This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

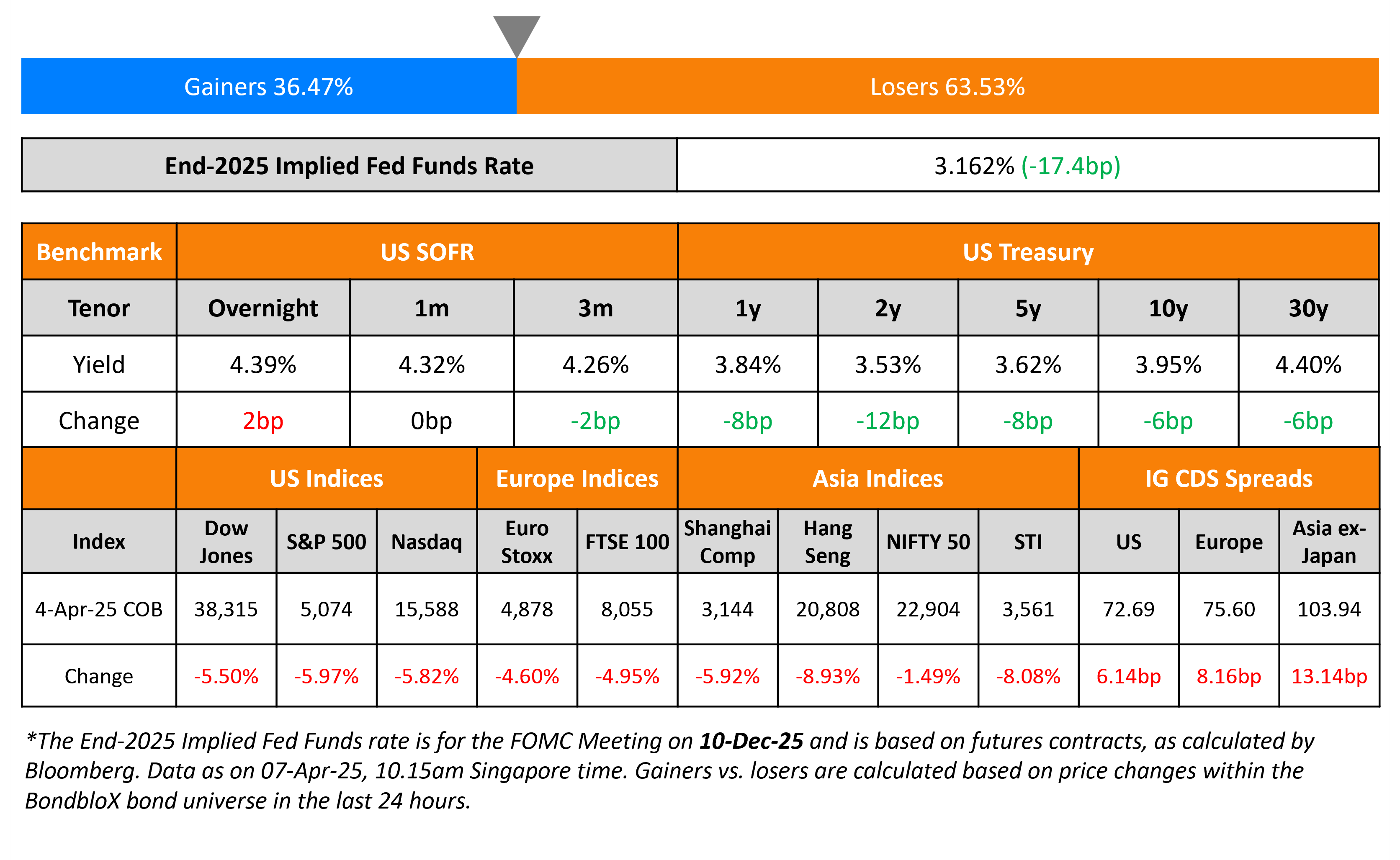

US 10Y Below 4% As Equity Sell-off Deepens

April 7, 2025

US Treasury yields dipped further, as the risk-off sentiment worsened. The 10Y yield fell below the 4%-mark for the first time since September 2024. On the data front, US Nonfarm Payrolls (NFP) for March came-in at 228k, better than estimates of 140k. However, February’s number was revised lower to 117k from 151k. Average Hourly Earnings (AHE) YoY rose 3.8%, softer than expectations of 4.0%. The Unemployment Rate edged higher to 4.2% from 4.1%. China announced that it will impose a 34% retaliatory tariff on all imports from the US, from April 10. Fed Chairman Jerome Powell continued to signal that there was no hurry to cut rates.

US equity markets ended sharply lower, with the S&P and Nasdaq down 6% and 5.8% respectively. Looking at credit markets, US IG and HY CDS spreads widened by 6bp and 24bp respectively. European equity markets ended sharply lower too. The iTraxx Main and Crossover CDS spreads widened by 8.2bp and 40bp respectively. Asian equity markets have opened deep in the red this morning. Asia ex-Japan CDS spreads were wider by 13.1bp.

New Bond Issues

Rating Changes

-

EchoStar Corp. Subsidiary Dish DBS Corp. Upgraded To ‘CCC+’; Outlook Negative

-

Moody’s Ratings upgrades Masdar’s ratings to A1, stable outlook

-

Moody’s Ratings downgrades ams-OSRAM’s CFR to B3; stable outlook

-

Fitch Revises Rwanda’s Outlook to Negative; Affirms at ‘B+’

-

Fitch Places Banca Popolare di Sondrio on Rating Watch Positive on BPER’s Exchange Offer

Term of the Day: Crossover CDS Spreads

The iTraxx Crossover Index is a credit default swap (CDS) based index compiled by IHS Markit (now part of S&P Global) which consists of the 75 most liquid sub-investment grade entities in Europe. The index helps track credit risk in the European high yield market, akin to the Markit HY CDS Index in the US. Performance is tracked in terms of the index’s value and the move in the spreads of the index. A tightening (a move lower) in its CDS spreads implies an easing of credit conditions in the European junk-bond markets which leads to an increase in the value of the index. On the other hand, a widening in its spread (a move higher) implies a worsening in credit conditions, which would lead to a fall in the index’s value. While the iTraxx Crossover Index helps track European high yield spreads, the iTraxx Main index helps track European investment grade spreads. The iTraxx Main index consists of 125 of the most liquid European entities with IG-ratings as published by Markit from time to time.

Talking Heads

On Global Rate Cut Bets Offer EM Investors Hideout From Trump Chaos

Grant Webster, Ninety One

“The interesting trade here is in rates. With a weaker growth outlook ahead, EM central banks are going to have a lot more room to ease… For some time now we have been running with higher yields in EM, but the strengthening dollar was the headwind”

Tina Vandersteel, Grantham Mayo Van Otterloo & Co.

“It would be ironic if EM local debt turns out to be the under-owned relative safe haven asset in all this”

On Global Junk Bonds Extending Selloff, Premiums at November 2023 High

“At the start of 2025, consensus suggested that growth would stay steady, inflation would continue its descent, and that technicals would remain solid for both supply and demand in the BSL market… However, in recent weeks, sentiment shifted sharply amid tariff uncertainty and stagflationary concerns.”

On warning that Trump is losing business leaders’ confidence – Bill Ackman, Pershing Square Capital

“The president has an opportunity to call a 90-day time out… If, on the other hand … we launch economic nuclear war on every country in the world, business investment will grind to a halt, consumers will close their wallets and pocket books, and we will severely damage our reputation”

Top Gainers and Losers- 07-April-25*

Go back to Latest bond Market News

Related Posts: