This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Will Decide Iran Strike in Two Weeks; Iran Hits Israeli Hospital; Liberty Downgraded to Caa1

June 20, 2025

US markets were closed on account of the Juneteenth National Independence Day. According to White House spokeswoman Karoline Leavitt, US President Donald Trump will decide within two weeks whether to strike Iran. Meanwhile, Israel has continued to strike Iranian nuclear sites. A missile from Iran hit an Israeli hospital on Thursday, impacting civilians for the first time since the war begun. Trump is expected to announce soon a nominee to replace Fed President Jerome Powell, whose term expires in May 2026.

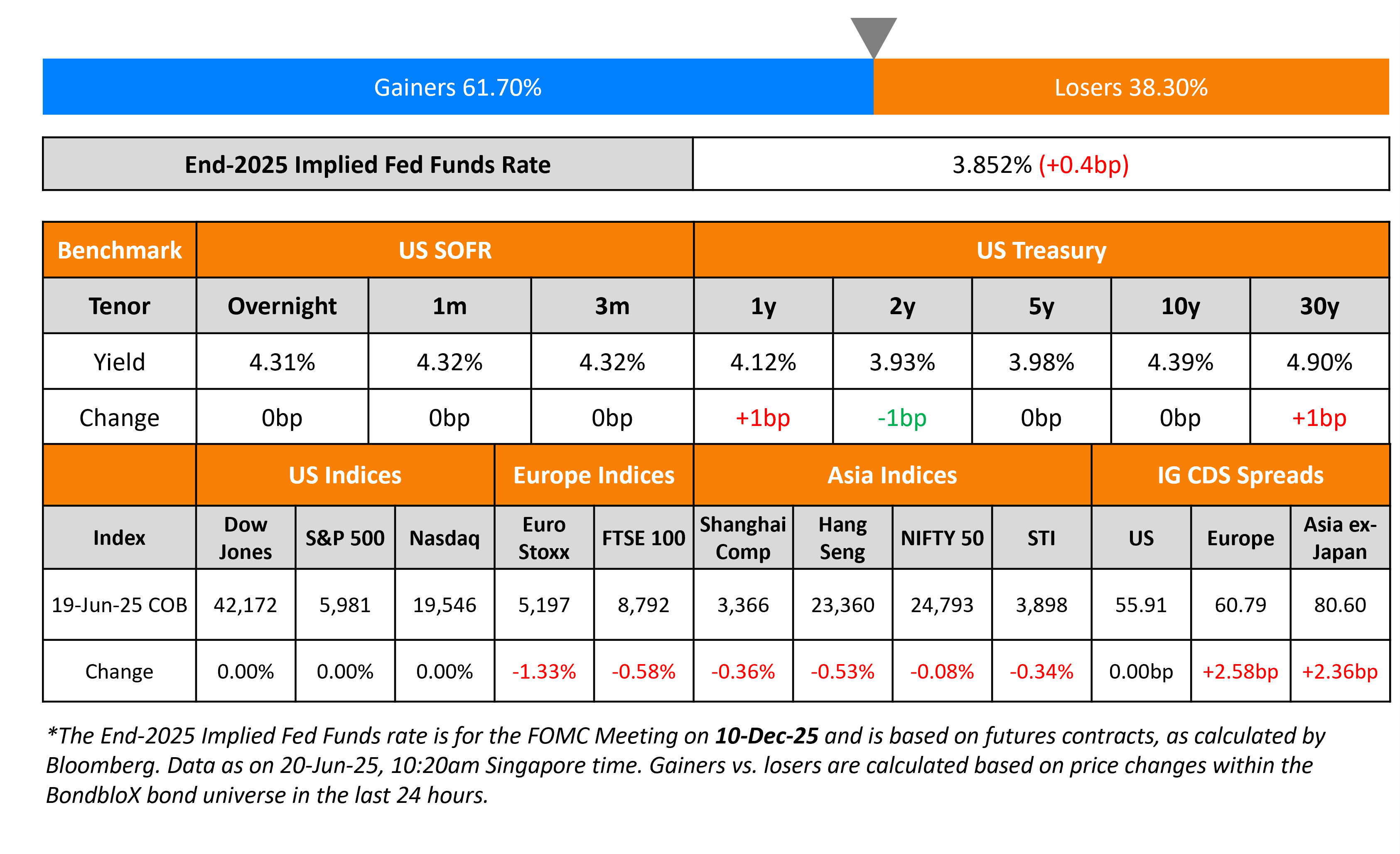

US IG CDS spreads remained unchanged, whereas US HY CDS spreads tightened by 3.4bp. European equity markets closed lower, with Euro Stoxx tumbling by almost 1.3%. The iTraxx Main CDS spreads and Crossover CDS spreads widened by 2.6bp and 13.1bp respectively. Asian equity markets have broadly opened higher today. Asia ex-Japan CDS spreads widened by 2.4bp.

New Bond Issues

Rating Changes

-

Moody’s Ratings downgrades Liberty PR’s ratings to Caa1; stable outlook

-

Moody’s Ratings upgrades Bayan Resources to Ba1; outlook stable

-

Fitch Downgrades Oriflame to ‘RD’ on Missed Coupon; Upgrades to ‘CC’

-

United Group Outlook Revised To Stable On Expected Heightened Leverage; ‘B’ Rating Affirmed

-

Moody’s Ratings revises outlook on Seazen Group to positive from negative; affirms Caa1/Caa2 ratings

Term of the Day: Golden Power

Golden Power refers to the special power of the Italian government to limit or stop foreign direct investments (FDI) and corporate transactions that involve Italian strategic assets. This provision was introduced in 2012 and now applies to sectors like defense, infrastructure networks, critical infrastructures and technologies, the iron and steel industry, agri-food, 5G, fintech/insurtech and smart contracts.

Talking Heads

On Midcaps Saying Tarriff Shock is Over – Fidelity Fund

“The worst of the shock is behind us with Liberation Day…The numbers that were recorded on that day were the worst it can get… In a world of trade disruption, I think it makes sense to focus on more domestic revenue generation”

On Australian Funds Cut US Treasury Holdings on Trump Policy Risks

Con Michalakis, Funds SA

“The US dollar will go first and if the fiscal situation gets worse you will see steeper yield curves…We want to be marginally longer the Australian dollar and carrying a lot more non-US foreign-currency exposure.”

Beverley Morris, Liquid Markets Group

“developments over the last few months had caused them to rethink their allocations to the US market, both in terms of fixed income but also currencies”

On Oil, War and Tariffs Tearing up Markets’ Central Bank Roadmap

Davide Oneglia, TS Lombard

“You cannot just take your cues from the central banks anymore as they are facing a harder job of reading the economy themselves…We’re getting into this next cycle in which variables are much more volatile”

John Stopford, Ninety One

“The stock market feels like it’s a thatched house in a hot country with a fire hazard risk”

Top Gainers and Losers- 20-Jun-25*

Go back to Latest bond Market News

Related Posts: