This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ukraine Launches Offer to Convert GDP-Linked Warrants to Bonds

December 3, 2025

Ukraine on Monday offered to swap about $3.2bn of GDP-linked warrants (due 2041) into cash and new “C Bonds” maturing 2030–2032, to avoid potentially large future payouts tied to post-war growth. Holders of the warrants would receive about $1,340 worth of the C bonds per $1,000 of principal held. The C bonds are expected to pay a coupon of 4.5% that would eventually rise to 7.25% by 2029, according to Bloomberg sources. The deal needs 75% holder approval, and early supporters who join by December 12 will receive extra cash. These warrants could cost Ukraine up to $6bn if growth rebounds, so buying them back now improves debt sustainability and helps Ukraine to exit default. The main bondholder group is open to the plan but says terms are still being negotiated. One of the sticking points is the amount that C bondholders would stand to receive in the event of a future restructuring, known as the loss reinstatement provision. The other is about concessions Kyiv should make to holders’ voting rights.

Bloomberg reported that the price of the warrants jumped over 6 points to 99 cents on the dollar. Meanwhile, its 4.5% 2029s fell by 2 points to 70.76, yielding 17.9%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

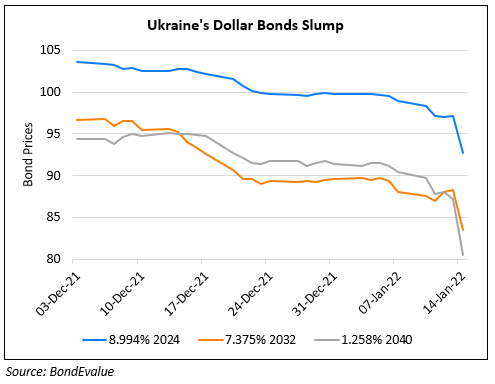

Ukraine’s Dollar Bonds Slump on Worries over Potential Invasion

January 14, 2022

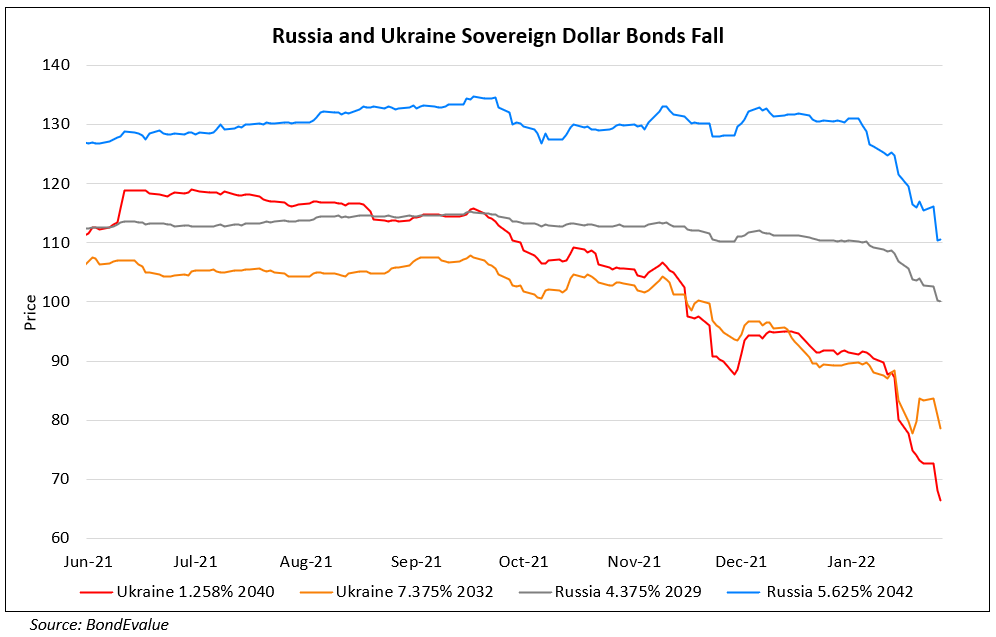

Ukraine & Russia’s Dollar Bonds Slip on Escalating Tensions

January 26, 2022

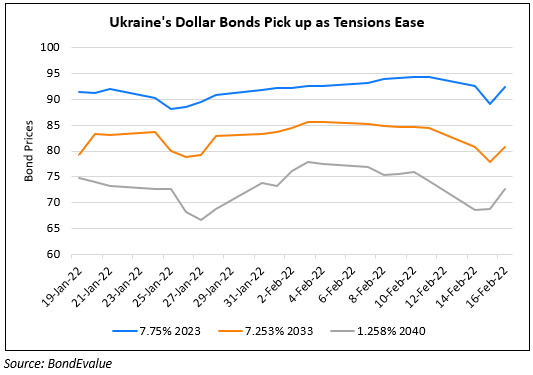

Ukraine Bonds Rally as Russia Says Troops Pulled Back

February 16, 2022