This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI and Core CPI In Line with Expectations

December 12, 2024

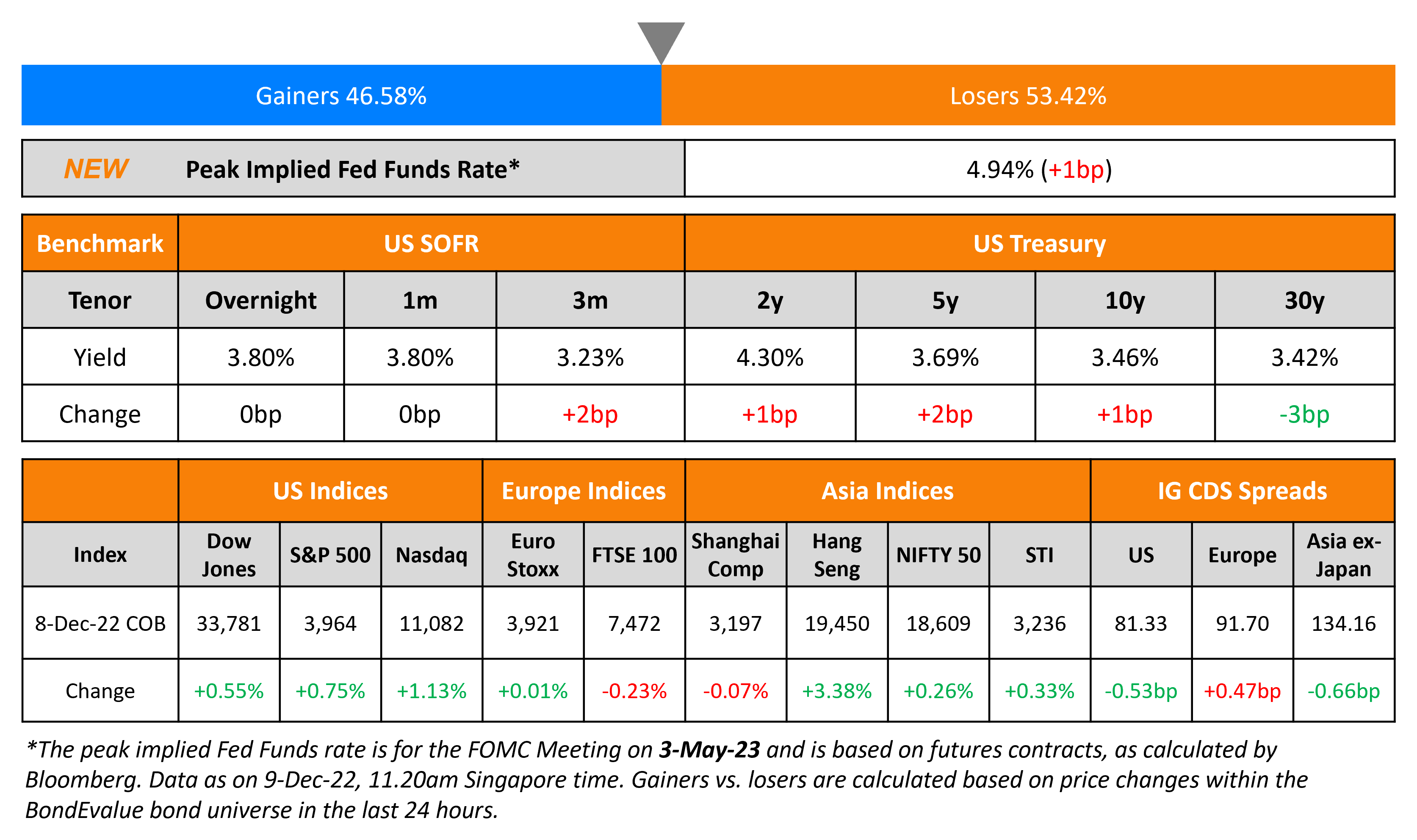

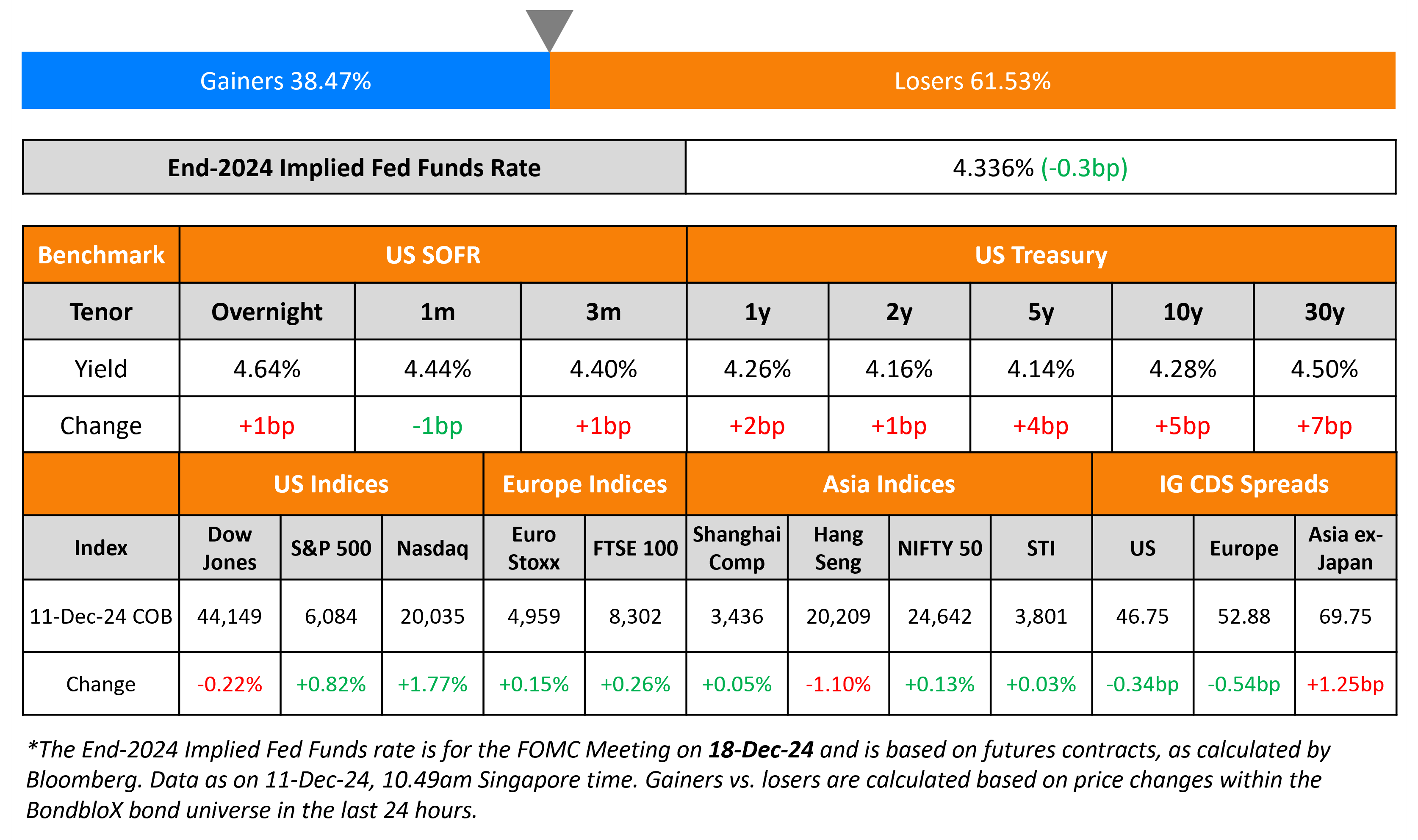

The US Treasury yield curve bear steepened, with long-end yields higher by over 5bp while the short-end was up 1-2bp, following the inflation report. The Headline CPI index rose by 2.7% YoY and the Core CPI was unchanged at 3.3%. With no major surprises on the inflation front, markets are now pricing-in a 98% probability of a 25bp rate cut by the Fed next week, as compared to an 85% probability prior to the inflation report.

US IG and HY CDS spreads tightened by 0.3bp and 1.5bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 0.8% and 1.8% higher respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 2.1bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 1.3bp wider.

New Bond Issues

Blackstone Secured Lending Fund raised $300mn via a tap of its 5.35% 2028s at a yield of 5.383%, 20bp inside initial guidance of T+145bp area. The senior unsecured notes are rated Baa2/BBB-/BBB. Proceeds will be used for general corporate purposes.

Rating Changes

-

Twilio Inc. Upgraded To ‘BB+’ On Expanding Business And Improved Credit Metrics, Outlook Stable

-

Moody’s Ratings upgrades SNB Capital Company’s ratings; outlook stable

-

Grifols S.A. Upgraded To ‘B+’ On Successful Deleveraging And Improved Liquidity Following Refinancing; Outlook Stable

-

Altice France S.A. Downgraded To ‘CCC/Dev’, Altice France Holding S.A. Rated ‘CCC-/Neg’ On Higher Risk Of Debt Exchange

-

Moody’s Ratings downgrades LG Chem’s ratings to Baa1 and maintains negative outlook; affirms LG Energy Solution’s ratings and revises outlook to negative

-

Fitch Revises Archer Daniels Midland’s Outlook to Negative; Affirms Ratings at ‘A’

-

Fitch Revises Celanese’s Outlook to Negative; Affirms Rating at ‘BBB-‘

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day: Bearer Bonds

A bearer bond is an unregistered debt security that could be issued by sovereigns or corporates. Unlike typical bonds, no records of the ownership or transactions are maintained for bearer bonds. The physical possessor of these bonds is the presumptive owner since there is no registered owner. Another difference is with respect to coupon payments. Coupons for bearer bonds are physically attached to the security so that the possessor can redeem these through an authorised agent. As with registered bonds, the bearer bonds are also negotiable and have a stated maturity date and coupon rate. The lack of legislation makes these bonds ideal instruments for tax evasion and money laundering. Such types of bonds were common in the 19th and 20th centuries and are no longer issued by the US treasury.

December 10 marked the 400th anniversary of the world’s oldest bearer bond, issued by Hoogheemraadschap Lekdijk Bovendams (NLD) to fund repairs to flood defences on the Lek river, south of Utrecht. The original bond was signed on 10 December 1624 and still continues to pay interest of 2.5% of the principal (which was 1,200 Dutch guilders).

Talking Heads

On US Junk-Bond Market Is Increasingly Just for Refinancing Itself

Scott Kimball, Loop Capital

“High-yield bonds will keep losing market share, until investors grow concerned about illiquidity, transparency and credit quality”

Geof Marshall, CI Global Asset

“The credit quality of the bond market is better than I’ve ever seen”

On business outlook brighter under Trump – BofA CEO, Brian Moynihan

“Regulatory changes will be favorable for the ability to get deals done… We’re seeing loan growth so far that would analyze out to 4%, 4% plus, better than what we see in the industry… So we’re growing faster in the economy”

On Donald Trump Seen as Unlikely to Stall Pace of ESG Debt Sales

Amy West, TD Securities

“It’s a little too soon to say if the Republican sweep of Congress will directly impact this market”

Stephen Liberatore, Nuveen

“Making this about investment returns and showing that sustainability, again, if done correctly, is profitable, especially from the investor perspective”

Aniket Shah, Jefferies

“This obsession with trying to define things perfectly for different frameworks is just an absolute waste of time”

Top Gainers and Losers- 12-December-24*

Go back to Latest bond Market News

Related Posts: