If the leveraged securities rise in value, the trader is at an advantage since the gains get added to the margin account. Here, the broker does not reap any reward, but is more certain about being paid back in full.

However, if the securities fall in value and go below the threshold, the broker triggers a margin call. The margin call is the amount that the trader has to add back to top-up their margin account since the margin account’s value has gone below the threshold/maintenance margin requirement.

Talking Heads

On Fed to stay patient amid cooling trade war and inflation

Jake Dollarhide, Longbow Asset

“There’s been a fear that tariffs are going to push inflation higher, and they may still, but today’s data at least gives investors a sense of relief that inflation is still moving in the right direction”

Economists at Raymond James

“Uncertainty about tariff policies and implications for inflation going forward will keep (Fed policymakers) on the sidelines for now”

On EU Plagued by ‘Collective Action Problem’ – US Treasury Secy., Scott Bessent

“I think the US and Europe may be a bit slower… My personal belief is Europe may have a collective action problem; that the Italians want something that’s different than the French. But I’m sure at the end of the day, we will reach a satisfactory conclusion”

On Buyout Firms Ramping Up Debt Deals to Pay Dividends

Nicolas Jullien, Candriam

“Private equity firms need to monetize their assets. In many cases equity multiples are lower than when they acquired businesses, so a dividend recap is the best option”

Joop Kohler, Robeco Institutional Asset

“If you have the balance sheet to execute a dividend recap deal, fine… higher-for-longer rates mean that aggressively-financed companies could struggle to service their debt”

Top Gainers and Losers- 14-May-25*

Go back to Latest bond Market News

Related Posts:

.png)