This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US-China Tariff De-escalation Sees Treasury Yields Jump Higher

May 13, 2025

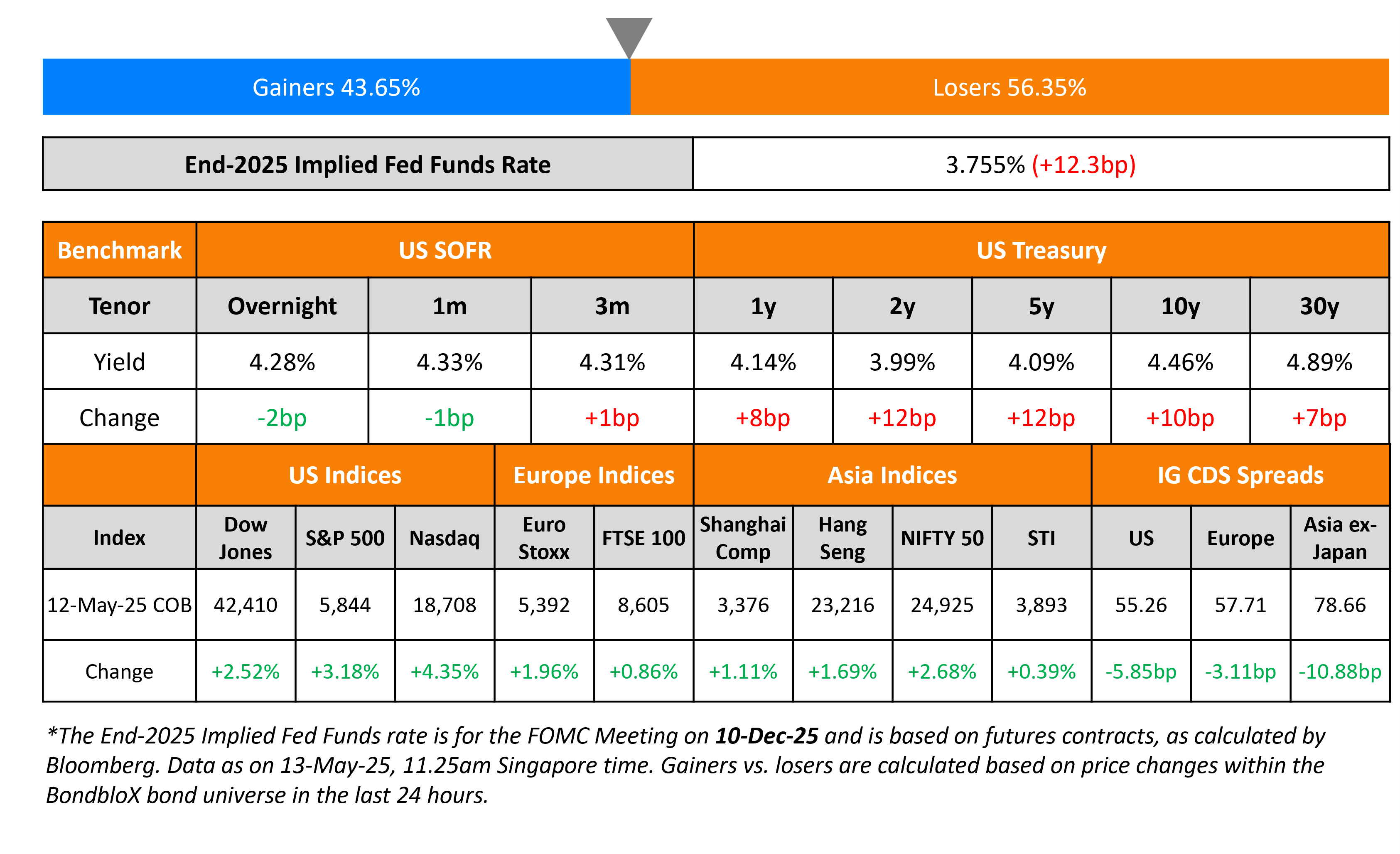

US Treasury yields jumped higher by 10-12bp across the curve, as global markets reacted favorably thanks to a significant de-escalation in the US-China trade dispute, albeit temporarily. Both nations agreed to a 90-day tariff reduction which will begin on Wednesday. The US will lower tariffs on Chinese goods to 30% from 145%, while China will lower tariffs on US imports to 10% from 125%. The agreement is set to expire in 90 days unless a more comprehensive trade deal is reached. Also, market expectations for Fed rate cuts fell from nearly three cuts to a little over two cuts by end-2025.

Looking at equity markets, the S&P and Nasdaq were both higher by 3.2% and 4.4% respectively. Looking at credit markets, US IG CDS spreads were tighter by 5.9bp, while HY CDS spreads tightened by a massive 34bp. European equity markets ended higher. The iTraxx Main CDS spreads tightened by 3.1bp and Crossover CDS spreads tightened by 13bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 10.9bp.

New Bond Issues

Carnival raised $1bn via a 6Y bond at a yield of 5.875%, ~6.25bp inside initial guidance of 5.875-6% area. The senior unsecured note is rated BB+. Proceeds will be used to refinance its 7.625% 2026s and to reduce interest expense and manage future debt maturities.

Rating Changes

-

Fitch Upgrades Carnival’s IDR to ‘BB+’; Outlook Positive

-

Fitch Upgrades Avolon Holdings Limited to ‘BBB’; Stable Outlook

-

Moody’s Ratings upgrades Tong Yang Life’s IFSR to A3; outlook stable

-

Office Properties Income Trust Upgraded To ‘CCC-‘ From ‘SD’, Outlook Negative; New Debt Rated

-

Cullinan Ratings Lowered To ‘B-‘, Outlook Negative On Pending Refinancing Risk

-

Moody’s Ratings downgrades Stellantis’ rating to Baa2, changes outlook to stable from negative

-

Fitch Places Banco de Sabadell on Rating Watch Positive on Potential Ownership Change

-

Fitch Revises Outlook on Shenzhen International to Negative; Affirms at ‘BBB’

-

Amgen Inc.’s Outlook Revised To Stable On Steady De-leveraging; ‘BBB+’ Rating Affirmed

New Bonds Pipeline

- Pertamina Hulu Energi hires for $ 5Y/10Y bond

- Sobha Realty hires for $ Long 3Y bond

Term of the Day: Special Drawing Rights (SDR)

Talking Heads

On Bond Traders’ Rate-Cut Optimism Flattened by Powell Tough Talk

Greg Peters, PGIM Fixed Income

“The bond market’s accepting the fact that inflation is going to be higher than kind of initially anticipated, and that is a complicating factor for investors’ belief that the Fed will step in and cut rates”

Sonal Desai, Franklin Templeton

“The market’s pricing of rate cuts is quite overdone. Absent a recession the Fed will only cut rates 25 basis points more”

John Madziyire, Vanguard

“The most frustrating thing at this point in time is the data — on jobs and inflation — we’re getting is actually backward looking”

On Citigroup Sees Risk of Yield Curve Steepening ‘Aggressively’

“We are moving from the tariff to the fiscal narrative, as President Trump has been focused on getting tax cuts on the book”… risk is that “the US curve will bear steepen aggressively again”

On Busy Week for Muni Debt Sales Tests Investors Wading Into Market

JPMorgan Chase & Co

“We believe that it is still a buyers’ market, with the tone again to be driven by the direction and magnitude of ETF flows”

Sylvia Yeh, a partner at Goldman Sachs Asset

“There’s still a fair amount of uncertainty out there that the market is going to continue to digest”

Top Gainers and Losers- 13-May-25*

Go back to Latest bond Market News

Related Posts: