This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey, Citibank Price $ Bonds

May 22, 2025

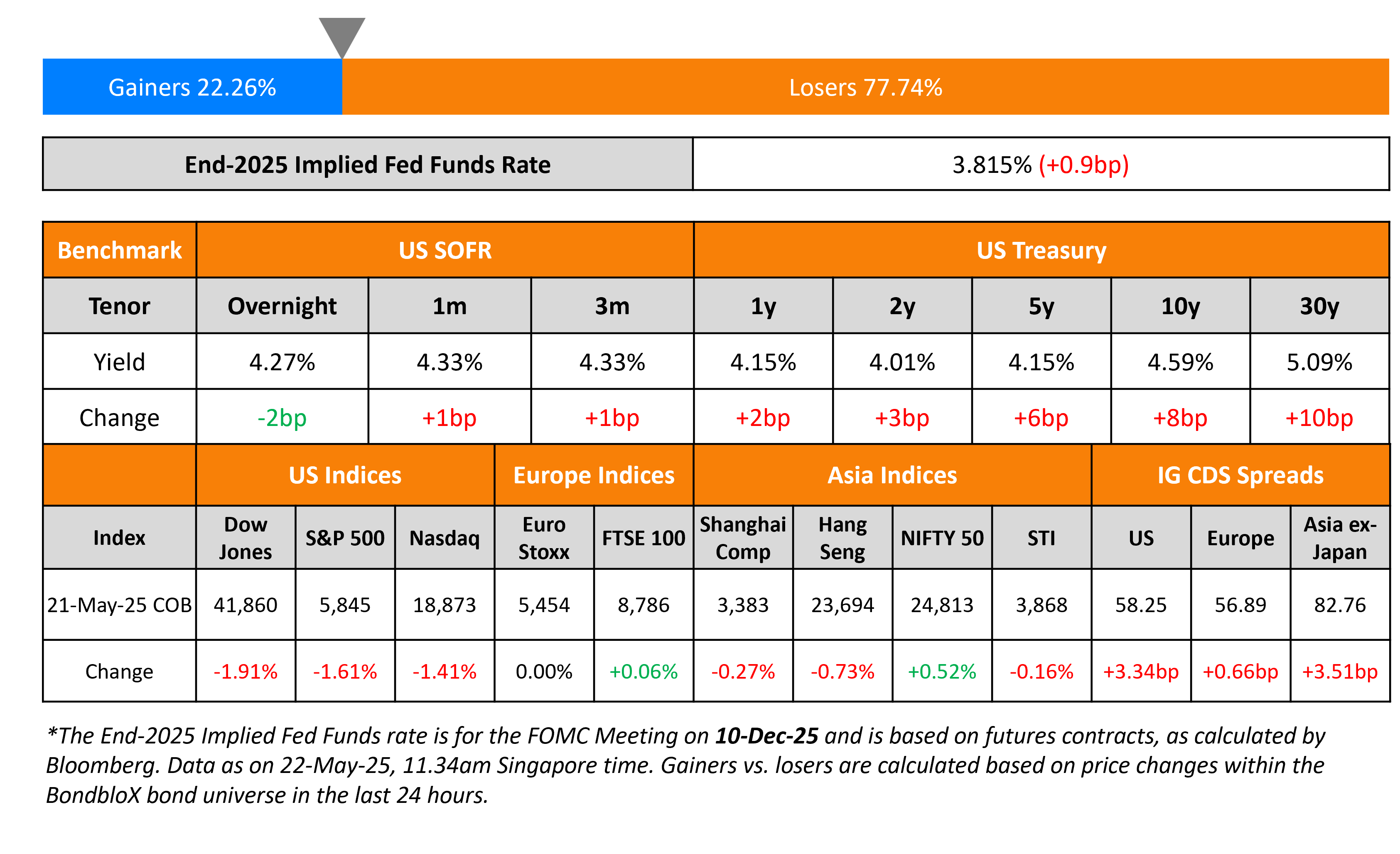

The US Treasury yield curve continued to bear steepen with the 2s10s spread moving further higher by 5bp. The move higher in long-end yields was led by the US Treasury’s 20Y auction that saw tepid demand, with a bid-to-cover of 2.46x, the weakest since February. The bond was awarded at a yield of 5.047%, tailing by 1.2bp over the when-issued yield. Reuters notes that the 5% coupon rate is the highest for a 20Y Treasury bond auction since the tenor was reintroduced in 2020.

Looking at the equity market, S&P and Nasdaq were fell by 1.6% and 1.4% respectively. Looking at credit markets, US IG and HY CDS spreads widened by 3.3bp and 12bp respectively. European indices ended flat. The iTraxx Main CDS spreads and iTraxx Crossover CDS spreads widened by 0.7bp and 2.9bp respectively. Asian equity markets have broadly opened in the red today. Asian ex-Japan IG CDS spreads widened by 3.5bp.

New Bond Issues

-

HSBC S$ 8NC7 HoldCo at 3.7% area

Turkiye raised $2bn via a 7Y bond at a yield of 7.45%, 30bp inside initial guidance of 7.75%. The SEC-registered note is unrated. Proceeds will be used for general budgetary purposes. The new bond was priced at a new issue premium of 15bp over its existing 7.125% 2032s that currently yields 7.30%.

Citibank NA raised $6.5bn via a four-part issuance. Details are given in the table below:

The senior bank notes are rated Aa3/A+/A+. Proceeds will be used for general corporate purposes.

BPCE raised $2bn via a two-part deal. It raised $1bn via a 6NC5 at 5.389%, 30bp inside initial guidance of T+155bp area. It also raised $1bn via a 11NC10 bond at a yield of 6.027%, 30bp inside initial guidance of T+175bp area. The senior non-preferred notes are rated Baa1/BBB+/A. Proceeds will be used for general corporate purposes.

CCB HK raised $2bn via a two-part deal. It raised $1bn via a 3Y FRN at SOFR+52bp, 53bp inside initial guidance of SOFR+105bp area. It also raised $1bn via a 5Y FRN at a yield of SOFR+60bp, 55bp inside initial guidance of SOFR+115bp area. The senior unsecured notes are rated A by Fitch. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

-

Al Rayan hires for $ 5Y Sukuk bond

- Telecom Argentina hires for $ 8Y bond

-

Macquarie Bank hires for A$ 10.5NC5.5 and/or 15NC10 bond

Rating Changes

- Moody’s Ratings upgrades Banco Comercial Portugues, S.A.’s long-term deposit ratings to A2; outlook stable

- TAV Airports Upgraded To ‘BB’ On Stronger Metrics And Antalya Debt Refinancing; Outlook Stable

- Hub International Ltd. Upgraded To ‘B+’ On Expected Deleveraging; Outlook Stable

- Fitch Upgrades Signet’s IDR to ‘BBB-‘; Removes from Under Criteria Observation

- Moody’s Ratings downgrades Telesat’s CFR to Caa2 on refinancing risk; outlook is stable

- Fitch Downgrades PizzaExpress to ‘C’ on Distressed Debt Exchange

- The Hershey Co. Outlook Revised To Negative On Elevated Leverage; ‘A’ Ratings Affirmed

Term of the Day: Exchangeable Bonds

Exchangeable bonds are a type of debt that gets converted into the common stock of a target firm in which the issuing firm has an ownership position. It signifies a potential change in the issuing company’s asset composition via the divesting of its ownership stake in the target firm.

Uber issued $1.2bn in exchangeable senior notes tied to its stake in Aurora Innovation. Click here to know more

Talking Heads

“The budget deficit is a larger concern to me than the trade deficit…. hope we do get more spending cuts… I still see us as a AAA credit… still rather buy US government securities than any other so-called AAA out there”

On Treasuries Vying for Demand With Japan’s Bonds

George Saravelos, Deutsche Bank

“The Japanese yen is strengthening even as US yields are rising… evidence that foreign participation in the US Treasury market is declining… JGB selloff is a bigger problem for the US Treasury market”

Morgan Stanley strategists

“Investors looking for alternatives to longer maturity USTs should be aware of the potential value trap forming in long-end JGBs”

On US Stocks to Power Global Rally – Morgan Stanley Strategists

Turning overweight on US stocks and Treasuries, while remaining constructive on corporate credit… “TINA – ‘there is no alternative’ – remains a theme for now… will attract the bulk of flows

Top Gainers and Losers- 22-May-25*

Go back to Latest bond Market News

Related Posts: