This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

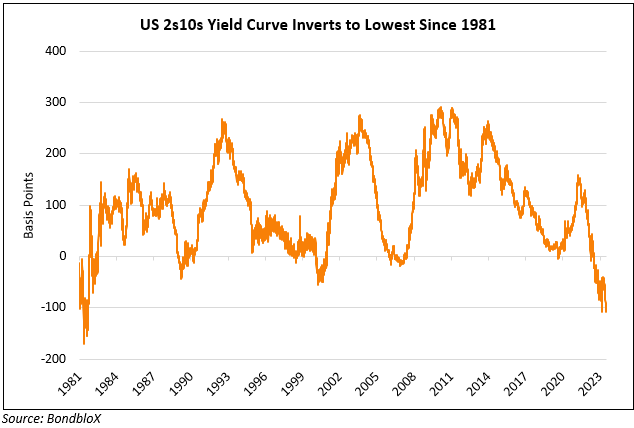

US 2s10s Curve Inverts to Lowest Since 1981

July 4, 2023

US Treasuries were 1-3bp higher across the curve with short-term yields moving slightly higher than long-term yields. The US 2s10s spread hit its lowest since 1981 at -109.50 earlier yesterday. The US ISM Manufacturing PMI dropped to 46 from 46.9, the lowest reading since May 2020, and below expectations of 47.2. Within the sub-components, the Price Paid Index also saw a 2.4 point drop to 41.8, below estimates of 44. A 25bp hike in the Fed’s July meeting is almost fully priced-in with CME probabilities indicate an 90% probability of the same. The peak Fed Funds rate was 1bp lower at 5.42%. US equity indices saw the S&P and Nasdaq edge 0.1-0.2% higher. Credit spreads tightened with the US IG and HY CDS spreads wider by 0.4bp and 3.7bp respectively.

European equity indices closed higher too, with European main and Crossover CDS tighter by 0.3bp and 0.8bp. Asia ex-Japan CDS spreads were 1.7bp tighter and Asian equity markets have opened flat today.

New Bond Issues

- ST Telemedia S$ PerpNC7 at 5.75% area

NordLB raised €500mn via a 5Y green bond at a yield of 4.887%, 15bp inside initial guidance of MS+175bp area. The senior preferred bonds have expected ratings of A3/A, and received orders over €775mn, 1.6x issue size. Proceeds will be used to (re)finance new and/or existing Eligible Green Assets in the Green Buildings and Renewable Energy categories.

Rating Changes

- Fitch Upgrades Deutsche Bank to ‘A-‘; Outlook Stable

- Fitch Upgrades Emaar Properties PJSC’s IDR to ‘BBB’; Outlook Stable

- Fitch Revises Societe Generale’s Outlook to Positive; Affirms at ‘A-‘

Term of the Day

Tuna Bonds

Tuna Bonds were bonds issued by Mozambique in 2013 to finance Mozambican state-owned fishing company EMATUM’s plans to develop tuna fishing. However, several hundred millions of dollars went missing and donors including the IMF stopped supporting the nation leading to a currency and debt crisis. Credit Suisse, which helped facilitate the transaction is set to face a trial after funds from the tuna bond issuances were used for purchasing military equipment instead. A UK judge yesterday ruled that the “tuna bond” scandal can proceed to a trial.

Talking Heads

On Morgan Stanley Warning Against Bets on Emerging-Market Rate Cuts

“While low inflation might justify a steep easing cycle in emerging markets, and even keep real rates steady, the sharp narrowing in nominal interest rate differentials that this implies would likely leave EM local markets vulnerable to shocks… might help to slow the pace of cuts, though there is more debate to be had about whether it simply pushes out the same terminal rate”

On Morgan Stanley Saying Bill Dudley Is Wrong About Bond Market

“While some describe the bond market sell-off as ‘far from over,’ we disagree and call it ‘long in the tooth’… expansion of central bank balance sheets leave “very little scope for term premiums to rise”

On Petrobras Switching From Asset Seller to Buyer as Debt Declines – CFO Sergio Caetano Leite

“Petrobras had a divestment program. The company has now changed sides of the table… The idea is not to put Petrobras into debt… “The time had come to put our feet in the water and see what the temperature was. The acceptance was good, which leads us to continue looking at the debt markets. Petrobras is back to the game… With this resource we’ll improve the profile, paying debts that have a higher rate”

On Bridgewater’s Greg Jensen Sees a ‘Bad’ Outlook for Bonds and Stocks

“The Fed seems a little bit more realistic than the markets do on what it’s going to take. To get an equity rally from here, you have to have lower rates fairly quickly into a world where earnings are pretty good. That’s kind of the discounted line. To get above that you need even more than that… My view is you end up with growth disappointing a bit and inflation disappointing on the high side a bit, ending up probably bad for bonds and probably a little bit bad for equities and generally weak growth”

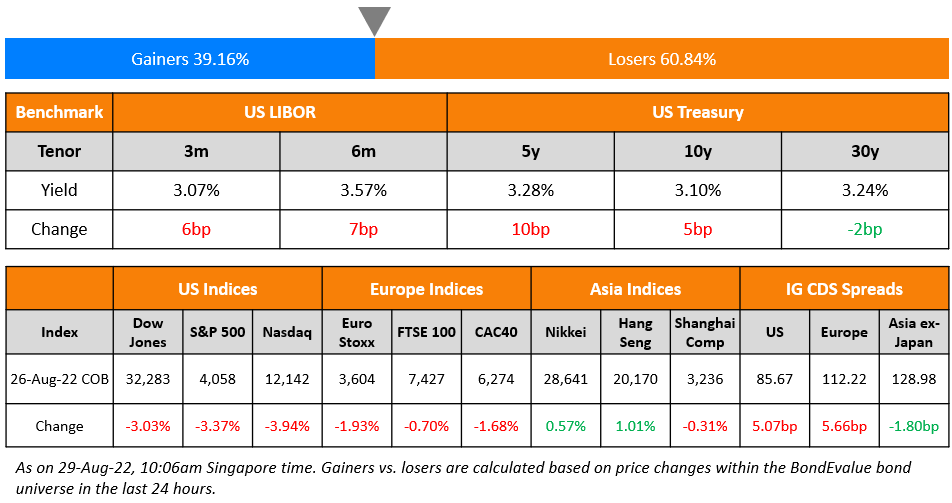

Top Gainers & Losers – 04-July-23*

Go back to Latest bond Market News

Related Posts: