This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 10Y Treasury Auction Sees Soft Demand

August 7, 2025

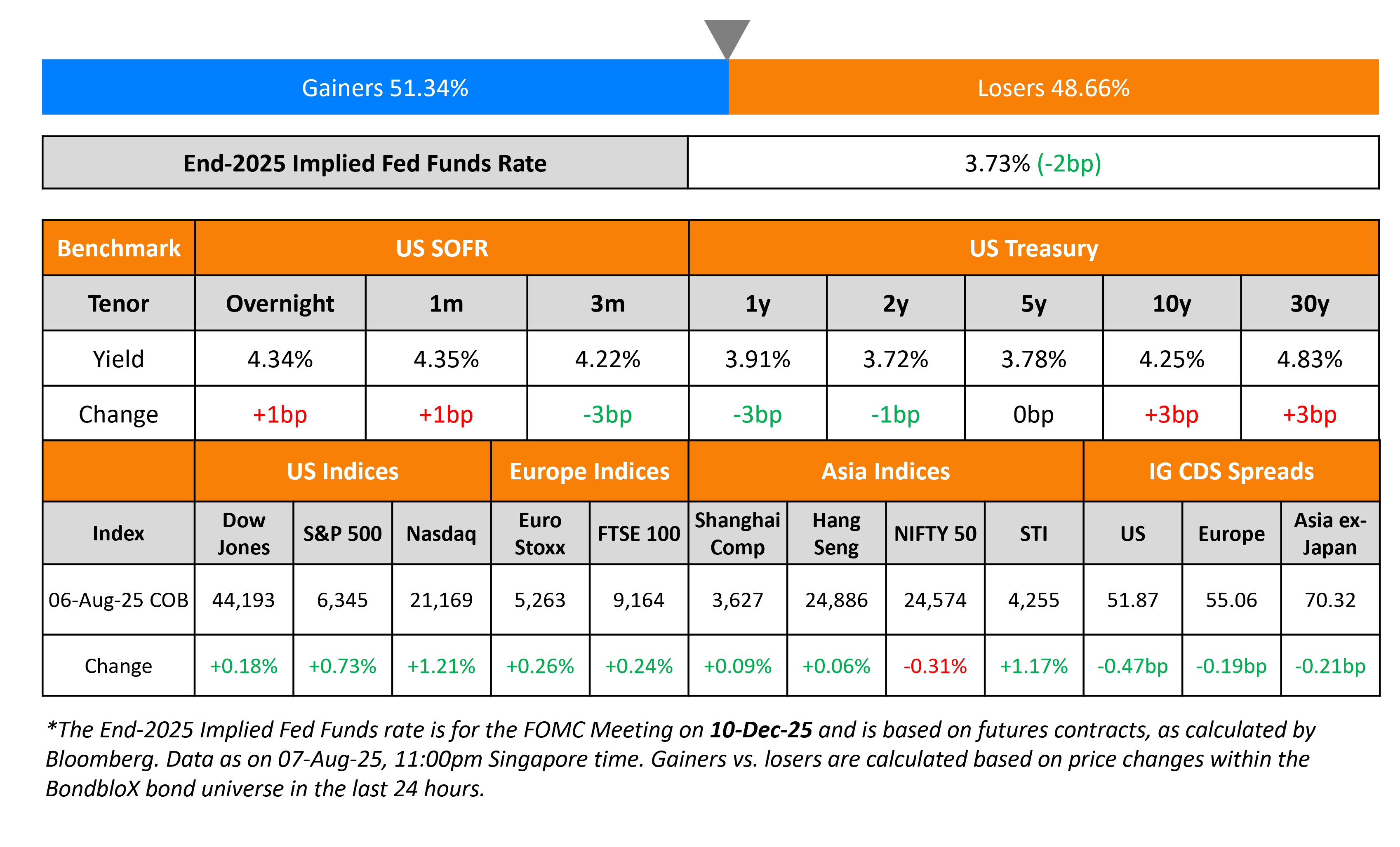

The US Treasury yield curve steepened on Wednesday, with the 2s10s spread widening by 4bp. US President Donald Trump signed off an executive order, imposing an additional 25% tariff on India. USA has now effectively imposed a 50% tariff on India, with Trump stating that it was due to India’s ongoing purchases of Russian oil and re-selling it in the open market. Minneapolis Fed President Neel Kashkari said that it would be appropriate to start adjusting the Fed Funds Rate downward in the near term. San Francisco Fed President Mary Daly said that central bank will likely need to “adjust policy in the coming months” after the soft labour market data. Separately, the US 10Y Treasury auction saw weak demand yesterday and tailed by nearly 1bp. The auction saw a bid-to-cover ratio of 2.35x, the lowest since August 2024. Primary dealers took about 16.2% of the total supply, the largest takedown in a year.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.7% and 1.2% respectively. US IG CDS spreads tightened by 0.5bp while HY CDS spreads widened by 2.0bp. European equity markets ended higher. The iTraxx Main spreads tightened by 0.2bp athe Crossover CDS spreads tightened by 0.6bp. Asian equity markets have broadly opened higher today. Asia ex-Japan CDS spreads were 0.2bp tighter.

New Bond Issues

Rating Changes

-

Fitch Downgrades Close Brothers Group to ‘BBB’; Outlook Negative

-

Moody’s Ratings affirms UPL’s Ba2 ratings; changes outlook to stable from negative

-

Whirlpool Corp. Outlook Revised To Negative From Stable On Weak Forecast; Ratings Affirmed

Term of the Day: Option Adjusted Spread (OAS)

Option Adjusted Spread (OAS) refers to a measure of the credit spread of a bond with embedded options relative to a benchmark, similar to the z-spread. The key difference between OAS and z-spread lay in the optionality. When comparing two bonds – one with an embedded option and one without – OAS is a better measure compared to z-spread as the former adjusts for/removes the impact of optionality for a like-to-like comparison. Put simply, OAS ≈ Z-Spread + Option cost.

On a technical note, the above formula is not an exact equation as the z-spread is calculated from the spot curve while the OAS is calculated from the forward curve. The OAS is less than the z-spread for callable bonds and greater than z-spread for puttable bond.

Talking Heads

On US Yield-Curve Shape Looking Like Zero-Rate Era – Goldman Sachs

William Marshall, Bill Zu

“The defining feature of the Treasuries market has been and remains how rich the belly is… Since the start of the year, the market has generally priced more near-term cuts alongside even deeper cuts cumulatively…The clearest route for steepening to shift in and belly richness to uncoil is a shift in behavior towards clearer front-loading.”

On Wall Street’s Transition to Faster Trading Paying Off for Credit

Zornitsa Todorova, Barclays

“Think of it as an efficiency boost to the system — or, put differently, as if your insurance premium just went down…That capital can either be used to trade more actively or deployed elsewhere.”

On Dollar Negative Story ‘Back in Play’ – UBS Strategists

“The significance of these developments is that for the first time since the Spring both the traditional macro and the risk premium elements of the dollar-negative story are back in play…The notion that the quality and trustworthiness of US economic data are in question does not bode well for the idea of holding on to US assets”

Top Gainers and Losers- 7-Aug-25*

Go back to Latest bond Market News

Related Posts: