This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey Hikes Rates by 250bp to 42.5%

December 22, 2023

Turkey’s central bank raised its key interest rates by 250bp to 42.5% on Thursday, but promised an end to an aggressive tightening cycle soon. With this, the policy rate has risen to two decade high bringing the real rates into positive territory based on 2024 inflation expectations. However, the pace of interest rate increase has halved compared to the 500bp of hike done over the last 3 months. The Turkish lira was largely stable after the policy and Turkey’s CDS dipped below 300bp from near 700bp in May, showing a sign of confidence.

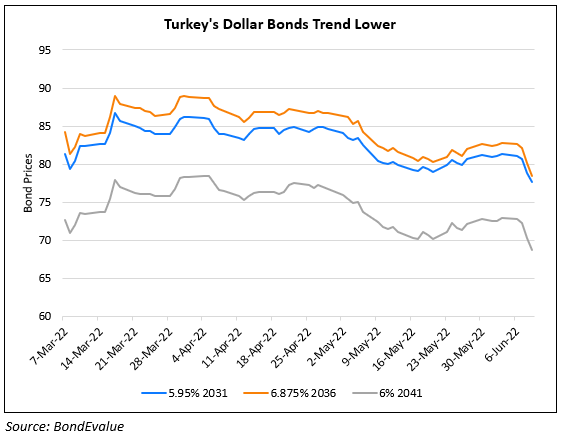

Turkey’s dollar bonds which have seen a massive rally since June Presidential elections, traded flat yesterday with its 3.25% 2025s at 99.2 cents on the dollar, yielding 3.8%

For more details, click here

Go back to Latest bond Market News

Related Posts: