This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 2Y Treasury Yield Below 4%; Hysan, Meiji Yasuda Launch $ Bonds

March 4, 2025

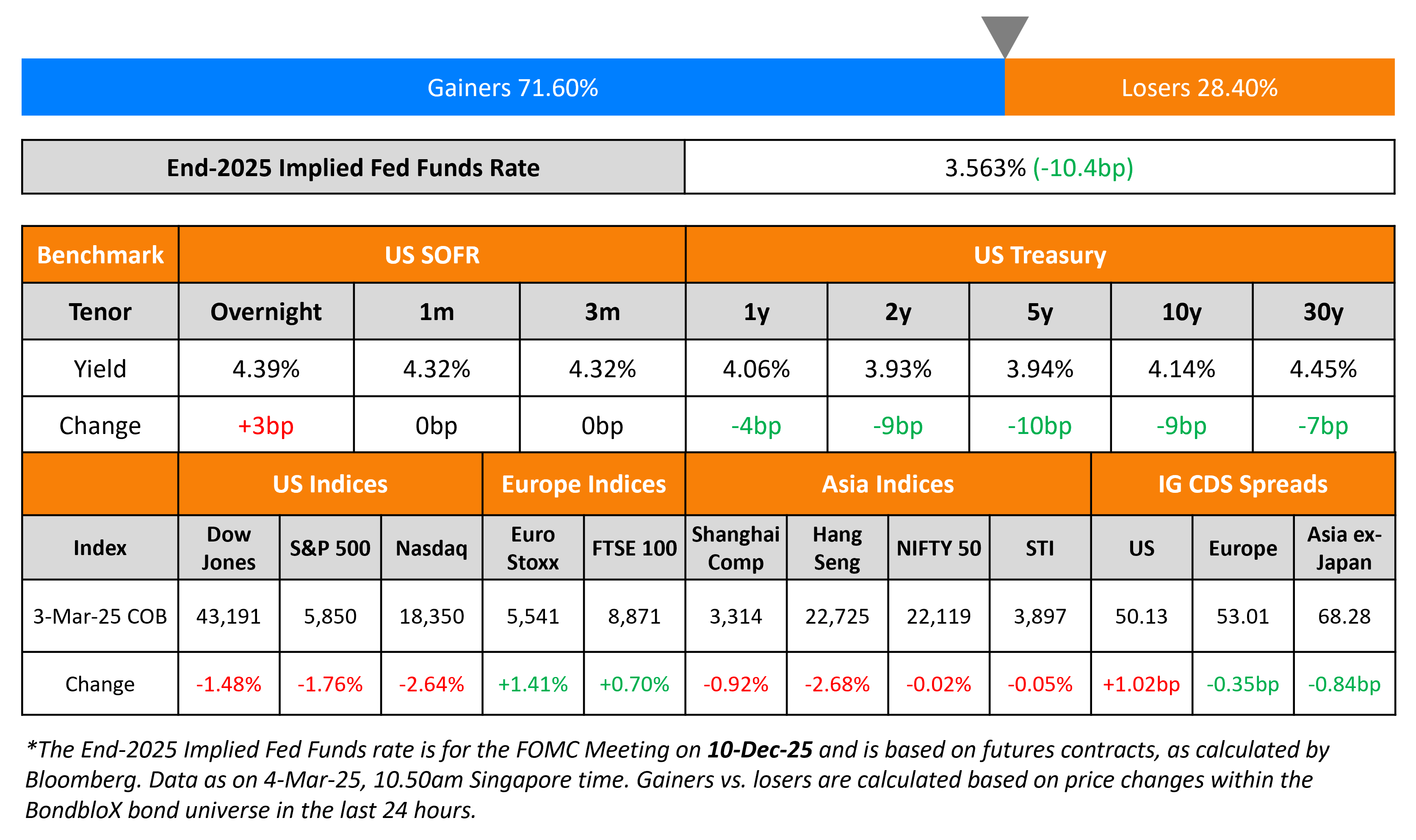

US Treasury yields dropped by over 9-10bp as the negative risk sentiment continued to weigh on markets. The 2Y yield dropped below the 4%-mark for the first time since October 2024. The US ISM Manufacturing Index for February came-in at 50.3, easing from the prior 50.9 reading, and was also lower than expectations of 50.7. This came especially on the back of a contraction in the New Orders and Employment components. However, the inflationary Prices Paid component rose sharply to 62.3, as survey respondents raised concerns about the impact of tariffs. Separately, US President Donald Trump said that he is set to impose additional 25% tariffs on Mexico and Canada, and a 10% duty on Canadian energy imports. Besides, he also signed an executive order to raise tariffs on China to 20% vs. the 10% tariff levied in February.

US equity markets saw the S&P and Nasdaq end lower by 1.8% and 2.6% respectively. Looking at credit markets, US IG and HY CDS spreads widened 1bp and 9bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads tightened by 0.4bp and 3bp respectively. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads were tighter by 0.8bp.

New Bond Issues

-

IIFL Finance $ 3.5Y Secured Tap at 100.5 price area

-

Meiji Yasuda $ 30.25NC10.25 at 6.5% area

-

Hysan Development $ PerpNC5.5Y at 7.6% area

Sumitomo Mitsui Trust raised $2.5bn via a four-trancher. Details are given in the table below:

The senior unsecured bonds are rated A1/A. Proceeds will be used for general corporate purposes.

Nucor raised $1bn via a two-part deal. It raised $500mn via a 5Y bond at a yield of 4.696%, 20bp inside initial guidance of T+90bp area. It also raised $500mn via a 10Y bond at a yield of 5.132%, 20bp inside initial guidance of T+115bp area. The senior unsecured notes are rated Baa1/A-/A-. Proceeds will be used to redeem, along with cash on hand if necessary, all of its 2% 2025s and 3.95% 2025s. Any remaining proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Central Nippon Expressway hires for $ 1Y bond

- Meiji Yasuda hires for $ 30.25NC10.25 bond

Rating Changes

-

Fitch Upgrades Paita to ‘BBB’; Outlook Stable

-

Moody’s Ratings downgrades Altice France to Caa3 on proposed debt restructuring

-

Moody’s Ratings downgrades Tripadvisor’s TLB to Ba3 from Ba2; outlook changed to stable from positive

-

3M Co. Outlook Revised To Stable From Negative On Lower Leverage; All Ratings Affirmed

-

Fitch Revises Outlook on Bapco Energies to Negative; Affirms at ‘B+’

Term of the Day: Credit Default Swap (CDS)

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On Bond Yields Jumping as Defense Promises Ripple Around the World

Jens Peter Sorensen, Danske Bank

“There is no doubt that defense spending will increase significantly… will be more issuance in the long end of the curve so investors want to have risk premium”

Robin Winkler, Deutsche Bank

“It would be a fiscal regime shift of historic proportions. If reports over the weekend prove correct, the two funds would add up to a significant fiscal impulse”

“If you don’t do it, you’re going to be in trouble… can’t tell you exactly when it’ll come, it’s like the heart attack. You’re getting closer. My guess would be three years, give or take a year, something like that… When you’re putting a lot more debt on top of that pile of debt, so it’s not just existing debt that’s a problem, but you have to add more debt sales”

On Musk’s Claim That the Fed Is ‘Absurdly Overstaffed’

Jerome Powell, Fed Chairman

“Overworked maybe, not overstaffed”

Scott Alvarez, former general counsel at the Fed

“Federal Reserve Act specifically gives the Fed authority to hire and fire its employees, and they’re not part of the civil-service system”

Top Gainers and Losers- 04-March-25*

Go back to Latest bond Market News

Related Posts: