This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

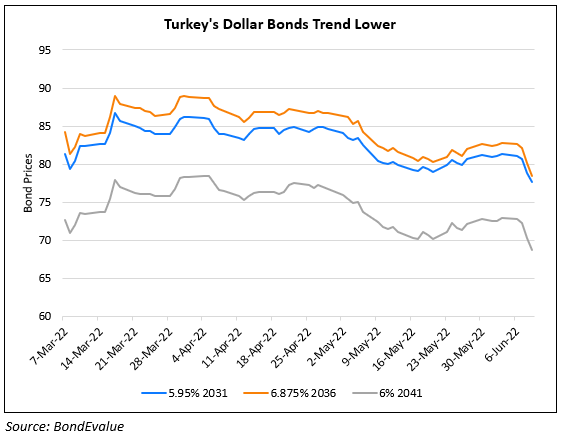

Turkey Hikes by 6.5%, Lower Than Expected as Dollar Bonds Trade Weaker

June 23, 2023

Turkey’s central bank, the CBRT hiked its policy rate by 6.5%, lower than the median 12% forecasted under new governor Hafize Gaye Erkan. This is Turkey’s first rate hike in two years and marks a move away from its unorthodox policy of cutting rates despite high inflation. The one-week policy repo rate now stands at 15% from 8.5%. Some market participants seem to view the hike as rather modest given that the Lira fell by over 5%. Other analysts look at the move as being a step in the right direction. The CBRT said, “Monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved”. Inflation is at 39.6% and analysts expect more hikes from the central bank in the coming months.

Turkey’s dollar bonds were trading broadly weaker across the curve. Its 8% 2034s were down 1.1 points to 94.69, yielding 8.78%

For more details, click here

Go back to Latest bond Market News

Related Posts: