This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS Confirms Equity Conversion for AT1s Following Shareholder Vote

May 14, 2024

UBS has confirmed that nearly $5bn of its AT1 bonds have been made available for equity conversion. This follows a decision by shareholders of the bank in late-April. At the time, shareholders voted to change the clauses on the notes wherein, upon the occurrence of a trigger event, the AT1s should convert into equity instead of being permanently written-down to zero. The change in the provisions covers three of its dollar AT1s with an amount outstanding totaling to $4.5bn in addition to an S$ 650mn AT1.

UBS’ AT1s traded steady with its 5.125% Perp at 95.52, yielding 7.4% to call.

For more details, click here

Go back to Latest bond Market News

Related Posts:

UBS Said to be Lining Up AT1 Issuance

August 28, 2023

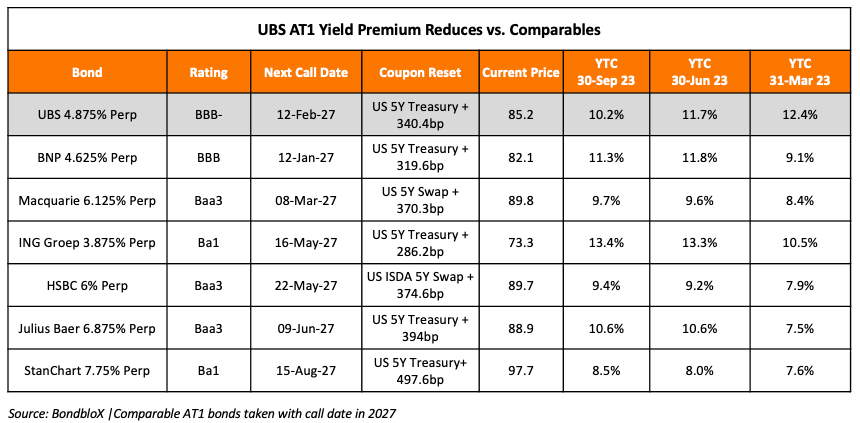

UBS’s AT1 Yield Premium Over non-Swiss Peers Vanishes

October 4, 2023

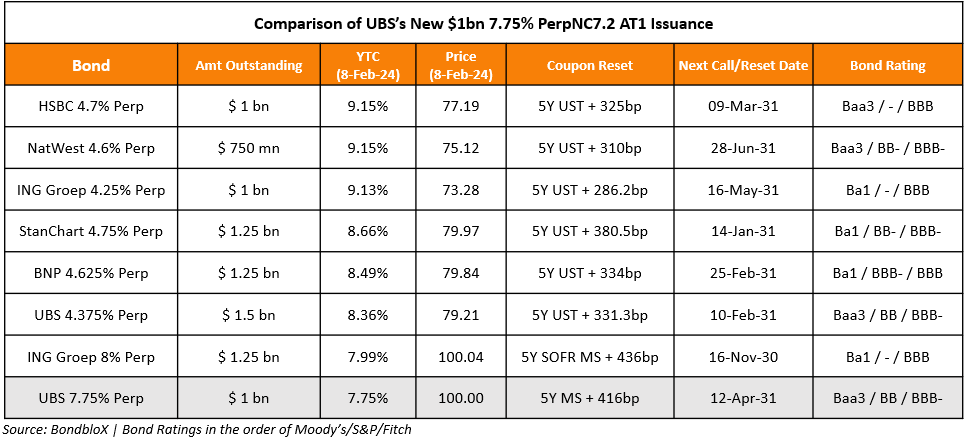

UBS Prices $1bn PerpNC7.2 AT1 at 7.75%

February 8, 2024