This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

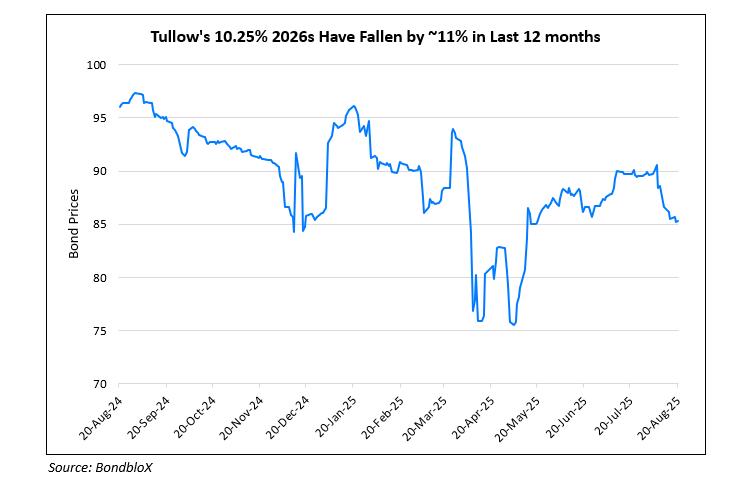

Tullow Oil in Refinancing Talks for $1.3bn 10.25% 2026s

August 20, 2025

Tullow Oil Plc is in discussions with bondholders to refinance its 10.25% bond maturing in May 2026, as the company works to ease pressure on its capital structure. Some bondholders have engaged law firm Weil, Gotshal & Manges LLP ahead of more formal negotiations and possible amendments to the debt terms. Tullow was once one of the UK’s most popular independent oil explorers after making major African discoveries in the late 2000s. However, huge debt for initial setup and recent struggles to bring Kenyan fields onstream have led to a total debt of $1.8bn. It has been navigating refinancing challenges due to weaker operating performance and high leverage. Tullow raised $300mn from the sale of Gabonese assets, and expects to raise $80mn more from Kenyan asset sales this year. Although these moves are aimed at paying down debt, asset sales have impacted production, with the firm warning that 2025 production might fall to its lowest level since 2020. Moody’s and S&P cited refinancing risks and downgraded Tullow to Caa2 and CCC+ respectively in the last few months. Tullow’s management said that it was making progress with its refinancing plan and hopes to simplify the capital structure in 2025.

Tullow’s 10.25% 2026s are currently trading at 85.26, yielding 34.45%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: