This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

U.S. Tax Plan Punitive For Bonds

September 28, 2017

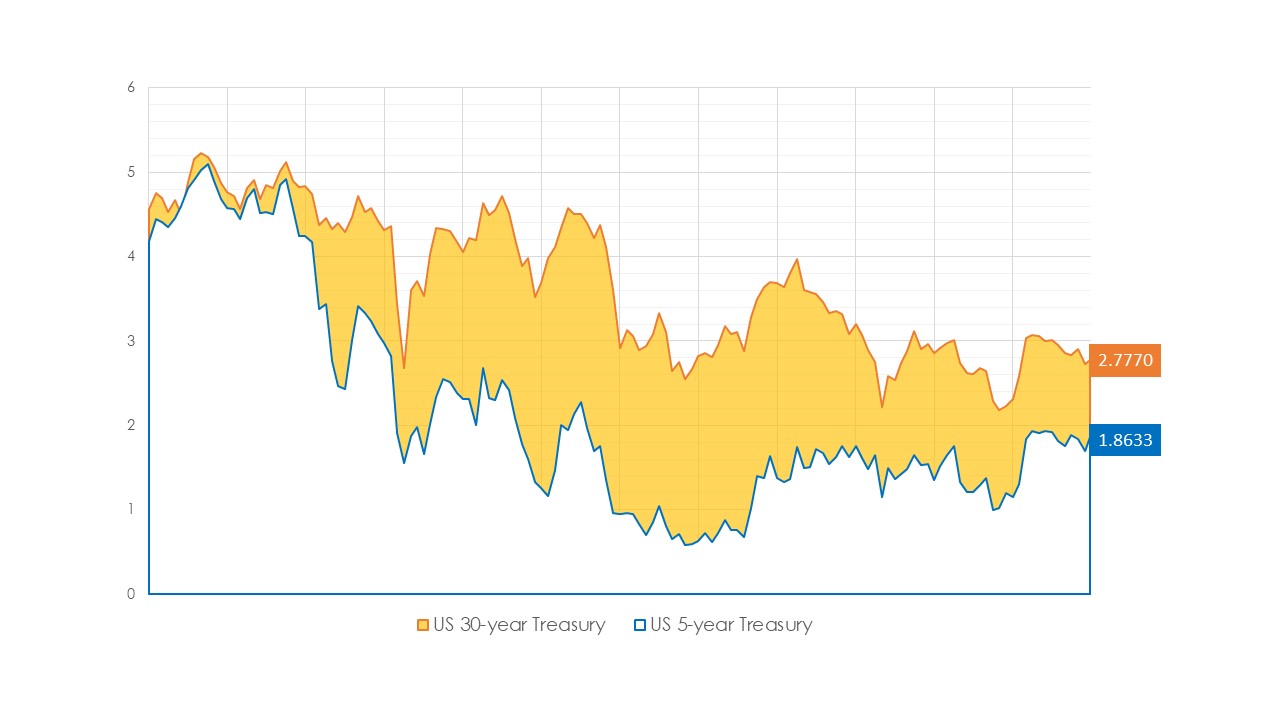

U.S. Treasury yields hit a 2-month high as President Trump announced his tax-reform plan, a key provision of which calls for the repatriation of $2.5 trillion that multinational companies are holding overseas mostly in Treasuries. Possible increased selling of these Treasury holdings in order to benefit from the Republic tax plan would increase supply into the market and drive up yields. Compounding this negative effect on Treasuries is market expectations that the Federal Reserve will hike rates another 0.25% in December, as well as start the unwinding of its $4.5 trillion balance sheet that includes nearly $2.5 trillion of Treasuries. Outside the U.S., Australian and Japanese bonds joined the global sell-off with their 10-year bond benchmark yields climbing 6 bp to 2.85% and 1 bp to 0.065%, respectively.

Go back to Latest bond Market News

Related Posts:

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017