This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkish Wealth Fund Considers First Dollar Bond Issuance of 2025 in September

August 27, 2025

The The Turkish Wealth Fund, Türkiye Varlık Fonu (Tvf), is considering a potential dollar debt sale in September, aiming to raise up to $500mn. This would be its first debt issuance this year, with the exact size and maturity of the note still being determined. The fund has been increasingly using loan financing, recently securing $600mn in sukuk financing, which complies with Islamic rules. The fund, established in 2016 to lead major investments, holds significant stakes in key Turkish companies. These include state lenders like Türkiye Halk Bankası and Ziraat Bankası, as well as Turkish Airlines and the local stock exchange.

Its dollar bonds offer a yield pick-up to the sovereign’s notes. For instance, Tvf’s 8.25% 2029s are trading at 105.88, yielding 6.33%. This offers a 48bp yield pick-up over Turkiye’s sovereign 7.625% 2029s that trade at 105.75, yielding 5.85%. Both issuers are rated Ba3/BB-/BB-.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

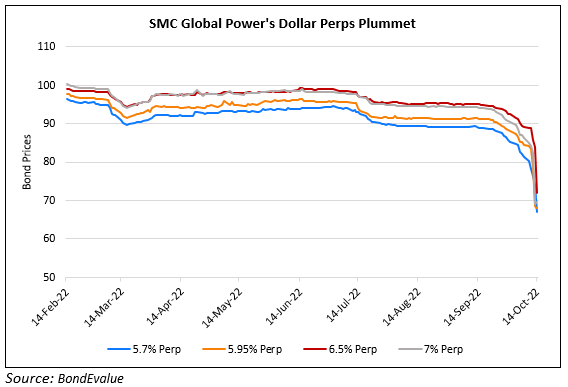

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

Fitch Expects Mexican Government to Continue Supporting Pemex

August 17, 2023