This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey, UBS, IBM Price $ Bonds

February 6, 2025

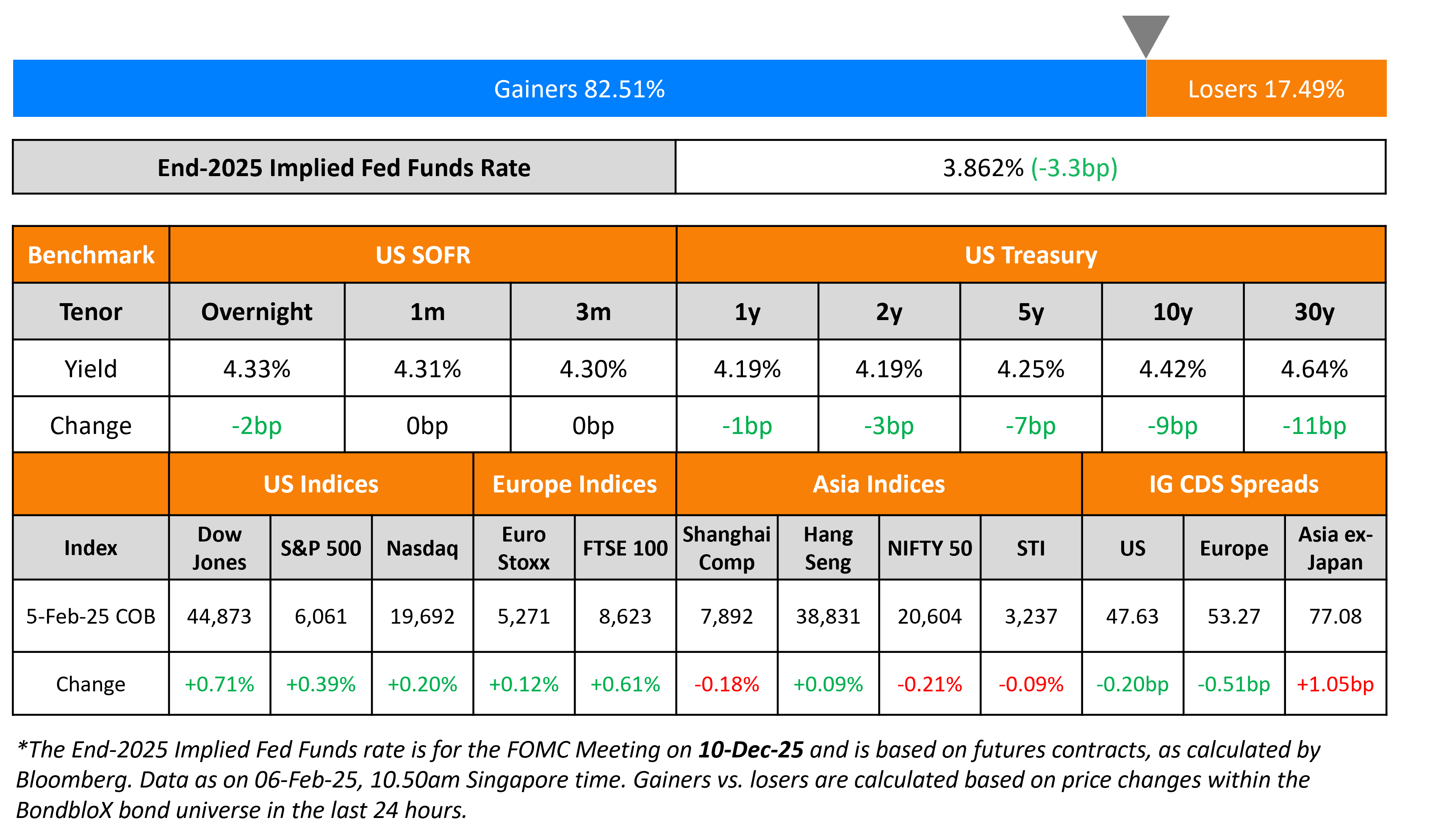

The US Treasury curve bull flattened with the 2Y yield down by 3bp while the 10Y was down 9bp. The US ISM Services PMI came-in at 52.8, softer than expectations and the previous reading of 54.0. Among its sub-components, both New Orders and Prices Paid softened. Separately, the US Treasury said that it expects to maintain the current auction sizes for at least the next several quarters. Fed officials including Thomas Barkin, Austan Goolsbee and Philip Jefferson underscored the need to further understand government policy, the underlying economy and inflation, before taking action.

US equity markets were higher with the S&P and Nasdaq up by 0.2-0.4%. Looking at credit markets, US IG and HY CDS spreads tightened by 0.2bp and 1.1bp respectively. European equity markets were higher too. European IG and Crossover CDS spreads tightened by 0.5bp and 1.5bp respectively. Asian equities have opened in the green this morning. Asia ex-Japan CDS spreads were 1.1bp wider.

New Bond Issues

-

Kepco $ 3Y at T+90bp

Republic of Turkiye raised $2.5bn via a 7Y bond at a yield of 7.2%, 30bp inside initial guidance of 7.5% area. The bond is rated B1/BB-. Proceeds will be used for general budgetary purposes. The new bonds are priced at a new issue premium of 13bp to its existing 7.125% 2032s that currently yield 7.07%.

UBS raised $3bn via a two-tranche deal. It raised $1.5bn via a PerpNC5.5 bond at a yield of 7%, 75bp inside initial guidance of 7.75% area. If not called by 10 August 2030, the coupon resets then and every five years at the 5Y Mid-Swap pus 307.7bp. The subordinated notes are rated Baa3/BB/BBB-.

It also raised $1.5bn via a PerpNC10 bond at a yield of 7.125%, 75bp inside initial guidance of 7.875% area. If not called by 10 February 2035, the coupon resets then and every five years at the 5Y Mid-Swap plus 317.9bp. The subordinated notes are rated Baa3/BB/BBB-.

IBM raised $4.75bn via a five trancher. It raised:

The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general corporate purposes, which may include the repayment of debt, investments in or extensions of credit to the company’s subsidiaries, redemption of any preferred stock, or the financing of possible acquisitions or business expansion.

Citigroup raised $2bn via a PerpNC5 preferred note at a yield of 6.95%, 42.5bp inside initial guidance of 7.375% area. The subordinated note is rated Ba1/BB+/BBB-. Proceeds will be used for general corporate purposes, which may include the partial/full redemption of outstanding shares of Citigroup preferred stock and related depositary shares, as applicable.

New Bonds Pipeline

- Embraer hires for $ 10Y bond

- Sharjah hires for € WNG 7Y bond

Rating Changes

-

Fitch Upgrades Turkish Airlines to ‘BB’; Stable Outlook

-

Fitch Upgrades Owens Corning’s IDR to ‘BBB+’; Outlook Stable

-

Fitch Revises Outlook on Port of Newcastle to Positive; Affirms Ratings at ‘BBB-‘

-

Whirlpool Corp. Outlook Revised To Negative On Weaker-Than-Expected Credit Measures, Ratings Affirmed

Term of the Day: AT1 Bonds

Additional Tier 1 (AT1) bonds are hybrid securities issued by financial institutions to meet their regulatory capital requirements. AT1s typically carry a provision wherein the instruments can be fully or partially written-down or converted to equity if the issuing bank’s capital ratio falls below a certain threshold. This is why AT1s are also known as contingent convertibles (CoCos). The key characteristics of AT1 bonds are:

- They have a perpetual maturity with a call option

- They are subordinated in nature, and the first line of debt to incur losses

- They can be written-down or converted into equity on the occurrence of a “trigger event”

- Coupons are usually higher as compared to other debt by the issuer, to compensate investors for the higher risk AT1s carry. However, coupons can be discretionary in nature.

Talking Heads

Fady Gendy – Arqaam Capital

“Our view is that Egypt is an improving credit story, and that’s reflected in the fact that it has regained eurobond conventional market access for the first time in four years and was able to print in size at $2 billion. We are also seeing the improving fundamentals reflected in the credit rating upgrades and the positive outlooks by the rating agencies, so we do feel that Egypt has turned the corner.”

On World Inflation At Risk of Rekindling

Carsten Brzeski – ING

“Tariff wars are inflationary, that’s not up for debate. In many places, they add to lingering effects from the past inflation shock, as well as big structural challenges like aging societies and climate change. There are currently only very few reasons to expect inflation to remain permanently low.”

On Embracing Trump Driven Bond Market Volatility

Daniel Ivascyn – PIMCO

“A little bit of volatility, a little bit of fear in markets, for us would likely be a good thing… It should be a target rich environment to put money to work, but you’ve just got to be a little careful of having too high an implied conviction level.”

Top Gainers and Losers- 6-February-25*

Go back to Latest bond Market News

Related Posts: