This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

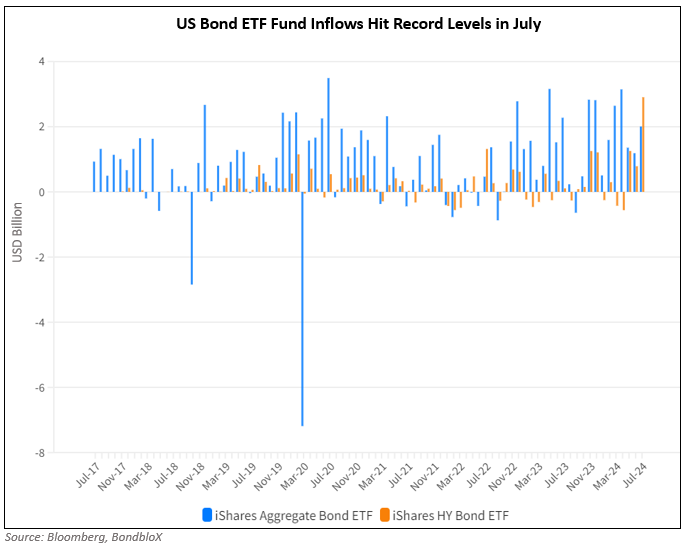

US Bond ETFs See Record Inflows in July

August 2, 2024

Bond funds saw record inflows of about $39bn in July, the most on record, as per data from Strategas. This comes amid a rally in US Treasuries where the 2Y and 10Y yields have fallen 46bp and 34bp respectively in July on the back of softer economic data and more rate cuts being priced by markets. “People want bonds…. (investors are) trying to take advantage of rates starting to move lower, so you get the price appreciation part”, said Todd Sohn, an ETF strategist at Strategas. In July, the iShares Core US Aggregate Bond ETF saw more than $2bn in inflows and the iShares Broad USD High Yield Corporate Bond ETF saw a massive $2.9bn inflow (as seen in the chart below). Bloomberg also notes that corporate bond trading volumes have surged with recent demand overtaking even the increased pace of new debt issuances. This is said to have driven money managers to secondary market to get the securities they want to buy.

For more details, click here

Go back to Latest bond Market News

Related Posts:

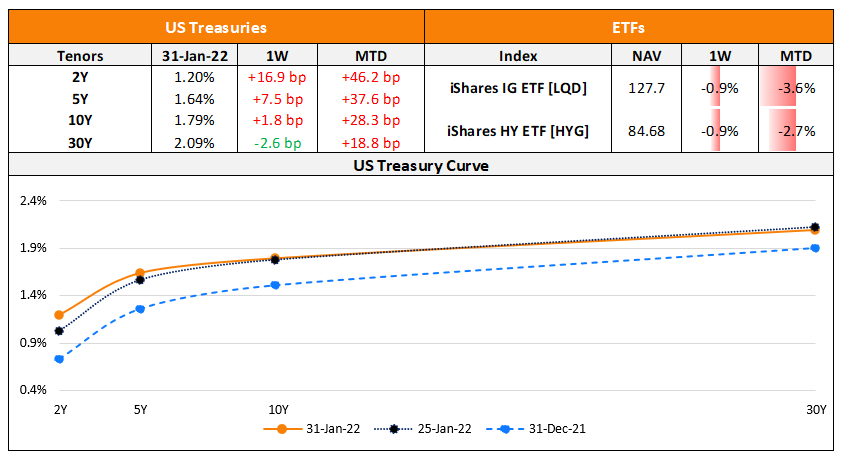

The Week That Was (24 – 30 Jan, 2022)

January 31, 2022

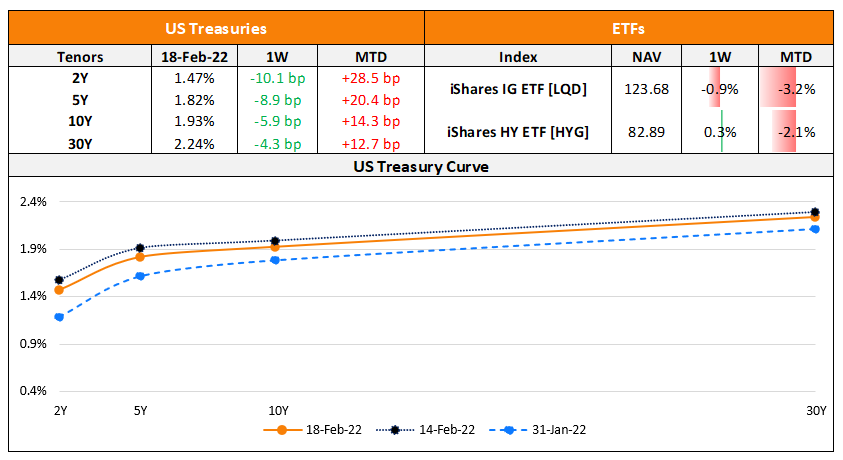

The Week That Was (14 – 20 Feb, 2022)

February 21, 2022

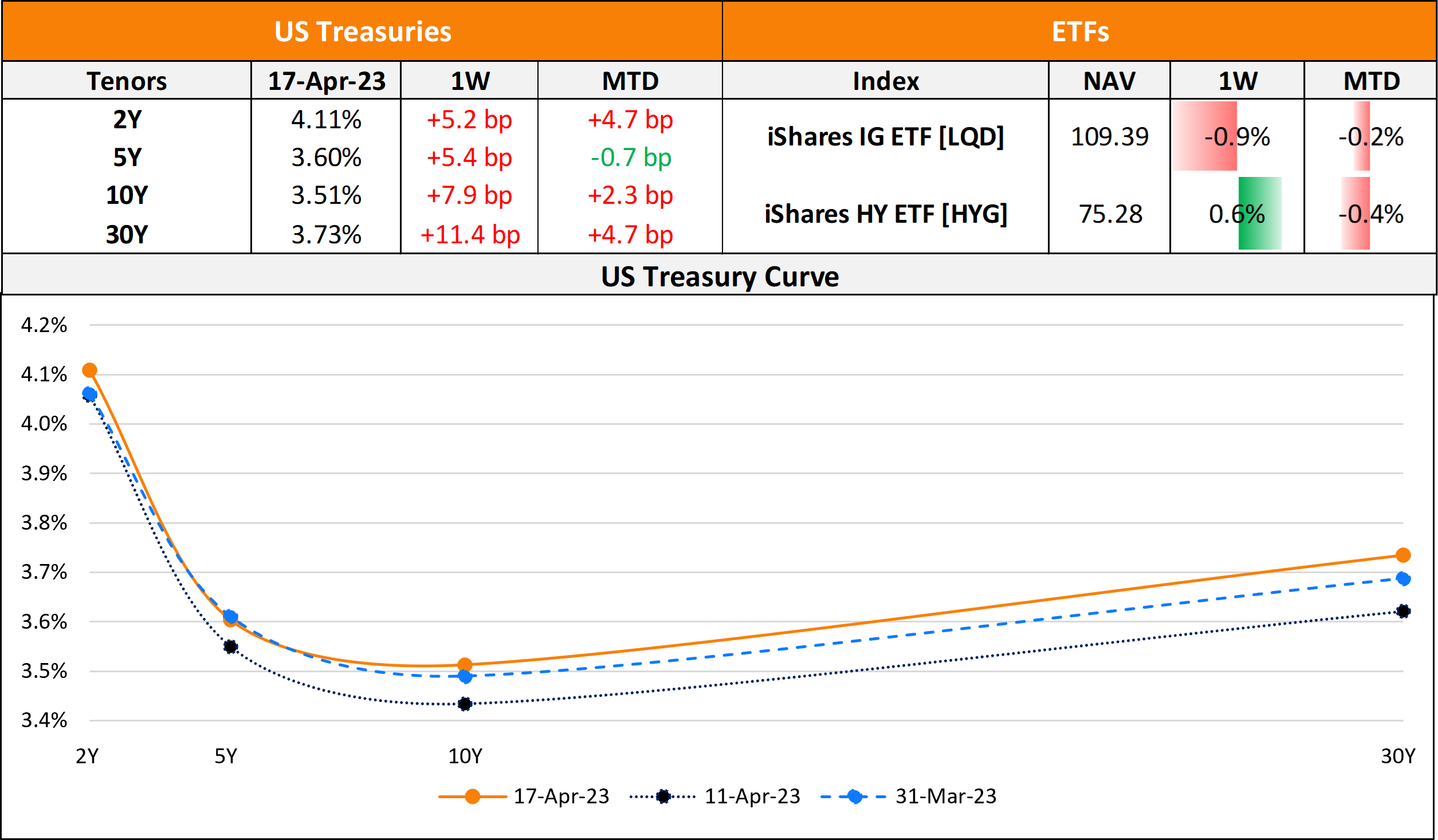

The Week That Was (10 – 16 April, 2023)

April 17, 2023