This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI Cools Down; ESR Reit, DBS, Beijing Capital Launch Bonds

March 13, 2025

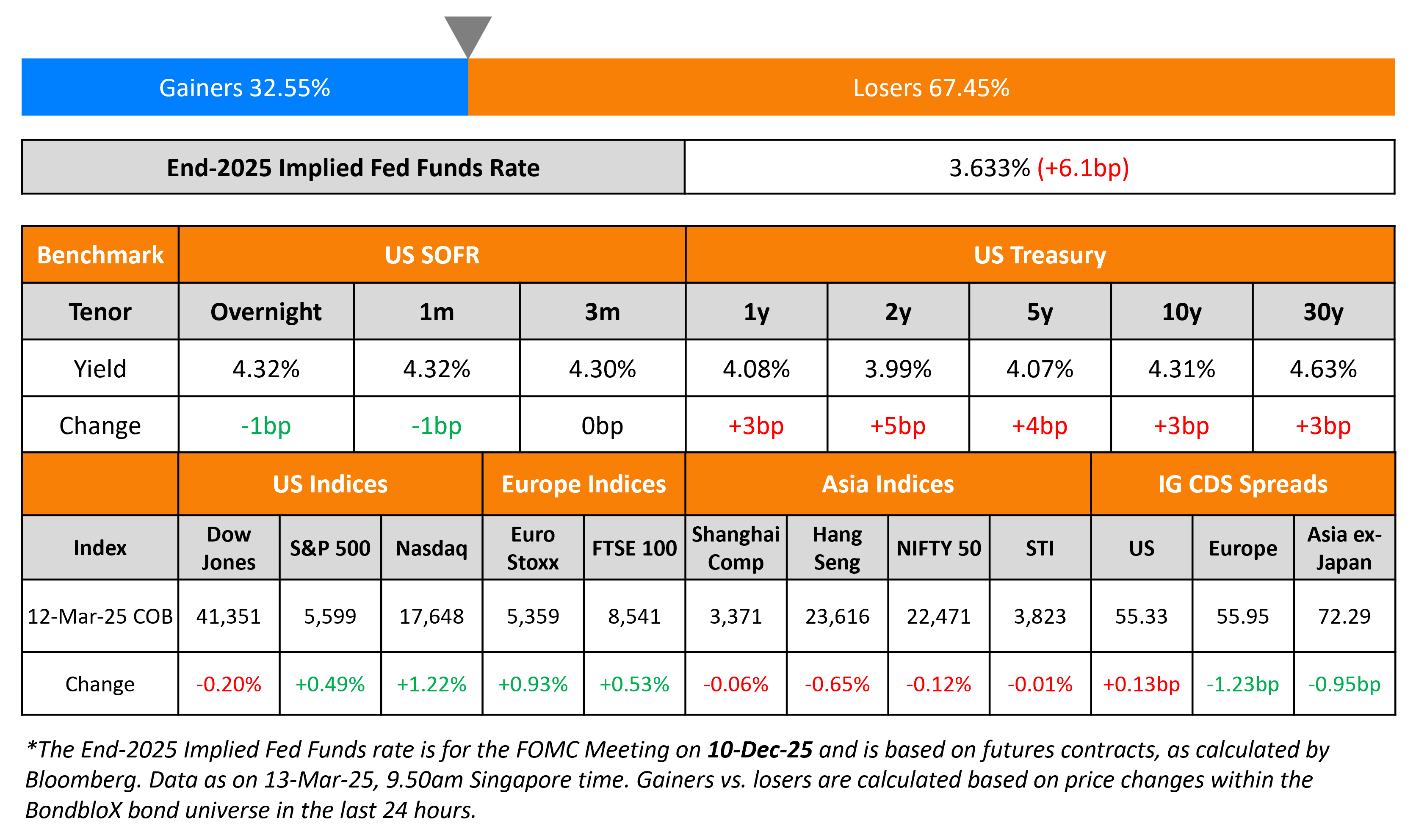

US Treasury yields climbed higher again by 3-5bp across the curve. The much awaited inflation data from the US showed signs of a marginal cooling down in consumer prices. US CPI For February rose by 2.8% YoY, softer than expectations of a 2.9% print and the prior month’s 3.0%. Core CPI rose by 3.1% YoY, also softer than expectations of 3.2% and the prior month’s 3.3%. US President Donald Trump imposed 25% tariffs as planned, on all steel and aluminum imported into the country.

US equity markets stemmed losses with the S&P and Nasdaq higher by 0.5% and 1.2% respectively. Looking at credit markets, US IG and HY spreads CDS spreads widened 0.1bp and 0.3bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads tightened by 1.2bp and 0.2bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 1bp.

New Bond Issues

-

Beijing Capital $ 3Y at 7.75% area

-

ESR REIT S$ Perp NC5 at 6% area

-

DBS $ 3Y/3Y FRN/5Y FRN at T+65bp/SOFR eq/SOFR+95bp area

AES Corp raised $800mn via a 7Y bond at a yield of 5.8%, 15bp inside initial guidance of T+175bp area. The senior unsecured note is rated Baa3/BBB-/BBB-. The bond has a change of control put at 101. Proceeds will be used to fund the purchases of its 2025s under its tender offer, with any remaining proceeds being used to repay outstanding debts.

PBF Holding raised $800mn via a 5NC2 bond at a yield of 10.25%, in-line with initial guidance of 10.25% area. The senior unsecured bond is rated Ba3/BB/BB. The bonds have a change of control put at 101. Proceeds will be used repay outstanding borrowings under its asset based revolving credit facility (RCF) and for general corporate purposes.

New Bonds Pipeline

- Tata Capital hires for $ long 3Y bond

- Shinhan Bank hires for $ bond

- Credit Agricole hires for € PerpNC10.75 RT1 bond

- BTN Indonesia hires for $ 5Y Tier 2

Rating Changes

-

Moody’s Ratings changes the outlook of Oncor to negative; affirms ratings

-

Fitch Revises Outlook on 4 Adani Group Infrastructure Entities, Removes RWN on 2; Affirms Ratings

-

Fitch Upgrades Development Bank of the Philippines’ VR to ‘bb’; Affirms IDR at ‘BBB’/Stable

-

Fitch Upgrades Metrobank’s VR to ‘bbb-‘; Affirms IDR at ‘BBB-‘; Outlook Stable

Term of the Day: Viability Ratings (VRs)

Viability Ratings (VRs) are ratings assigned by Fitch to be internationally comparable and show their view of the intrinsic creditworthiness of an issuer. VRs are a key component of a bank’s Issuer Default Rating (IDR), as per Fitch. VRs are assigned primarily to banking companies with certain factors that could be indicative of a bank likelihood of failing or becoming non-viable. These factors include defaulting on senior obligations, entering a resolution regime/bankruptcy/administration receivership etc., triggering non-viability clauses embedded in the instrument, execution of a distressed debt exchange as defined by Fitch’s criteria and receiving extraordinary support such that a default or other event of non-viability is avoided.

Talking Heads

On the Potential of Russia’s Return to Markets

Iskander Lutsko, Istar Capital

“[Investors] understand that as soon as there’s a thaw, these discounts [on Russian securities] will collapse”

Evgeny Kogan

“There’s an aggressive search for securities of Russian issuers around the world…Investors in general are asking how quickly they can enter the Russian market.”

On TCW and Threadneedle Eyeing Complex Mortgage Bonds Over CLOs

Liza Crawford, TCW

“The relative value across market sectors is always evolving and more recently it’s made perfect sense to increase agency CMO floater exposure while swapping out of some AAA CLOs”

On German Benchmark Bond Yield Nearing 3% High

Brian Mangwiro, Barings

“The anticipated fiscal spending is huge…[investors] have to ask for a better clearing price for bonds.”

Top Gainers and Losers- 13-March-25*

Go back to Latest bond Market News

Related Posts: