This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

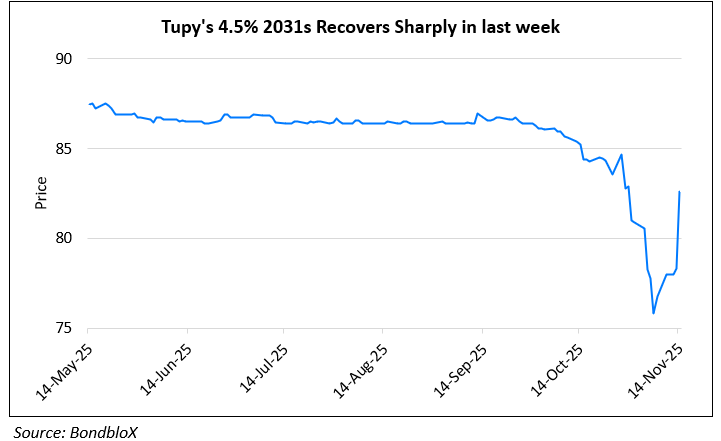

Tupy Downgraded to BB- by Fitch

November 14, 2025

Brazilian components manufacturer Tupy, was downgraded by two notches to BB- from BB+ by Fitch. The downgrade reflects Fitch’s expectation that Tupy’s financial profile will remain pressured over the next 18 months amid depressed demand in its core commercial vehicle and heavy machinery markets, which is weighing on revenues, margins and leverage. Weaker volumes have pushed leverage higher, and Fitch now anticipates Tupy may breach its 3.5x net leverage covenant within six months, though a waiver is likely. Fitch expects leverage to gradually improve only from late-2026 as volumes recover, with net leverage remaining above 2.5x and gross leverage above 3.5x through the next three years. Tupy’s operational performance is also set to stay soft with revenues projected below BRL 10bn ($1.9bn) in 2025 and around the same level in 2026. EBITDA margins are expected to remain under 7% in 2025 and below 10% until 2027. On the positive side, liquidity and refinancing risks are manageable, with no significant debt maturities until 2029 and solid operating cash flow generation. While electrification poses long-term risks, Fitch views these as manageable given Tupy’s focus on heavy vehicles and its growing capabilities in alternative energy and decarbonization technologies.

Tupy’s 4.25% 2031s had seen a massive drop of 11 points since the beginning of October but has recovered sharply over the last week, as seen in the chart above.

Go back to Latest bond Market News

Related Posts:

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018