This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

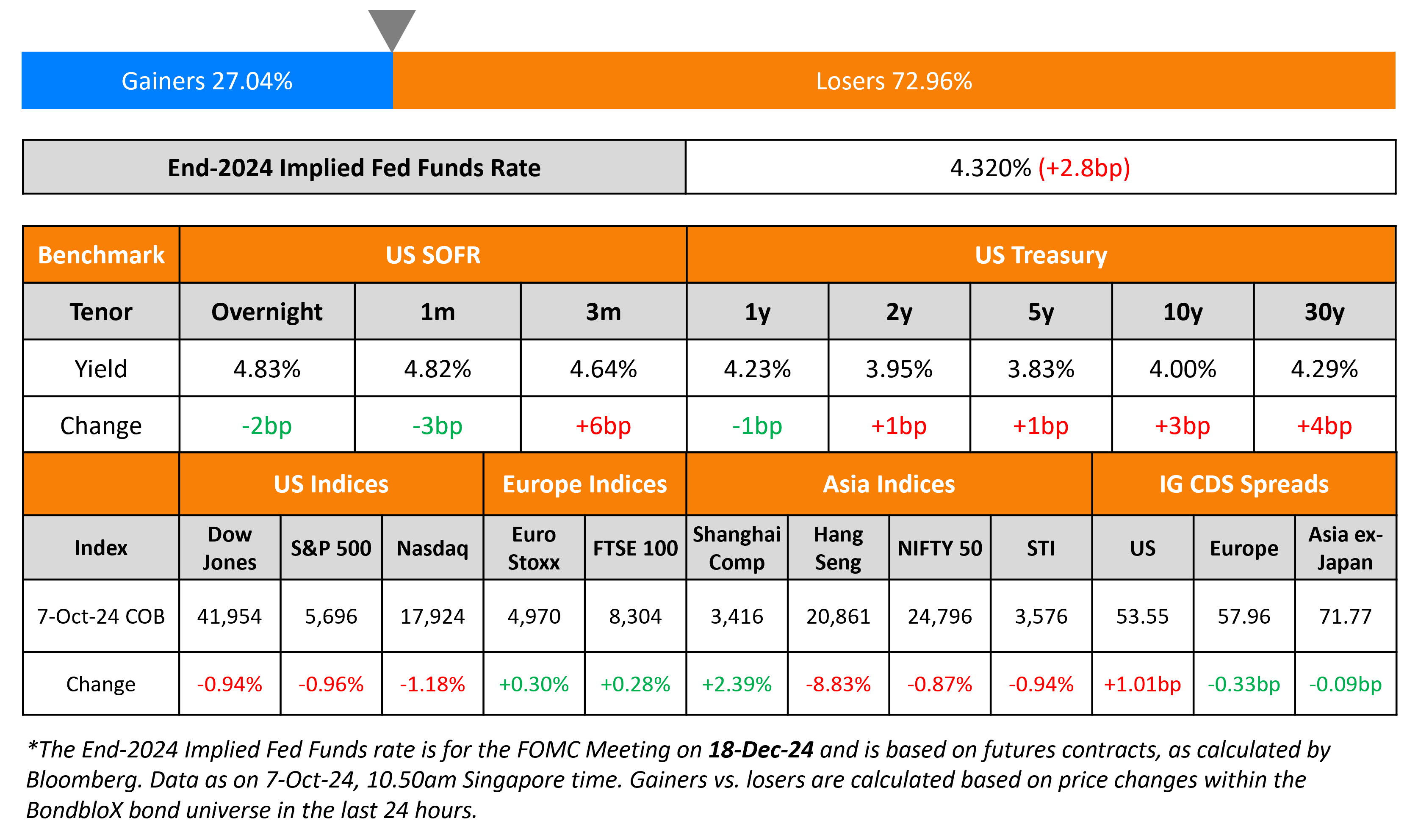

US 10Y Treasury Yield Touches 4% Mark

October 8, 2024

US Treasury yields inched higher across the curve with the 10Y yield crossing the 4%-mark for the first time since end-July. While there were no major data points, St. Louis Fed President Alberto Musalem said that he preferred further rate reductions to be gradual. He viewed the “costs of easing too much too soon as greater than the costs of easing too little too late”. US IG CDS and HY CDS widened by 1bp and 4.5bp respectively. Looking at US equity markets, S&P and Nasdaq both closed lower by 1-1.2% respectively.

European equities ended higher. Looking at Europe’s CDS spreads, the iTraxx Main CDS spreads tightened by 0.3bp while Crossover spreads widened by 1.2bp. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads tightened by 0.1bp.

New Bond Issues

- BNP Paribas S$ 10.5NC5.5 Tier 2 at 4.2% area

-

KDB $ 3Y at SOFR MS+62bp area

-

Islamic Development Bank $ 5Y at SOFR MS+55bp area

-

World Bank $ 5Y at MS+41bp area

Toyota Motor Credit raised $3bn via a three-part deal. It raised:

- $1bn via a 1.5Y FRN at SOFR+45bp vs. initial guidance of SOFR+70bp area.

- $1.25bn via a 3Y bond at a yield of 4.364%, 28bp inside initial guidance of T+75bp area. The new bonds are priced at a new issue premium of 16.4bp over its existing 4.55% 2027s that currently yield 4.2%.

- $750mn via a 7Y bond at a yield of 4.634%, 28bp inside initial guidance of T+100bp area. The new bonds are priced at a new issue premium of 6bp over its existing 5.1% 2031s that currently yield 4.57%.

The senior unsecured bonds are rated A1/A+/A+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Adani Hybrids Renewables hires for $ 20Y bond

- Sharjah hires for $ 10.5Y bond

Rating Changes

- Fitch Affirms Dell Technologies at ‘BBB’/’F2’; Outlook Revised to Positive

- Global Carmaker Stellantis N.V. Outlook Revised To Negative On 2024 Profitability Slump; ‘BBB+/A-2’ Ratings Affirmed

- Fitch Revises Polygon’s Outlook to Stable; Affirms at ‘B’

Term of the Day

Debt-for-Nature Swap

Debt-for-nature swaps are a transaction wherein an amount of debt owed by a developing country government is cancelled or reduced by a creditor, and swapped with a financial commitment earmarked for environmental conservation. Once the creditor reduces or cancels the debt repayment amount, both the creditor and debtor arrive at an agreed amount that would have otherwise been used for servicing the debt, to be used for environmental projects. These swaps typically involve countries that are distressed and find it difficult to repay offshore debt. The earnings generated through swaps are often administered by local conservation or environmental trust funds.

The world’s first debt-for-nature swap was between Bolivia and foreign creditors, who forgave $650k of its debt in exchange for setting aside 3.7mn acres of land adjacent to the Amazon Basin for conservation.

Talking Heads

On US Corporate Bond Spreads Rallying to 3Y Low, Bucking Risks

BI Analyst

“Despite the myriad economic, political and geopolitical uncertainties, the asset class has been sustained by a persistent duration bid amid expectations for loosening monetary policy and lower yields”

Noah Wise, Allspring Global Investments

“Investors are more concerned with declining cash yields than the level of credit spreads”

On US Yields Back at 4% for First Time Since August on Fed Rethink

Goldman Sachs

“We’ve expected higher yields but anticipated a somewhat gradual adjustment… extent of strength in the September jobs report may have accelerated that process”

Dario Perkins, TS Lombard

“It doesn’t need a recession to get inflation to tolerable levels, so the Fed is easing policy without waiting for genuine economic weakness… By now, everyone should have realized the Fed is cutting rates pre-emptively”

On Wall Street Strategists Saying Jobs Surprise Bodes Well for Stocks

Michael Wilson, Morgan Stanley’s

“We continue to believe we’re in a ‘good is good’ environment in terms of the equity market’s response to the labor/economic growth data… bond market is becoming less skeptical on the soft landing outcome”

David Kostin, Goldman Sachs

Upgrading his 12-month target for the benchmark to 6,300 points from 6,000, implying gains of about 10% from current levels

Top Gainers & Losers 8-October-24*

Go back to Latest bond Market News

Related Posts: