This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Consumer Confidence Drops to 4Y Low; UOB, Petronas Launch $ Bonds

March 26, 2025

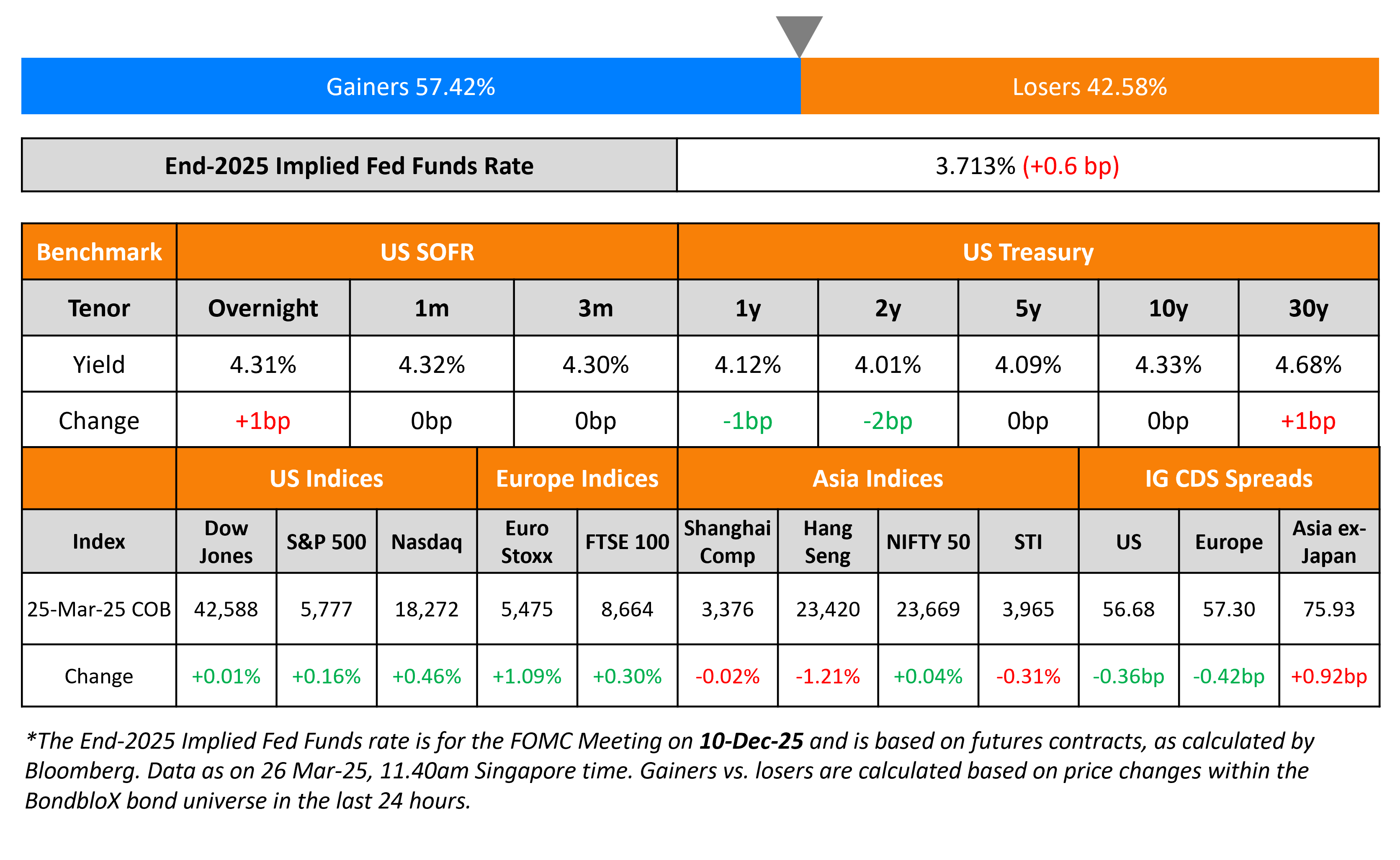

US Treasury yields were steady across the curve. The US Conference Board Consumer Confidence Index fell to its lowest level in four years to 92.9, and lower than expectations of 94.0. This also marks a fourth successive decline in the reading since the recent high of 112.8 seen in November 2024. To recall Fed Chairman Powell’s comments in last week’s FOMC meeting, he said that hard data indicated a solid economy while the weak consumer sentiment surveys may have been outliers. Separately, the US Treasury saw strong demand at its auction of the 2Y note.

US equity markets moved higher, with the S&P and Nasdaq up by 0.2% and 0.5% respectively. Looking at credit markets, US IG and HY CDS spreads tightened 0.4bp and 1.3bp respectively. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads tightened by 0.4bp and 4.6bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were wider by 0.9bp.

New Bond Issues

-

Petronas $ 5Y/10Y/20Y at T+120/130/150bp area

-

UOB $ 3Y/3Y FRN/5Y FRN at T+65/SOFR eq/SOFR+90bp area

-

Mongolia Mining $ 5NC2 at 8.8% area

Far East Horizon raised $500mn via a 3.5Y bond at a yield of 6.21%, 35bp inside initial guidance of T+255bp area. The bond is rated BBB- by S&P. Proceeds will be used for general corporate purposes, working capital financing and will possibly be lent to subsidiaries in China by way of intercompany loans.

Jollibee raised $300mn via a 5Y bond at a yield of 5.332%, 35bp inside initial guidance of T +160bp area. The senior unsecured note is unrated. The bond has a change of control put at 101. It also has negative pledge covenants. This includes limitations on the following: (a) indebtedness (b) guarantees by material subsidiaries (c) dividend restrictions (d) consolidation/merger/sale of assets. Proceeds will be used for general corporate purposes and to refinance existing debt.

MTR raised $3bn via a three-trancher. It raised:

- $500mn via a 5Y bond at a yield of 4.458%, 35bp inside initial guidance of T+75bp area

- $1bn via a 10Y bond at a yield of 4.888%, 27bp inside initial guidance of T+85bp area

- $1.5bn via a long 30Y bond at a yield of 5.3554%, 30bp inside initial guidance of T+100bp area

The senior unsecured bonds are rated Aa3/AA+. Proceeds will be used for general corporate purposes.

AerCap raised $500mn via a 30NC5 bond at a yield of 6.5%, 37.5bp inside initial guidance of 6.875% area. The junior subordinated WNG note is rated Baa2/BBB-/BBB-. Proceeds will be used for general corporate purposes which may include the redemption of all or a portion of its 2045s.

Cote d’Ivoire raised $1.75bn via a 10Y bond at a yield of 8.45%, 42.5bp inside initial guidance of 8.875% area. The bond is rated Ba2/BB/BB-. Net proceeds will be used to finance the repurchase of its 6.375% 2028s and 4.875% 2032s in cash, subject to the maximum acceptance amount. Proceeds may also be used for general budgetary purposes including prepayment of other debt.

New Bonds Pipeline

- Philippines BPI hires for $ 5Y/10Y bond

- Morocco hires for € 4Y/10Y bond

Rating Changes

-

General Electric Co. Upgraded To ‘A-‘ On Improved Metrics And Strong Demand; Outlook Stable; Debt Ratings Raised To ‘A-‘

-

Carnival Corp. Upgraded To ‘BB+’ On Expected Improvement In Credit Metrics; Outlook Stable

-

Moody’s Ratings upgrades Saipem’s ratings to Ba1, positive outlook

-

Turkish Appliances Maker Arcelik Cut To ‘BB-‘; Outlook Stable; Debt Downgraded To ‘B+’

-

Grupo de Inversiones Suramericana S.A. Downgraded To ‘BB’ From ‘BB+’ On Delayed Leverage Reduction; Outlook Stable

-

Moody’s Ratings downgrades Cornerstone’s CFR to B3; outlook revised to stable

-

Moody’s Ratings downgrades NFE’s senior secured term loan to B3 and legacy notes to Caa2; outlook remains negative

-

Fitch Affirms PERU LNG’s IDRs at ‘B’; Removes Rating Watch Negative

Term of the Day: Covenants

Debt covenants (also known as loan covenants, banking covenants or financial covenants) are lending restrictions in financial agreements that limit the actions of the borrowers. Lenders typically use covenants to ensure borrowers will operate within certain rules so that borrowers can repay their debt.

Covenants can either be positive or negative. With positive covenants, borrowers promise to do certain actions such as maintain a certain debt to equity ratio, interest coverage ratio, or level of cash flow, etc. With negative covenants, borrowers are restricted from certain actions such as to sell certain assets or incur more debt. Investors can find the covenants on a bond in its offering circular or prospectus.

Talking Heads

On ECB Rate Cuts Neither Finished Nor Automatic – ECB GC Member, Francois Villeroy

“The easing cycle is neither finished nor automatic… This is what I call agile pragmatism: Making monetary-policy decisions based on the data — actual as well as forecasted “… levies shouldn’t a have a “significant inflationary effect”

On Playing Defense as Tariffs Roil Bonds – DoubleLine’s Jeff Sherman

“I think being a little defensive right now is the right thing… now is the time to rethink things, and I don’t think it’s the time to be an extreme risk-taker… Guess what? If you leave a little money on the table, it’s not a big deal”

“We are at a precarious time in what I call the Big Cycle, where there is a confluence of major forces playing out in a way that is similar to many times in history… There was a good understanding of the choices and the possibilities to manage this dire situation over time”

Top Gainers and Losers- 26-March-25*

Go back to Latest bond Market News

Related Posts: