This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

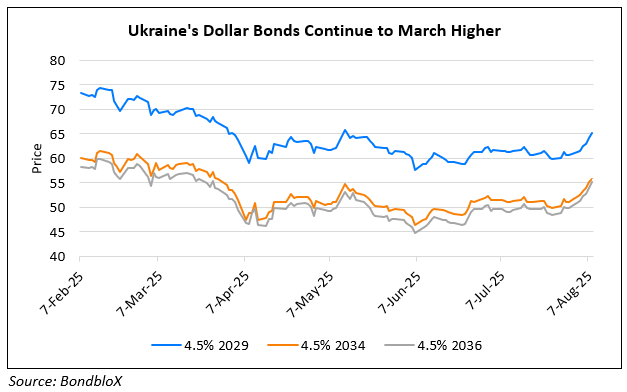

Ukraine’s Dollar Bonds Tick Higher after IMF Talks, Reports of Trump-Putin Meeting

August 8, 2025

Ukraine’s dollar bonds were higher by over 1 point after its President Volodymyr Zelenskyy discussed a new financial assistance programme with IMF Managing Director Kristalina Georgieva. The talks come ahead of an IMF staff visit later this month, with Kyiv aiming to address a widening budget deficit projected at $19bn next year. Ukraine’s current $15.5bn IMF programme expiring in 2027, may be updated to reflect changing wartime needs.

Prime Minister Yulia Svyrydenko also spoke with Georgieva and appointed a new economic security chief to meet reform conditions set by lenders. Analysts warn that the financing gap could grow if Russian attacks persist and reforms stall. The IMF and Ukrainian authorities plan to intensify discussions on the 2026 budget and medium-term financing.

Ukraine’s dollar bonds have been on an uptrend since late-July as shown in the chart above. For instance its 4.5% 2035s have rallied by ~12% since July 28 to currently trade at 55.7, yielding 12.7%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: