This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

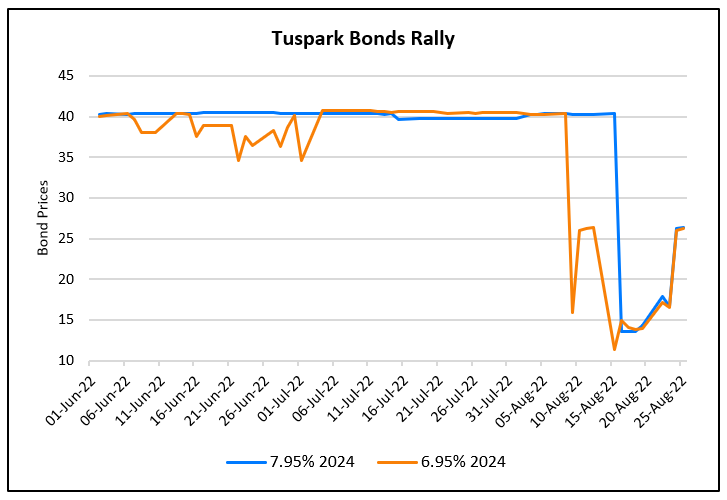

Tuspark’s Dollar Bonds Jump over 55% after Consent Solicitation

August 25, 2022

Tuspark Forward (issuer of Tus-Holdings’ bonds) launched a consent solicitation for two of its dollar bonds on which it missed payments in August. These bonds are its $308mn 7.95% May 2024s and $522.5mn 6.95% May 2024s guaranteed by Tus-Holdings. The bonds jumped over 55% post the announcement. As per an exchange filing, the consent solicitation proposed to extend the bonds’ mandatory redemption dates by 10 months and the maturity date by 13 months. The company was initially required to redeem at least 35% of the principal amount on 13 August 2022 and another 30% on 13 August 2023, with the maturity date on 13 May 2024. Now, Tuspark seeks to postpone the redemption dates to 13 June 2023, and 13 June 2024, and to extend the maturity date to 13 June 2025. The company plans to have a maximum of 70% of the initial principal outstanding after the first redemption date, and a maximum of 40% after the second redemption. The company will also redeem 3% of the original principal amount when the solicitation is settled, and 7% within one month after the settlement date.

If approved by bondholders, then Tianfu Qingyuan Holdings, Beijing Baijun Investment and Hefei City Construction and Investment Holding (Group) will provide a keepwell letter for both bonds. These companies hold 22.24%, 22.24%, and 14.8% respectively in Tus-Holdings. For early consent till 31 August 2022, bond holders will get a 0.5% consent fee and after that date, the fees will fall to 0.2%. The proposal requires at least 66% of outstanding amount of bonds to have a consent for a meeting and 75% of votes in favor of proposal. The voting deadlines ends on 7 September.

Go back to Latest bond Market News

Related Posts:

Tus-Holdings’ Bondholders Approve Debt Extension Plan

August 17, 2021

CK Asset Bids for Evergrande’s Hong Kong HQ

July 29, 2022

Logan Suspends Interest Payments on $1.6bn of Offshore Bonds

August 10, 2022