This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 10Y Yield Crosses 4.5%; Prudential Launches S$ Tier 2; SocGen, Bombardier Price $ Bonds

May 15, 2025

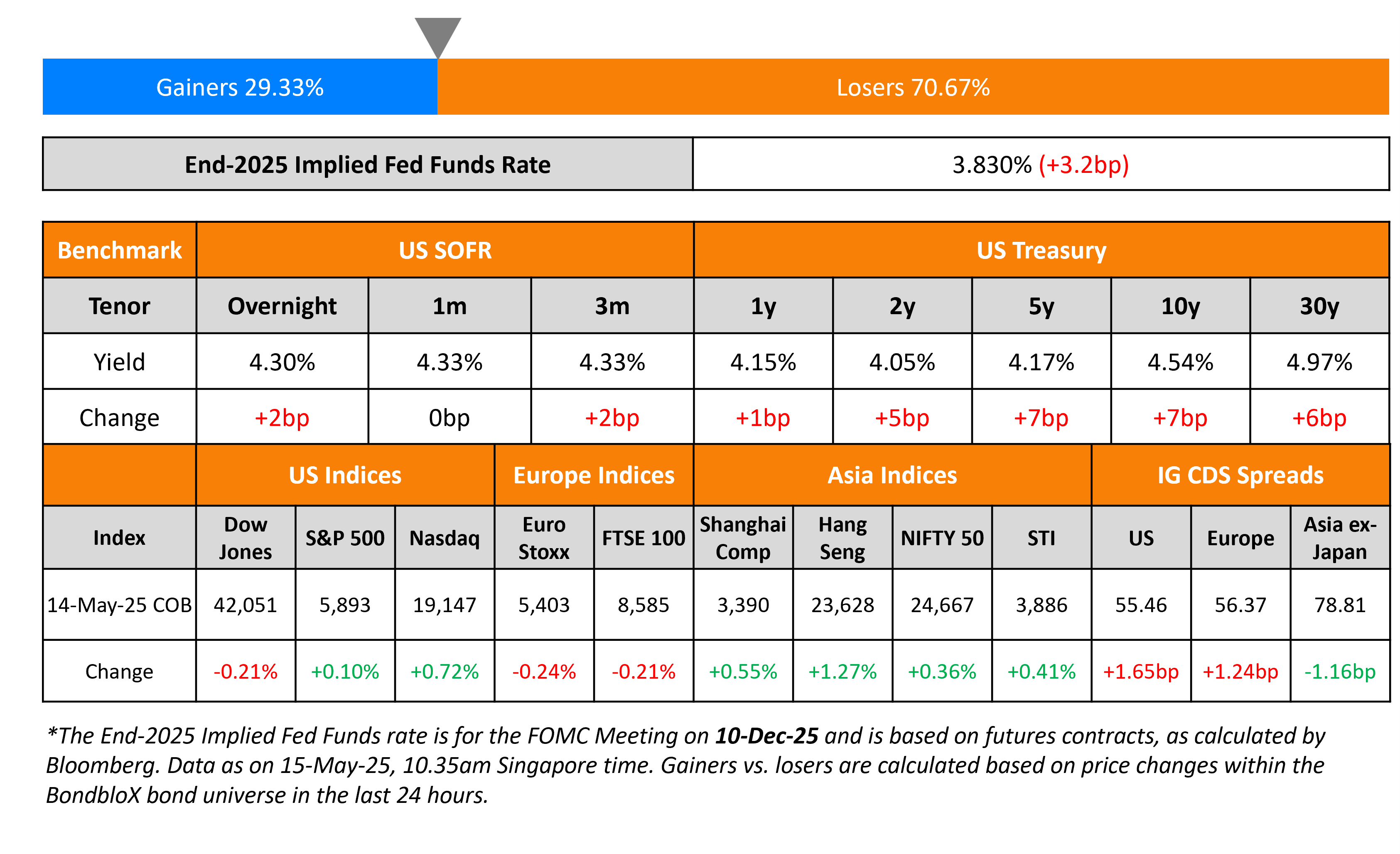

US Treasury yields rose by 5-7bp across the curve. The US10Y yield crossed the 4.50% mark for the first time since mid-February. With this, markets are currently pricing-in just about 50bp in Fed rate cuts by end-2025 vs. 75bp in rate cuts a week ago. There were no major data releases in the US yesterday.

Looking at equity markets, the S&P and Nasdaq were both higher by 0.1% and 0.7% respectively. Looking at credit markets, US IG and HY CDS spreads widened by 1.7bp each. European equity markets ended lower. The iTraxx Main CDS spreads widened by 1.2bp and Crossover CDS spreads widened by 3.5bp. Asian equity markets have opened lower across the board today. Asia ex-Japan IG CDS spreads were tighter by 1.2bp.

New Bond Issues

- Prudential S$ 10Y Tier 2 at 4.15% area

- Shandong Gold Group $ 3Y at 5.2% area

SocGen raised $2.5bn via a two-trancher. It raised $1bn via a 4NC3 bond at a yield of 5.249%, 30bp inside initial guidance of T+150bp area. It also raised $1bn via a 6NC5 bond at a yield of 5.512%, 30bp inside initial guidance of T+165bp area. The senior non-preferred notes are rated Baa2/BBB/A-. Proceeds will be used for general corporate purposes. The new 4NC3s are priced at a new issue premium of 7bp over its existing 6.446% 2029s (callable in 2028) that currently yield 5.18%.

Bombardier raised $500mn via an 8NC3 bond at a yield of 6.75%, inline with initial guidance of 6.75% area. The senior unsecured note is rated B1/B+. Proceeds will be used together with cash on hand to (a) fund the repayment and/or retirement of outstanding debts, including its $500mn 7.875% 2027s (b) pay accrued interest.

ICBC Singapore raised $300mn via a 3Y green bond at a yield of 4.249%, 61bp inside initial guidance of T+85bp area. The senior unsecured note is rated A1. Separately, ICBC Hong Kong raised $1bn via a 3Y green FRN at SOFR+52bp, 53bp inside initial guidance of SOFR+105bp area. The senior unsecured note is rated A1. Proceeds from both issuances will be used for financing/refinancing green assets as per the issuer’s green framework.

Korea Water raised $300mn via a 2Y green bond at a yield of 4.615%, 40bp inside initial guidance of T+100bp area. The senior unsecured note is rated Aa2. Proceeds will be used for financing/refinancing in whole or part as per the issuer’s green framework.

Rating Changes

-

Fitch Upgrades Matador Resources’ Ratings to ‘BB’; Outlook Stable

-

Murphy Oil Corp. Outlook Revised To Negative On Weaker Credit Measures, Ratings Affirmed

-

Fitch Revises TechnipFMC plc’s Outlook to Positive; Affirms Ratings at ‘BBB-‘

New Bonds Pipeline

- Air France hires for € PerpNC5.2 bond

- KEXIM hires for € 3Y/5Y bond

Term of the Day: Accrued Interest

Accrued interest for a bond refers to the interest or coupon that has accrued since the last coupon payment date but not yet paid. When a bond is traded between coupon payment dates, accrued interest is paid by the bond buyer to the bond seller. The final price paid by the buyer is called dirty price and is calculated by adding the accrued interest to the price of the bond (clean price). The reason buyers have to pay accrued interest is because they stand to receive the full coupon on the next payment date, even though they are only entitled to the coupon that has accrued since the date the bond was purchased.

Talking Heads

On US May Need a Bond-Market Blowup to Cut Deficit – Stephen Jen, Eurizon SLJ Capital

“I’m conceding that we don’t seem to be moving in the right direction… may be necessary to have a repeat of what happened to Liz Truss with the US bond market forcing them, actually sending yields close to or breaching 5%… not enough to warn people that that could happen and do something to avoid that from happening”

On Bank Strategists Grow More Bullish on Credit as Trade Fears Ease

Barclays strategists

“We view last weekend’s trade war de-escalation as a major and lasting shift in the economic backdrop… near term, we think the path of least resistance is tighter”

Lotfi Karoui, Goldman Sachs

“The policy shifts that initially drove risk premia higher have softened, effectively acting as a circuit breaker ─ somewhat more persuasively than we had expected”

On seeing economic slowdown amid tariff confusion – Steve Cohen, Point72

“We don’t think the Fed’s going to act right away, because they’re still going to be worried about inflation from tariffs”

Top Gainers and Losers- 15-May-25*

Go back to Latest bond Market News

Related Posts: