This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

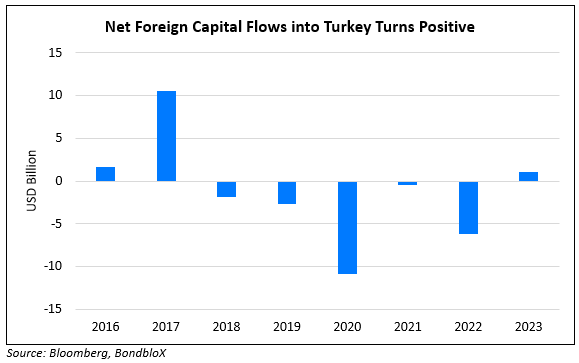

Turkey Draws First Net Foreign Inflows Since 2017

December 8, 2023

Turkey’s stocks and bonds drew its first foreign inflows in six years, as per the central bank’s data. This comes after the country’s move in June towards higher interest rates and a more orthodox monetary policy that is said to have seen favorable investor sentiment. Foreign investors bought a net $528.6mn in Turkish stocks and bonds last week, with the cumulative inflows this year touching $1.1bn. Since June, Turkish President Erdogan appointed Hafize Gaye Erkan and Mehmet Simsek as the central bank governor and finance minister respectively. Bloomberg notes that while foreigners’ total ownership levels are still far from what was seen prior to 2018, recent inflows suggest a shift away from negative sentiment.

For more details, click here

Go back to Latest bond Market News

Related Posts: